TODAY ONLY: Win Lufthansa lounge passes and $100 LoungeBuddy credit

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Today – and only today – we are running a competition with LoungeBuddy.

We are giving away two prizes – one person will win $100 of LoungeBuddy airport lounge credit and another will win two passes for participating Lufthansa lounges, including Heathrow Terminal 2, which can be used irrespective of which airline you are flying.

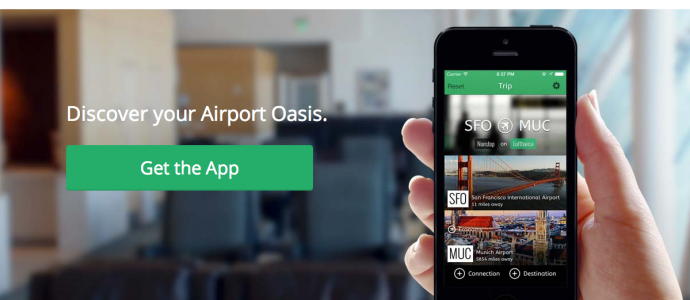

Long-term HfP readers will know that we have covered LoungeBuddy in the past. LoungeBuddy is an app which helps you find lounges at the airport where you currently are (via the GPS signal on your phone) or you can search for lounges at any airport.

Listings include ratings, reviews, photos and access requirements. If you store details of your airline status cards with LoungeBuddy, the app will show you which lounges you are allowed to use.

LoungeBuddy also sells day passes to pay-as-you-go airport lounges. When you look at LoungeBuddy listings for a particular airport, lounges where you can use the app to purchase a day pass are highlighted with a large ‘Buy’ button. You can then use a pre-stored credit card number to buy an entrance pass for yourself and any number of guests. You simply show your LoungeBuddy confirmation code at the lounge entrance and you will be allowed in.

Pretty much every major UK lounge which offers paid access is available via LoungeBuddy.

A few months ago LoungeBuddy teamed up with Lufthansa to give travellers the option of booking paid access to participating Lufthansa lounges via the app and website.

You don’t need to be flying with Lufthansa to use a Lufthansa lounge with LoungeBuddy. At Heathrow, you can buy access to the Lufthansa Business Lounge in Terminal 2. LoungeBuddy can also get you into Lufthansa lounges in Germany (Frankfurt, Munich, Dusseldorf) and elsewhere (New York JFK, Paris CDG, Washington etc).

If you don’t win the competition, you can still save $10 on your first LoungeBuddy lounge visit . HfP readers get a free $10 sign-up credit when they download the iOS or Android and app and use the code headfp when registering.

Competition

In order for HfP readers to try the LoungeBuddy service, we are giving away two prizes:

- Two free passes to participating Lufthansa lounges (expire 31st August 2017)

- $100 LoungeBuddy credit (expires 1st July 2018)

All you have to do to enter this competition is fill out the Gleam widget at the bottom of this page with your email address. Your email address remains private. We will not give it to LoungeBuddy (unless you win) and we won’t be using it for anything else.

You need to enter by midnight tonight.

The first winner gets to choose his or her prize and the runner-up will receive the other prize. The two Lufthansa passes could be worth more than $100 but, of course, you need to be travelling through a suitable airport in order to use them.

You must be a UK resident to enter.

Full terms and conditions are in the widget below.

If you want to find out more about LoungeBuddy, visit their website here.

If you cannot see the entry widget below then click here to be taken to a special entry page online.

Win lounge passes with Head for Points and LoungeBuddy

How to get FREE airport lounge access via UK credit cards (April 2024)

Here are the four options to get FREE airport lounge access via a UK credit card.

The Platinum Card from American Express comes with two free Priority Pass cards, one for you and one for a supplementary cardholder. Each card admits two so a family of four gets in free. You get access to all 1,300 lounges in the Priority Pass network – search it here.

You also get access to Eurostar, Lufthansa and Delta Air Lines lounges. Our American Express Platinum review is here. You can apply here.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

If you have a small business, consider American Express Business Platinum instead.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Preferred Rewards Gold is FREE for the first year. It comes with a Priority Pass card loaded with four free visits to any Priority Pass lounge – see the list here.

Additional lounge visits are charged at £24. You get four more free visits for every year you keep the card.

There is no annual fee for Amex Gold in Year 1 and you get a 20,000 points sign-up bonus. Full details are in our American Express Preferred Rewards Gold review here.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

HSBC Premier World Elite Mastercard gets you get a free Priority Pass card, allowing you access to the Priority Pass network. Guests are charged at £24 although it may be cheaper to pay £60 for a supplementary credit card for your partner.

The card has a fee of £195 and there are strict financial requirements to become a HSBC Premier customer. Full details are in my HSBC Premier World Elite Mastercard review.

HSBC Premier World Elite Mastercard

A huge bonus, but only available to HSBC Premier clients Read our full review

PS. You can find all of HfP’s UK airport lounge reviews – and we’ve been to most of them – indexed here.

Rob

Rob

Comments (58)