Priority Pass adds sleep pods in Dubai

Links on Head for Points may support the site by paying a commission. See here for all partner links.

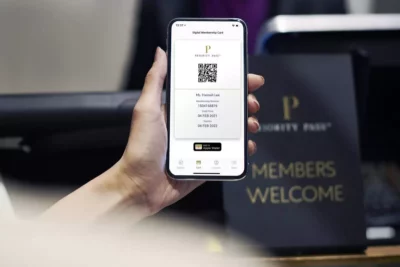

You can’t accuse airport lounge card Priority Pass of standing still. After adding a restaurant / bar at Gatwick South (you get £15 of free food and drink by showing your Priority Pass) and seven restaurants / bars in Sydney, it is now offering its first sleep pods.

When I was in Dubai in March I walked passed the YAWN area and thought it looked …. umm …. interesting. This is a new airport sleep concept, whereby you can get a 2-hour session in one of 20 Igloo Sleep Pods.

The pods are available 24 hours a day and come with free wi-fi and power points! They are situated in Terminal 3 of Dubai International Airport so ideal for anyone flying on Emirates or Qantas.

As a Priority Pass member, you can get two hours use of a Sleep Pod for free. Full details are on the Priority Pass website here.

How to get FREE airport lounge access via UK credit cards (April 2024)

Here are the four options to get FREE airport lounge access via a UK credit card.

The Platinum Card from American Express comes with two free Priority Pass cards, one for you and one for a supplementary cardholder. Each card admits two so a family of four gets in free. You get access to all 1,300 lounges in the Priority Pass network – search it here.

You also get access to Eurostar, Lufthansa and Delta Air Lines lounges. Our American Express Platinum review is here. You can apply here.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

If you have a small business, consider American Express Business Platinum instead.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Preferred Rewards Gold is FREE for the first year. It comes with a Priority Pass card loaded with four free visits to any Priority Pass lounge – see the list here.

Additional lounge visits are charged at £24. You get four more free visits for every year you keep the card.

There is no annual fee for Amex Gold in Year 1 and you get a 20,000 points sign-up bonus. Full details are in our American Express Preferred Rewards Gold review here.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

HSBC Premier World Elite Mastercard gets you get a free Priority Pass card, allowing you access to the Priority Pass network. Guests are charged at £24 although it may be cheaper to pay £60 for a supplementary credit card for your partner.

The card has a fee of £195 and there are strict financial requirements to become a HSBC Premier customer. Full details are in my HSBC Premier World Elite Mastercard review.

HSBC Premier World Elite Mastercard

A huge bonus, but only available to HSBC Premier clients Read our full review

PS. You can find all of HfP’s UK airport lounge reviews – and we’ve been to most of them – indexed here.

Rob

Rob

Comments (40)