British Airways Avios ‘taxes and charges’ creeping up and miscalculated

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Whilst the oil price has been relatively steady since Autumn 2015, oscillating around the $50 mark for Brent Crude, that hasn’t stopped British Airways quietly sneaking up its ‘taxes and charges’.

On Wednesday we ran an article showing you the peak and off-peak Avios redemption dates for 2018.

As part of that article we did an example of a British Airways Club World redemption to New York, with a ‘taxes and charges’ figure of £529.

In April 2017, we ran a very similar article with the peak / off-peak calendar for 2017. Last April, the taxes for the identical flight were £480.

This represents an increase of £49, so £98 for a couple using a British Airways American Express 2-4-1 voucher.

If we look at Iberia, the taxes and charges for Madrid to JFK went up by just £14, from £145 to £159 return in Business Class. This means that the difference cannot be down to increased US airport and security fees.

Part of the difference will be increased Heathrow passenger service charges, and £4 is down to increased Air Passenger Duty, but in general it does give the impression of BA arbitrarily increasing its ‘surcharges’ for no good reason.

ba.com is still incorrectly showing taxes and charges

To make matters worse, on some routes ba.com has trouble accurately calculating the taxes and charges due. It always corrects itself by the time you get to the payment page but you should never treat the figure shown on the flight selection page as correct.

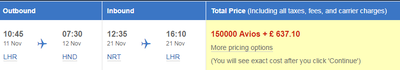

Here is a Club World redemption from London to Tokyo. The flight selection page shows taxes of £637:

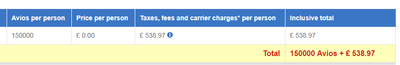

….. but the payment page shows – correctly, if you compare with the charges on a cash ticket – that the total should be £539:

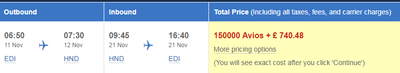

If you search for Edinburgh to Tokyo via London the error is even more stark. The flight selection page shows taxes of £740 per person:

…. instead of £539.

No-one is being overcharged here, but British Airways isn’t doing itself any favours by giving the impression that taxes and charges are (even) higher than they actually are.

PS. Visitors to our office will recognise the image above, because we have it – an original from the 1950’s – on the wall! Similar are available from Antikbar on Kings Road.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (61)