We look at the details of Marriott’s new ‘cash and points’ rewards

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Marriott Rewards announced four changes to its programme on Monday as I outlined here. What I didn’t know at the time was how the new ‘cash and points’ option would work.

Marriott has chosen to take the path of Hyatt and Starwood and make ‘cash and points’ redemptions a separate redemption ‘bucket’.

This means two things:

Availability will be worse than for ‘100% points’ redemptions

They are, in some scenarios, a good deal if they are available and increase the value of your Marriott points

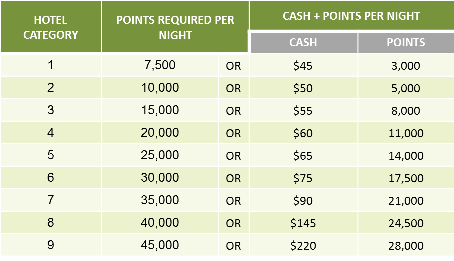

Here is the Marriott redemption chart using ‘cash and points which is taken from the Marriott website here:

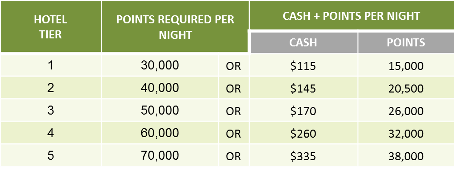

…. and here is the Ritz-Carlton version:

If we get the calculator out, you will see that you are, de facto, ‘buying’ the additional points from Marriott at the following rates:

- Category 1: 1c

- Category 2: 1c

- Category 3: 0.79c

- Category 4: 0.67c

- Category 5: 0.59c

- Category 6: 0.6c

- Category 7: 0.64c

- Category 8: 0.94c

- Category 9: 1.29c

- Tier 1: 0.77c

- Tier 2: 0.79c

- Tier 3: 0.71c

- Tier 4: 0.93c

- Tier 5: 1.05c

I usually say that I conservatively value a Marriott point at 0.5p, which is around 0.8 cents.

On that basis, I should definitely do ‘cash and points’ for Category 4 to Category 7 redemptions. Marriott is ‘selling’ me half of the points I need for a redemption for less than my valuation of them.

For the other categories, plus Tier 4 and 5 at Ritz-Carlton, it does not look so attractive. I am not sure of the logic of this, because ‘cash and points’ is capacity-controlled by each hotel. If a hotel is worried about getting too many redemption requests, it can simply not participate – you don’t need to use pricing to put people off.

You cannot book ‘cash and points’ rooms yet – we are promised ‘early 2016’. More details can be found on the Marriott website here.

How to earn Marriott Bonvoy points and status from UK credit cards (April 2024)

There are various ways of earning Marriott Bonvoy points from UK credit cards. Many cards also have generous sign-up bonuses.

The official Marriott Bonvoy American Express card comes with 20,000 points for signing up, 2 points for every £1 you spend and 15 elite night credits per year.

You can apply here.

Marriott Bonvoy American Express

20,000 points sign-up bonus and 15 elite night credits each year Read our full review

You can also earn Marriott Bonvoy points by converting American Express Membership Rewards points at the rate of 2:3.

Do you know that holders of The Platinum Card from American Express receive FREE Marriott Bonvoy Gold status for as long as they hold the card? It also comes with Hilton Honors Gold, Radisson Rewards Premium and MeliaRewards Gold status. We reviewed American Express Platinum in detail here and you can apply here.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

You can also earn Marriott Bonvoy points indirectly:

- American Express Gold (20,000 bonus Amex points)

- American Express Rewards Credit Card (10,000 bonus Amex points)

and for small business owners:

- American Express Business Gold (20,000 bonus Amex points)

- American Express Business Platinum (40,000 bonus Amex points)

The conversion rate from American Express to Marriott Bonvoy points is 2:3.

(Want to earn more hotel points? Click here to see our complete list of promotions from the major hotel chains or use the ‘Hotel Offers’ link in the menu bar at the top of the page.)

Rob

Rob

Comments (3)