Bits: new way to spend Emirates miles, British Airways removes therapeutic oxygen

Links on Head for Points may support the site by paying a commission. See here for all partner links.

News in brief:

A new way to spend expiring Emirates Skywards miles

I get a lot of emails from HfP readers concerned about some Emirates Skywards miles which are approaching expiry.

Your options are fairly limited. There is no way of extending their life so you need to spend them before they expire. For small amounts your options include:

- tickets to Arsenal, either in the stands or in the Emirates suite

- easyJet flights

- transferring them to Heathrow Rewards, albeit the points are ring-fenced for Heathrow shopping vouchers and cannot be transferred to Avios

There is now a new option. Thanks to a new partnership with Rocketmiles, you can now redeem Emirates Skywards miles for hotel rooms across the world. You can combine miles and cash – as long as you have at least 5,000 miles – so this is a good way of using up your entire expiring balance.

You can also earn Emirates Skywards miles on hotel rooms booked via Rocketmiles.

Full details can be found on the Emirates website here.

BA to remove therapeutic oxygen from short-haul flights

In an interview with Skift last month, British Airways CEO Alex Cruz said “If one particular day we don’t come up with an idea to reduce our costs, then we’re not doing our job.”

And so it came to pass on Friday that BA announced it will no longer provide therapeutic oxygen on short-haul flights departing after 1st February 2018.

Customers requiring therapeutic oxygen on short-haul flights are being told to make their own provisions. You need to receive medical clearance from BA before you can bring your own therapeutic oxygen onboard, and it must be from a list of acceptable providers.

British Airways will continue to provide therapeutic oxygen on board long-haul flights.

Etihad offering a free repeat holiday if it rains

Etihad is pushing its Etihad Holidays packages at the moment with an interesting guarantee.

If you book a break in Abu Dhabi, and there is more than 5mm of rain during your stay, Etihad will provide you with a free replacement holiday up to the same value.

The small print is confused, however. The website for this offer mentions ‘1st May to 30th September’ but the small print talks about stays between 1st June and 31st August. This is a major difference as your best chance of a downpour is obviously in the shoulder season, primarily May. That said, the chance of a payout is slim in any event.

How to earn Etihad Guest miles from UK credit cards (April 2024)

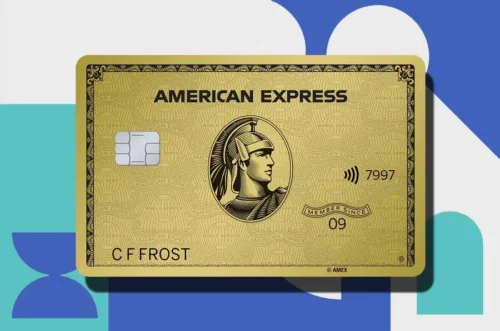

Etihad Guest does not have a UK credit card. However, you can earn Etihad Guest miles by converting Membership Rewards points earned from selected UK American Express cards.

Cards earning Membership Rewards points include:

- American Express Preferred Rewards Gold (review here, apply here) – sign-up bonus of 20,000 Membership Rewards points converts into 20,000 Etihad Guest miles. This card is FREE for your first year and also comes with four free airport lounge passes.

- The Platinum Card from American Express (review here, apply here) – sign-up bonus of 40,000 Membership Rewards points converts into 40,000 Etihad Guest miles.

- American Express Rewards credit card (review here, apply here) – sign-up bonus of 10,000 Membership Rewards points converts into 10,000 Etihad Guest miles. This card is FREE for life.

Membership Rewards points convert at 1:1 into Etihad Guest miles which is an attractive rate. The cards above all earn 1 Membership Rewards point per £1 spent on your card, which converts to 1 Etihad Guest mile. The Gold card earns double points (2 per £1) on all flights you charge to it.

Comments (91)