How to pay (almost) ANY bill with an American Express or other credit card, with Billhop

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Billhop is an easy way of running up credit and charge card spending by paying your day-to-day bills. For some HfP readers, it could be very useful indeed.

Registration with Billhop is free – see here – so you have nothing to lose by signing up and seeing how it works.

When it comes to paying bills your options are limited. Most companies want you to set up a direct debit or pay by bank transfer. Credit cards are rarely accepted (although some companies do take them quietly, even if they don’t mention it on their bills, eg Thames Water, Scottish Power). American Express is very, very rarely accepted.

You have very little chance of paying your business suppliers or personal rent with a credit card. (Although WeWork does let us pay the rent for the HFP office on an Amex.)

However there is finally a way around that. Thanks to Billhop you can now pay almost any bill or invoice with any Amex, Visa or Mastercard card, have it treated as a purchase and earn reward points.

More importantly to HfP readers, payments made via Billhop will also count towards spend targets on American Express cards, either for a sign-up bonus or a spending bonus such as the British Airways American Express 2-4-1 voucher.

The only major exception is that you cannot use Billhop to pay instalments on loans, mortgages or credit card bills, ie anything paid to a financial services business.

Is Billhop too good to be true?

If this sounds too good to be true, there is a catch – the service is not free. There is a 2.95% charge on every payment you make, i.e. if you pay a bill of £100, you will pay £102.95 in total.

This means that, unless you also want the cashflow benefits of putting your bills onto a credit or charge card, this is an expensive way of earning miles or points. It is something that you will find useful if you are struggling to hit the ‘£3000 spend in 90 days for 10000 bonus points’ target on a new American Express Gold card for example.

On the other hand remember that, if you run your own business and are paying company expenses, the Billhop fee is fully tax deductible.

Where is Billhop based?

Billhop was founded in Stockholm in 2012 – where it has proven very popular with the frequent flyer community – and has recently launched in the UK with plans to extend further in Europe in the current months.

The company is fully regulated in Sweden (which, under EU passporting rules, means they are regulated here as well) and, in any event, your money is fully protected because all payments are handled by an established bank. Billhop never has access to your funds, apart from the fee.

How does Billhop work?

You need to create an online account on the Billhop website here.

Once you are signed up, you can pay an individual person or a company using any credit card.

In order to find out how Billhop works, and how long it takes for a transaction to reach the account, we decided to give it a try. As neither Rob nor I had any bills flying through the door, we decided that I’d transfer £200 into Rob’s account. (That’s another 200 Amex points for me).

[UPDATE: Since this review was published, it is no longer possible to pay a private person via Billhop using an American Express card, unless you can supply an invoice for services provided. There is no problem paying council tax or any other bill you receive.]

Click ‘Get Started’ on the homepage and you will be taken to a page explaining how to use Billhop. Click the ‘register your account now’ button.

On the next page you can choose whether you’d like to register as a company (with company number) or as an individual (with your date of birth).

Click on any of the images to enlarge:

To create a personal account you need to fill out your details including email and postal address. You can transfer up to £250 without providing any verified ID, but for money laundering reasons Billhop will need a scanned copy or picture of your passport before you can make larger payments.

On the dashboard you can see your past bills, scheduled bills and pay new bills with a few clicks.

How to make a payment

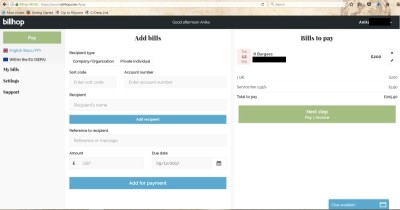

The payment process is very straight forward.

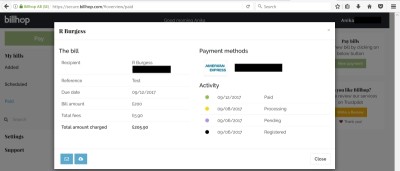

You enter the details on the left side of the screen including the date you would like the money to reach the recipient. I set up a £200 payment to Rob:

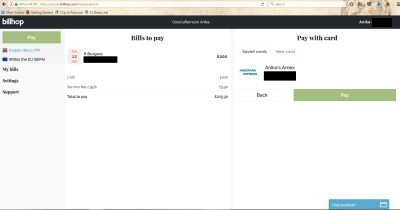

Then click ‘add to payment’ and the payment will show on the left side. A field appears on the the right side where you can enter your card details.

As you can see, a service fee of 2.95% has been added to my £200:

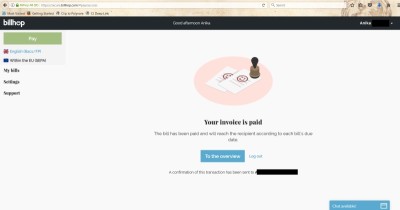

Then press ‘Pay’ and you’re done.

Immediately after paying, you receive an email confirmation that the bill has been paid.

In theory, the recipient will receive the money within 6 days. The money actually ended up reaching Rob’s account after 5 days and this included a weekend. The next day I received an email confirming my payment and my Billhop account also showed the payment.

Conclusion

Based on our own – admittedly simple – trial, and the experiences of the readers who have recommended the company to us, Billhop seems to be working as promised.

Billhop is not for everyone due to the 2.95% fee on every bill you pay. However a lot of Head for Points readers will instantly see the potential for hitting a sign-up target on a new credit card or for triggering a spending target on an existing one.

If you have been putting off getting the British Airways American Express Premium Plus card, for example, because you felt you couldn’t spend £3,000 in 90 days to earn the 25,000 Avios sign-up bonus, Billhop can help. The same goes for the big sign-up bonus on American Express Preferred Rewards Gold or American Express Platinum, both of which need a few thousand pounds of spending within 90 days.

It you were struggling to hit your £10,000 of spending for your British Airways American Express 2-4-1 voucher towards the end of your card year, it may be worth making a rent payment via Billhop in order to push yourself over the line. Paying, say, a £59 fee on a £2,000 payment (and earning 3,000 Avios back via Amex) is a far better deal than losing out on your 2-4-1 voucher.

If you have your own business, note that Billhop also works with companies – in fact, they see this as their core market – who can use the service to help with their working capital requirements.

The Billhop homepage is here if you want to give it a go. Even if you don’t want to make a transfer immediately, it may be worth signing up so that you don’t forget about it and to receive news of special offers and other promotions.

Want to earn more points from credit cards? – April 2024 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Virgin Atlantic Reward+ Mastercard

15,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending.

Barclaycard Select Cashback Business Credit Card

1% cashback uncapped* on all your business spending (T&C apply) Read our full review