Bits: Club Eurostar Shop opens, has the Avios reward chart vanished?, Cathay Pacific sale

Links on Head for Points may support the site by paying a commission. See here for all partner links.

News in brief:

The Club Eurostar Shop opens for business

One aspect of the new Club Eurostar programme I haven’t touched on yet is the new Club Eurostar shop.

This offers a new redemption option for those travellers who are – in the nicest possible way – sick to death of Eurostar after weekly commutes and would prefer to use their points for something totally different!

The Club Eurostar Shop is only available to mid-tier Avantage and top-tier Carte Blanche members. You will find a link on your home page after you log in.

There is certainly a lot on offer and the quality level seems to be pitched right given the target Eurostar market.

Regular readers won’t be surprised to know that the value you get is not great. I ran a few examples and you seem to be getting around 3p per point.

This isn’t Club Eurostar trying to rip you off, it is simply logical because of how these schemes work. If you redeem for, say, a Pure Evoke H3 DAB radio (3,460 points) then Eurostar has to buy it for you for £120. They would be happier if you redeemed for a Eurostar ticket which costs them virtually nothing in comparison. This is why you get around 10p to 15p per point for train redemptions.

That said, I am always in favour of giving people more choice when it comes to redemptions and the Club Eurostar Shop does add a lot of new options.

Has the Avios reward chart vanished?

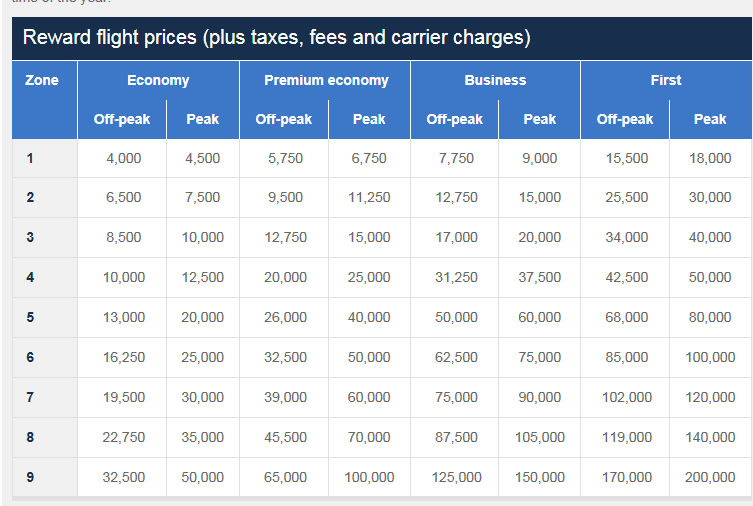

I was trying to find the Avios pricing chart on ba.com yesterday. Since the site had its revamp, however, I can’t find it anywhere.

If you want to know how much a redemption costs, it seems that you need to plug in your route into the redemption flight calculator here.

I also looked on avios.com. It still has a zonal map but nothing as simple as the table below.

This is, of course “not a good thing”. An unwillingness to be upfront about what redemptions actually cost is the first step to removing reward charts altogether and moving to some form of variable pricing.

The zones relate to the distance flown:

- Zone 1: 1 – 650 miles

- Zone 2: 651 – 1,150 miles

- Zone 3: 1,151 – 2,000 miles

- Zone 4: 2,001 – 3,000 miles

- Zone 5: 3,001 – 4,000 miles

- Zone 6: 4,001 – 5,500 miles

- Zone 7: 5,501 – 6,500 miles

- Zone 8: 6,501 – 7,000 miles

- Zone 9: 7,000+ miles

Cathay Pacific launches its winter sale

The Cathay Pacific sale is now on, with headline prices to Asia from £489 in Economy.

Business Class deals start at £2999 to Australia and New Zealand, £2359 to China, £2469 to Japan and Korea and £3619 to Hong Kong. (Hong Kong is never a great deal with Cathay because it is a direct flight from the UK, other destinations require a change of plane.) These are for travel from 9th January to 30th September 2018.

Cathay Pacific is a member of oneworld, so you will earn Avios and British Airways tier points when you fly with them.

Don’t forget that Cathay also flies from Manchester as well as Heathrow and Gatwick.

Full details are on the Cathay Pacific website here.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (73)