How to earn top-tier IHG Rewards Club status by transferring Virgin Flying Club miles

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Over the last few years, IHG Rewards Club has made it a lot harder to earn top-tier Spire Elite status by restricting the sort of points which count towards it.

I wrote a long article here looking at the different ways of earning IHG points and whether or not they count for status.

EDIT: IMPORTANT – as of July 2018, IHG is no longer treating transfers from Virgin Flying Club as status qualifying. Do NOT make transfers into IHG if you are purely interesting in earning status quickly.

The following points activities DO count towards IHG Rewards Club status:

- Room spend

- Points from a ‘Bonus Points’ room package

- Points from IHG credit card monthly spending

- Points from crediting a car rental

- Points from Virgin Atlantic transfers

The following points activities do NOT count towards status:

- Status bonuses on room spend

- Check-in amenity bonuses

- IHG credit card sign-up bonuses

- Accelerate and other promotional bonus points

- Points from e-rewards

What this means is that unless you spend £37,500 in a calendar year on the IHG Rewards Club Premium Mastercard or book a lot of stays which come with a bonus points package, you will need to spend $7,500 before VAT at InterContinental, Holiday Inn, Crowne Plaza etc hotels in a year to earn the 75,000 base points required for Spire Elite status.

Unless you’re me, of course. Back in 2015, I used the one roundabout route left to earn those key 75,000 base points. By making transfers to IHG Rewards Club from Virgin Atlantic Flying Club.

This page on the Virgin Atlantic website explains how to do it. You transfer at 1:1 with a minimum of 10,000 miles.

Before you say ‘that is a terrible idea’ and close the page, let me explain why.

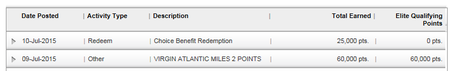

First, here is the proof from my own account that 1:1 transfers of Virgin Flying Club miles to IHG Rewards Club count as base points. This is a 2015 screenshot but I get regular reports from readers who confirm that it still works OK:

I have, in the past, said that transferring Virgin miles to IHG is a bad idea. And, on the face of it, it is. I value an IHG Rewards Club point at 0.4p so effectively getting 0.4p of value for a Virgin Flying Club mile by transferring it is not clever.

However, Spire Elite status has real value. Whilst IHG has never been great in terms of upgrades, you are top of the pecking order now.

There is one extra benefit: you receive 25,000 bonus IHG Rewards Club points when you reach or renew IHG Spire Elite top tier status. These points post instantly to your account. There is an alternative of gifting Platinum status to a friend but I have discounted that in this analysis.

Analysing the value of a Virgin Flying Club transfer to IHG

I value IHG Rewards Club points at 0.4p, based on redeeming 70,000 for a five-star InterContinental night valued at £250+ in a major city.

Let’s look at three scenarios for getting to the magical 75,000 qualifying points figure, based on different starting levels of elite qualifying points and assuming you take the 25,000 bonus points as your Spire Elite welcome gift:

Current elite points: 15,000 / Transferred Virgin miles: 60,000 / IHG points earned: 85,000 inc the 25,000 Spire bonus / Value: £340

Current elite points: 35,000 / Transferred Virgin miles: 40,000 / IHG points earned: 65,000 inc the 25,000 Spire bonus / Value: £260

Current elite points: 55,000 / Transferred Virgin miles: 20,000 / IHG points earned: 45,000 inc the 25,000 Spire bonus / Value: £180

This values your Virgin Flying Club miles at:

0.57p (£340 / 60,000) in example one

0.65p (£260 / 40,000) in example two

0.90p (£180 / 20,000) in example three

The last one is an acceptable valuations for a Virgin Flying Club redemption, in my opinion. However, you ALSO need to factor in the 100% points bonus that you will receive on your IHG stays whilst you have top tier status AND whatever upgrades and benefits the new tier will bring. That will add extra value on top.

Another example using American Express points

Imagine that you have no Virgin Flying Club miles at the moment but obtain them by transferring in from American Express Membership Rewards points at 1:1.

You would get the same valuations – 0.57p per Amex point if you transferred 60,000 up to a decent 0.9p per Amex point for transferring 20,000.

Again, this assumes ZERO value for the 100% base points bonus you will get as a top tier member on your stays or the value of upgrades etc.

A final example using Tesco Clubcard points

Here is another example. Imagine that you convert Tesco Clubcard points to Virgin Flying Club to IHG Rewards Club.

Tesco regularly runs 20% conversion bonuses to Virgin Flying Club. These bonuses have been so frequent that my numbers assume that such a bonus is running and you receive 300 Virgin miles instead of the usual 250 per £1:

Current elite pts: 15,000 / Transferred Tesco to Virgin: £200 = 60,000 miles / IHG points earned: 85,000 / Value: £340

Current elite pts: 35,000 / Transferred Tesco to Virgin: £133 = 40,000 miles / IHG points earned: 65,000 / Value: £260

Current elite pts: 55,000 / Transferred Tesco to Virgin: £66 = 20,000 miles / IHG points earned: 45,000 / Value: £180

This gives you a multiple on your Tesco vouchers of:

1.7x (£340 / £200) in example one

2.0x (£260 / £133) in example two

3.0x (£180 / £66) in example three

The last one is as good as Tesco Clubcard redemptions get, given the devaluation last week. And, again, it ignores any benefits you get from Spire Elite such as a 100% status bonus on your future stays.

Timing is an issue ….

If you are thinking of doing this, there is a timing issue to consider.

IHG status years are based on calendar years.

It is now only June. I would be surprised if you know, with certainty, how many more IHG cash stays you will have this year. This means that you won’t know how many base points you be ‘short’ for hitting Spire Elite.

To maximise value, you should arguably wait until you have done your final IHG stay for the year and then do the smallest Virgin Flying Club transfer possible to hit 75,000 points.

On the other hand, you will maximise your upgrade chances and earn a 100% status bonus on your future stays if you get yourself upgraded now.

PS. If you are not bothered about Spire Elite, remember that IHG Rewards Club gives our free mid-tier Platinum Elite status with the £99 IHG Rewards Club Premium Mastercard. You also get free Gold Elite status with the free IHG Rewards Club Mastercard.

How to earn Virgin Points from UK credit cards (April 2024)

As a reminder, there are various ways of earning Virgin Points from UK credit cards. Many cards also have generous sign-up bonuses.

You can choose from two official Virgin Atlantic credit cards (apply here, the Reward+ card has a bonus of 15,000 Virgin Points):

Virgin Atlantic Reward+ Mastercard

15,000 bonus points and 1.5 points for every £1 you spend Read our full review

Virgin Atlantic Reward Mastercard

A generous earning rate for a free card at 0.75 points per £1 Read our full review

You can also earn Virgin Points from various American Express cards – and these have sign-up bonuses too.

American Express Preferred Rewards Gold is FREE for a year and comes with 20,000 Membership Rewards points, which convert into 20,000 Virgin Points.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express comes with 40,000 Membership Rewards points, which convert into 40,000 Virgin Points.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Small business owners should consider the two American Express Business cards. Points convert at 1:1 into Virgin Points.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Virgin Points.

(Want to earn more Virgin Points? Click here to see our recent articles on Virgin Atlantic and Flying Club and click here for our home page with the latest news on earning and spending other airline and hotel points.)

Rob

Rob

Comments (46)