Why Hilton’s proposed new UK reward credit card could be one of the best

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Hilton Honors sent a few members a questionnaire yesterday seeking their opinion on two new UK credit card options. And, it has to be said, it looks promising.

I have written before that Hilton is known to be working on a new product to replace the existing Barclays product, now closed to new applicants. The two scenarios being circulated are both attractive, and one could be great for high spenders.

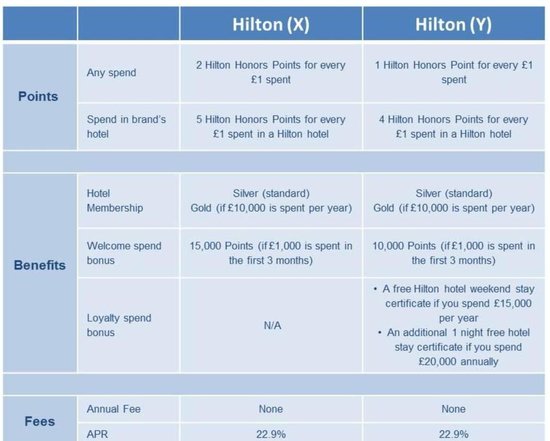

Here are the two options:

Let’s summarise this briefly:

Neither scenario has an annual fee (surprising, because in the new 0.3% interchange environment, a fee is one of the few ways to generate revenue)

The proposed sign-up bonus is pretty good for a free card, being worth £33-£50 for £1000 spend

The proposed earning rate for spending at Hilton properties is excellent (4-5 points per £1)

All cardholders get Silver status in Hilton Honors, with Gold (free breakfast) for spending £10,000 in a year

The earning rate would be either 2 points per £1 (worth about 0.66p – very good for a Visa / Mastercard in the current environment) or, far more interesting, 1 point per £1 PLUS a free weekend night voucher at £15,000 and ANOTHER free weekend night voucher at £20,000

Let’s do the maths.

For someone who spends £20,000 on the proposed 2nd version, you would receive:

20,000 Hilton Honors points, worth £66

Gold status in Hilton Honors, which we’ll assume is worth £100 to the average leisure guest over a year

TWO free weekend nights which – if they can be used at any Hilton Group hotel, including the top Conrad and Waldorf Astoria options – could be valued at £500 between them

This gets you £666 of benefits for £20,000 of spending. This is an attractive 3.3% return.

The proposed 1st version is better for low spenders but less attractive to high spenders. All you receive is 2 Hilton Honors points per £1 spent, which I value at 0.66p, so a 0.66% return on your spending. This goes up to 1.66% if the cardholder spent £10,000, earned Hilton Gold status and got £100 of value from the free breakfasts.

How does this compare to other cards on the market?

This is how I value the long-term spending benefits on the airline and hotel credit cards still available to new applicants. To understand my calculations, read this article.

- British Airways American Express Premium Plus – 10.1% back on first £10,000

- British Airways American Express (free version) – 6.1% back on first £20,000

- IHG Rewards Club Premium Mastercard – 2.3% back on first £10,000

- Generic cashback Visa or Mastercard – 0.5% back, usually in vouchers

The free Virgin Money Reward Mastercard varies by status:

- Base Virgin Flying Club member – up to 2.4% on first £20,000

- Silver Virgin Flying Club member – up to 3.4% on first £20,000

- Gold Virgin Flying Club member – up to 6.4% on first £20,000

The £160 Virgin Money Reward+ Mastercard also varies by status:

- Base Virgin Flying Club member – up to 4.4% on first £10,000

- Silver Virgin Flying Club member – up to 6.3% on first £10,000

- Gold Virgin Flying Club member – up to 12.3% on first £10,000

As you can see, if Hilton Honors went with the 2nd proposal above:

It would be more generous for a high spender than the IHG Rewards Club Premium Mastercard

It would be more generous than the free Virgin Money Reward Mastercard if you don’t have Virgin Flying Club status

I have a proposed tweak though ….

I accept that Hilton Honors may not want to launch a card which requires £20,000 of expenditure to unlock all of the benefits. It excludes a lot of the potential market.

I would be tempted to ‘do an IHG’ and have two variants:

as ‘Option X’ above, a free card earning 2 points per £1, giving Silver status to everyone and Gold at £10,000

a revised ‘Option Y’ with an annual fee of, say, £75 but with a higher earning rate of 2 points per £1 plus the two free night vouchers for spending £20,000

My revised ‘Option Y’ is actually a better deal for Hilton than their ‘Option Y’ except when dealing with ultra-high spenders. One way around this would be to reduce the earning rate to 1 point per £1 after spending, say, £50,000 per year.

On £20,000 of annual spend they would be giving out 20,000 additional Hilton Honors points but they are getting a £75 fee – albeit the card issuer will want a cut.

Importantly, both of the cards I outline above would be more attractive than their respective IHG Rewards Club variants. The free card would also be more attractive than the Marriott Rewards Mastercard, assuming that it returns to the market next month with the same benefits package (1 point per £1, no long-term spend incentive) as the old version.

Conclusion

If Hilton Honors does go ahead and launches a free Mastercard / Visa product offering two free weekend nights EVERY YEAR for spending £20,000, I think it would have substantial appeal to Head for Points readers.

A product which got you a free 2-night weekend break every year at Hilton Venice, Conrad London St James, Waldorf Astoria Rome, Waldorf Astoria Berlin etc would be very tempting.

It isn’t that clear cut of course. I am assuming that the free night voucher can be used at any hotel, which may not be the case. Restricting it to weekend use also makes it less flexible.

Make no mistake though – I would be getting one of these cards if they did come to market.

How to earn Hilton Honors points and status from UK credit cards (April 2024)

There are various ways of earning Hilton Honors points from UK credit cards. Many cards also have generous sign-up bonuses.

Do you know that holders of The Platinum Card from American Express receive FREE Hilton Honors Gold status for as long as they hold the card? It also comes with Marriott Bonvoy Gold, Radisson Rewards Premium and MeliaRewards Gold status. We reviewed American Express Platinum in detail here and you can apply here.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Did you know that the Virgin Atlantic credit cards are a great way of earning Hilton Honors points? Two Virgin Points can be converted into three Hilton Honors points. The Virgin Atlantic cards are the only Visa or Mastercard products in the UK which can indirectly earn Hilton Honors points. You can apply here.

You can also earn Hilton Honors points indirectly with:

- American Express Gold (20,000 bonus Amex points)

- American Express Rewards Credit Card (10,000 bonus Amex points)

and for small business owners:

- American Express Business Gold (20,000 bonus Amex points)

- American Express Business Platinum (40,000 bonus Amex points)

The conversion rate from American Express to Hilton points is 1:2.

(Want to earn more hotel points? Click here to see our complete list of promotions from the major hotel chains or use the ‘Hotel Offers’ link in the menu bar at the top of the page.)

Rob

Rob

Comments (127)