Mistake or madness? Virgin Flying Club adds £200+ to USA Upper Class flight surcharges

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Either something has gone wrong with the Virgin Atlantic pricing computer, or someone at Virgin Atlantic has been smoking something dodgy this week.

Whichever reason it is, pricing for Virgin Atlantic Upper Class redemptions to the US – and only the US, and only if you fly with Virgin Atlantic – has gone crazy.

The taxes and charges figure for ALL Virgin Atlantic Upper Class redemptions to the US from Heathrow is now showing as £764 return. From Gatwick it is £732.

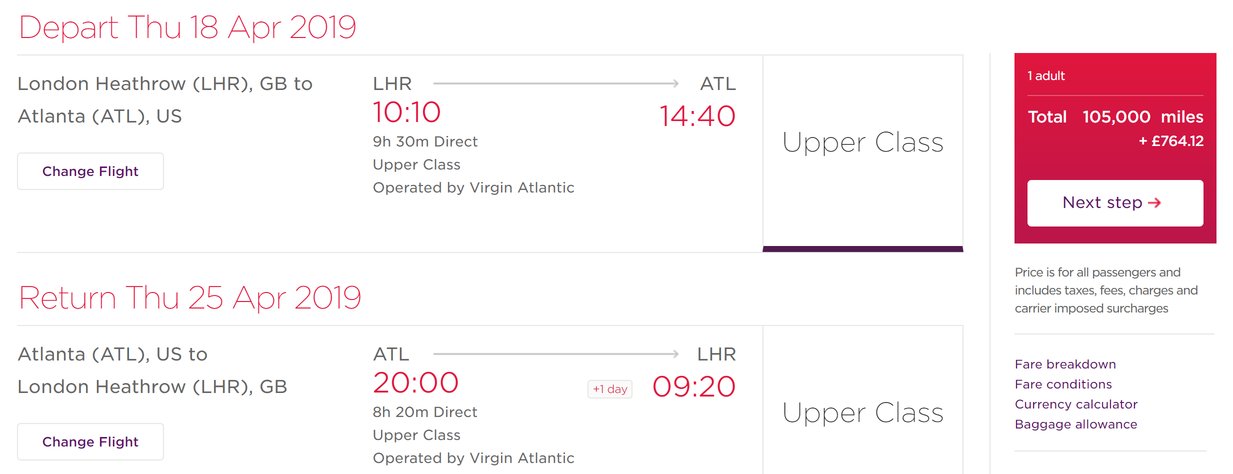

Take a look, Heathrow to Atlanta (click to enlarge):

As you can see …. £764 of taxes and charges.

This could be a mistake of some sort …. hopefully. Here’s why.

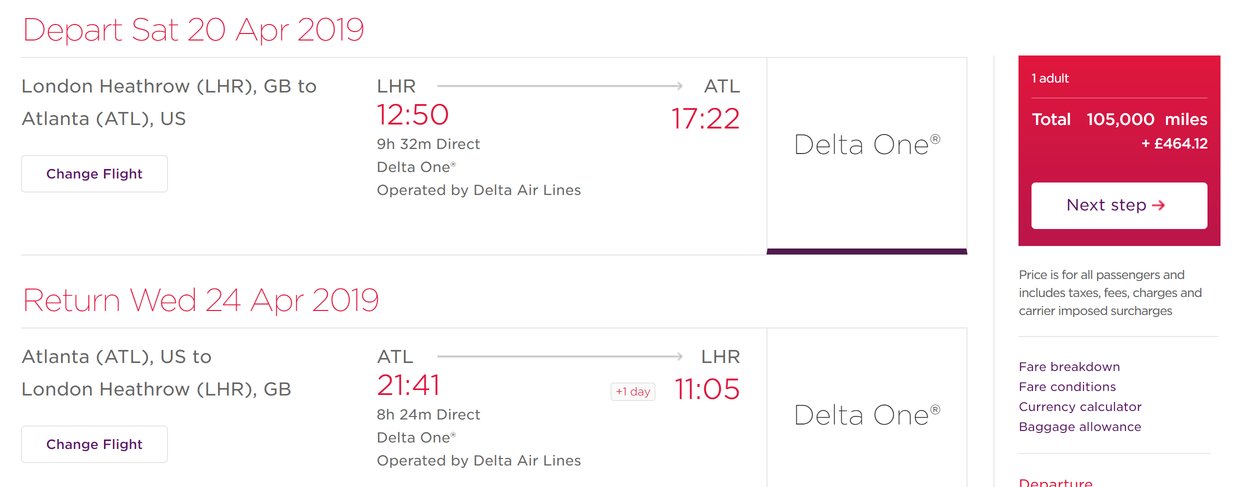

This screenshot shows the same route, Heathrow to Atlanta, but flying with Virgin’s partner and main shareholder Delta:

With Delta, you pay just £464 in taxes and charges. It is exactly £300 cheaper, to the penny, reflecting the additional £300 of charges that Virgin is adding to its own flights for some reason.

This is only happening with Virgin Atlantic routes to the US.

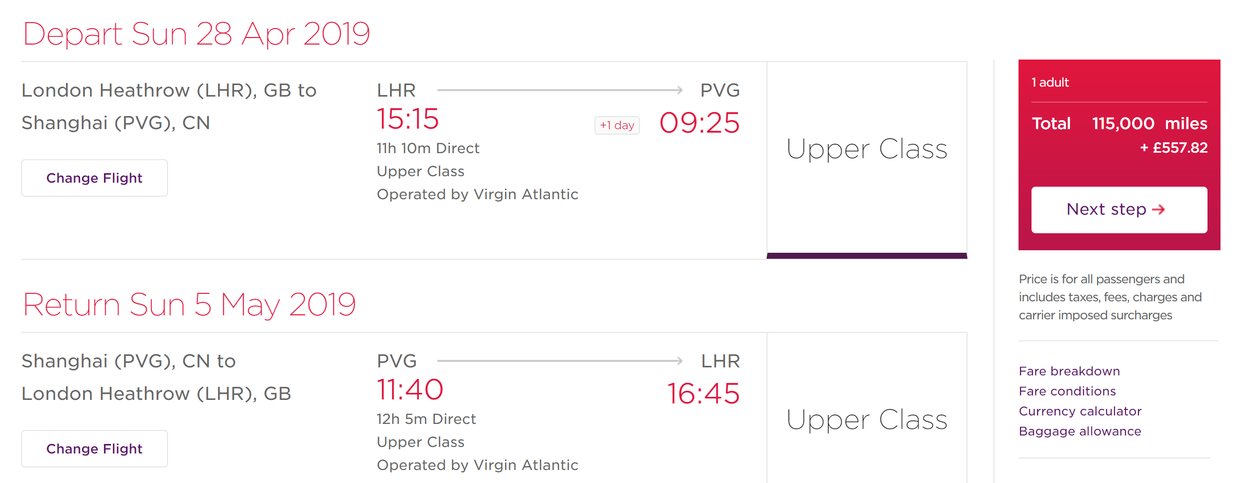

Here is a screenshot to Shanghai:

The taxes and charges are the same as they always were – £557.

Johannesburg is unchanged at £573. Barbados is unchanged at £533. The same goes for all other non-US routes that I checked.

So …. what is happening here? Has a gremlin got into the Virgin Atlantic pricing computer? Does it really want you to stop redeeming for US routes in Upper Class? Does it really want you to start flying Delta on routes where the two airlines share the flights (Atlanta, Boston, New York etc)?

It is all very, very odd.

How to earn Virgin Points from UK credit cards (April 2024)

As a reminder, there are various ways of earning Virgin Points from UK credit cards. Many cards also have generous sign-up bonuses.

You can choose from two official Virgin Atlantic credit cards (apply here, the Reward+ card has a bonus of 15,000 Virgin Points):

Virgin Atlantic Reward+ Mastercard

15,000 bonus points and 1.5 points for every £1 you spend Read our full review

Virgin Atlantic Reward Mastercard

A generous earning rate for a free card at 0.75 points per £1 Read our full review

You can also earn Virgin Points from various American Express cards – and these have sign-up bonuses too.

American Express Preferred Rewards Gold is FREE for a year and comes with 20,000 Membership Rewards points, which convert into 20,000 Virgin Points.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express comes with 40,000 Membership Rewards points, which convert into 40,000 Virgin Points.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Small business owners should consider the two American Express Business cards. Points convert at 1:1 into Virgin Points.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Virgin Points.

(Want to earn more Virgin Points? Click here to see our recent articles on Virgin Atlantic and Flying Club and click here for our home page with the latest news on earning and spending other airline and hotel points.)

Rob

Rob

Comments (128)