Tesco Bank suspends applications for its Avios-earning current account

Links on Head for Points may support the site by paying a commission. See here for all partner links.

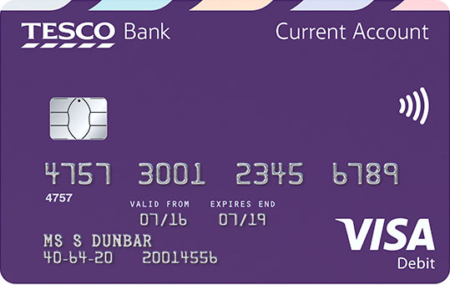

Since 2014, when Tesco launched its current account, it has been possible to earn Avios or Virgin Flying Club miles with your day-to-day DEBIT card banking.

Until this week.

Tesco has suspended new applications for its current account. Take a look on its website here.

It isn’t clear if this is permanent or not.

The website simply says:

“Sorry, we’re not accepting new current account applications at the moment, but please pop back in the new year for an update on this.

If you’re an existing customer you can continue to use your account as normal.”

Tesco has done this before, but for different reasons. Earlier suspensions were due to the account being overrun with applications due to an exceptionally generous interest rate. Given how far that rate has been cut in recent years, this certainly is not the case now.

Tesco let you earn Avios with your current Account DEBIT card

If you had this account, you were earning Clubcard points on all of your debit card transactions:

1 point per £1 spent in Tesco (2.4 Avios per £1 / 2.5 Virgin miles per £1)

1 point per £8 spent elsewhere (0.3 Avios per £1 / 0.31 Virgin miles per £1)

The ‘1 point per £1’ spent in Tesco was a very generous benefit. If you were spending £100 per week in Tesco, which includes Tesco Fuel, you would earn 12,480 Avios or 13,000 Virgin Flying Club miles per year if you put all of this spending onto your debit card. That was on top of the base Clubcard points you would receive irrespective of how you pay. This was a pretty attractive deal.

Even the ‘1 point per £8 spent elsewhere’ was attractive. Whilst you would be better off in most circumstances using a loyalty credit card instead, it was not always possible to avoid using a debit card.

There was ‘small print’ attached to the ‘1 Clubcard point per £8 spent on the debit card’. All payments to ‘banks and financial institutions’ were exempt. This means that you could not pay your mortgage, pay off a credit card bill or pay money into a savings account.

It DID work with payments to the Inland Revenue. With Curve now imposing fees on HMRC payments and Capital On Tap switching to a credit card from a debit card, it was one of the few ways of profiting from tax payments.

Is Tesco Bank still in the game or not?

I get a feeling that Tesco is trying to wind down Tesco Bank without making a big song and dance over it. As Tesco owns its bank outright, winding it down would release a lot of capital.

In September 2019, Lloyds Bank bought Tesco’s mortgage portfolio for £3.8bn. Not only does it no longer sell mortgages, it has sold off all the ones it had already generated.

It quietly started cutting the interest rates on its savings accounts. These had been aggressive – I have two myself – because Tesco wanted the funding to support its mortgage lending. Now that it isn’t making any new mortgage lending, it doesn’t have much use for deposits. The top offering is currently 1.2% vs 1.35% at Marcus.

The credit card arm has also had a lobotomy. The Premium card was closed, as were many variants of the standard credit card. It is a long time since there was an incentive to sign up to their credit cards, which are another way of earning Avios and Virgin Flying Club miles, albeit at a very low rate.

I’ll keep an eye out and let you know if the current account reappears, as long as it still earns Clubcard points.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (211)