Is the new Tesco Clubcard Plus credit card, which earns Avios, worth a look?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This is our review of the new Tesco Clubcard Plus credit card. Does it have anything new to offer?

Last November, Tesco launched its new subscription-based Clubcard Plus proposition. The idea is that, for a monthly fee of £7.99, you get a range of benefits on Tesco products.

Here is what you get for your money:

10% off two monthly shops, up to £200 each (INSTORE ONLY)

10% off F&F, Fred & Flo, Go Cook, Fox & Ivy, Tesco Pet and Carousel brands all year round

Double data on your Tesco mobile contract

Exclusive access to a Tesco Bank card with 0% foreign transaction fees

These are on top of the usual benefits you’d get from a ‘standard’ Clubcard, including points earning and spending.

The response to date from the public seems to have been muted, to say the least.

Whether these benefits are worth the £7.99 a month you are paying depends on your personal shopping habits. If you spend £100 on groceries every fortnight in a single shop, you would save £20 per month. That would mean, disregarding all the other benefits, that you were saving £12 a month.

The problem is that many of us are moving away from big weekly or monthly shops, choosing to nip around to the local shop more often to buy fresh produce. There is no simple answer, so you will have to work out yourself if you will save any money upgrading yourself to Clubcard Plus.

The inability to claim the discount on deliveries is also odd.

Is the Tesco Clubcard Plus credit card any good?

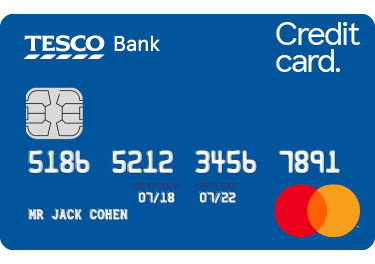

Whilst Clubcard Plus launched in November, the credit card only launched this month. It looks like this:

Here is a summary of the benefits:

No annual fee

No foreign exchange fees

0% interest on purchases for 12, 15 or 18 months depending on status

Earn 1 Clubcard point for every £8 you spend (1 per £4 in Tesco)

Representative interest rate on purchases 19.9% variable

There is NO sign-up bonus.

On the face of it, these benefits are not bad. The problem is this – they are nowhere good enough, on their own, to justify paying £7.99 per month for Clubcard Plus.

I would go further, in fact, and say that this credit card should play no part in your decision on whether to get Clubcard Plus or not.

The Clubcard earning rate on this card is the same as the rate on the free Tesco credit card. At 0.125 Clubcard points per £1, you would get 0.3 Avios or 0.312 Virgin Flying Club miles per £1. It’s not great, but the ability to use your vouchers for other Clubcard deals if you change your mind about Avios or Virgin miles is a strong plus point.

However, if you want a Tesco credit card, you can get the free one which has the same earning rate – there is no need to join Clubcard Plus.

Similarly, there are no shortage of free credit cards offering 0% foreign exchange fees.

There is one genuine benefit. As well as 0% FX fees, you will also earn Clubcard points on your foreign spend. This means that it is the only personal credit card which lets you earn Avios on foreign spend whilst paying 0% FX fees. The Avios rate is so low, however, that you could never justify the £7.99 fee just for this.

Conclusion

Tesco Clubcard Plus is a bit of a missed opportunity and, for Tesco, possibly a mistake.

If you spend £80 or more across no more than two in-store shopping trips per month, it makes sense to join – but does it make sense for Tesco to give you a big discount, whilst also alienating online customers?

For everyone else, the additional benefits – such as this credit card – are so weak that signing up makes no sense. This isn’t Amazon Prime, by a long way

If you have got Clubcard Plus already and spend a lot of money outside the UK, it may be worth adding this card in order to earn Avios whilst racking up 0% FX fees. Assuming you already have a 0% FX fees card without rewards, however, I doubt the benefits make it worth adding yet another card to your life. If you had £5,000 of foreign spend per year you would earn just 1,500 Avios, which is hardly worth the effort of applying.

You can apply for the card on the Tesco Bank website here.

Want to earn more points from credit cards? – April 2024 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Virgin Atlantic Reward+ Mastercard

15,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending.

Barclaycard Select Cashback Business Credit Card

1% cashback uncapped* on all your business spending (T&C apply) Read our full review

Comments (136)