Apple Pay is now functioning on the Barclaycard Avios credit cards

Links on Head for Points may support the site by paying a commission. See here for all partner links.

As our article on Tuesday explained, an astonishing bonus of 50,000 Avios is currently available if you apply for the Barclaycard Avios Plus credit card. You can apply here.

The benefits are very impressive. The Barclaycard Avios Mastercards are, easily, the most rewarding non-Amex travel credit cards on the market. They are arguably the most valuable Visa or Mastercard credit cards in the UK of any sort.

There were, however, delays in setting up the cards to work with Apple Pay. This was especially frustrating because the pre-printed brochure that arrived with the cards said that it was functioning.

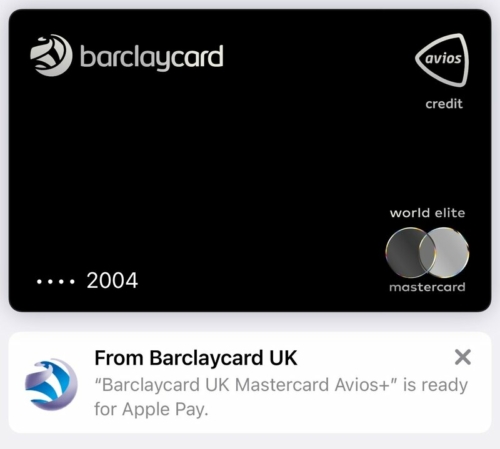

The good news is that Apple Pay functionality is now here. It has actually been in beta for the last few weeks, but Barclaycard is now happy to publicly announce it. Above is a screenshot to prove it.

If you had been putting off getting one of the cards due to the lack of Apple Pay support, you can now jump in.

The 50,000 Avios sign-up bonus on Avios Plus runs to 18th July. You can also pick up a 10,000 Avios bonus on the free Avios Mastercard – but as long as you can spend £3,000 in three months it makes more sense to get Avios Plus and reconsider later.

To learn more about the cards, read our Barclaycard Avios Mastercard credit card review here and our Barclaycard Avios Plus Mastercard credit card review here.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rhys

Rhys

Comments (57)