LAST CHANCE: Get 1,500 bonus Avios with the British Airways Prepaid Mastercard

Links on Head for Points may support the site by paying a commission. See here for all partner links.

UPDATE – APRIL 2024: This article is now out of date, but don’t worry. We produce a monthly directory of the top UK travel credit card offers – please click HERE or use the ‘Credit Cards’ menu above. Thank you.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Keep up to date with the latest UK credit card bonuses by signing up for our free daily or weekly newsletters.

British Airways has recently launched a Prepaid Mastercard – and we’ve negotiated a special sign-up bonus for Head for Points readers.

This is your last chance to apply. The offer closes on Sunday evening, 14th August.

You will receive a total of 3,000 Avios (1,500 Avios on top of the standard welcome bonus of 1,500 Avios) when you sign-up using our special promo code HFP2022. You only need to spend £500, €500 or $500 within 90 days to earn the bonus. The card is FREE for the first six months but after that it will cost £2.99 per month if you keep it long term.

This is NOT just a travel product. You can use it in the UK for your day to day spending.

Full details are on ba.com here although you cannot apply via the website.

What is the British Airways Prepaid Mastercard?

Good question. Long-term readers may remember that Avios used to have a prepaid travel money card in the past. This is a next-generation product which can be operated via your smartphone.

Here are the key things you need to know:

- This is NOT a credit card – it is a prepaid card

- You must preload your card before you can spend on it

- There are no credit checks when applying, because you’re not being given any credit. As long as you have a UK current account, you will be accepted

- The card is managed via the British Airways Executive Club Rewards app, which is separate to the British Airways app

- There are no foreign exchange fees when spending in $ and € although there are loading limits

How many Avios do I earn on the card?

It is very simple. You earn 1 Avios for every £2, €2 or $2 of eligible purchases you make.

Your Avios are added to your British Airways Executive Club account on a transaction-by-transaction basis, which is useful – there is no need to wait until the end of the month.

There is a list of transaction types which will not earn Avios.

Is there a sign-up bonus?

Yes.

The standard welcome bonus is 1,500 Avios. You will receive this after spending £500, $500 or €500 on the card in the first 90 days.

There is a special offer for Head for Points readers which runs until tomorrow, Sunday 14th August.

Apply by 14th August using promo code HFP2022 when you apply and you will receive a higher welcome bonus of 3,000 Avios (1,500 Avios on top of the standard welcome bonus of 1,500 Avios).

3,000 Avios is clearly a good return for spending £500, $500 or €500 on the card, especially as it is totally OK to spend the entire £500 in Sterling. You don’t need to be travelling in the next 90 days to earn the bonus.

Is there a fee for the card?

The British Airways Prepaid Mastercard is free for the first six months.

If you choose to keep it after six months, there will be a monthly fee of £2.99.

If you apply now, your free six months will see you through the core Summer and Autumn travel period.

Does the card work with Apple Pay?

Yes. Google Pay has now also launched.

Can you withdraw cash for free with the card?

Yes. You can make three withdrawals of up to £300 equivalent per month with no FX fees.

Additional withdrawals will incur a 2% withdrawal fee. There is no FX fee as long as you are withdrawing in £, € or $ and have a balance in the relevant ‘wallet’ on the card.

How does the card work day to day?

Your British Airways Prepaid Mastercard will be linked to your UK current account debit card. You top it up in Sterling via the British Airways Executive Club Rewards app.

When travelling abroad, you have two options:

- you can move funds from the Sterling ‘wallet’ on your card into either the Euro or Dollar wallets, or

- you can keep your funds in the Sterling ‘Wallet’ with transactions being charged at the Mastercard exchange rate + 1.5%

The second option applies by default if you make a purchase which is not in € or $. You also find the second option cheaper than the first even if you are spending in € or $, as we explain below.

You cannot withdraw money back from the card into your current account. The only exception is if you are closing your card, at which point you will be charged a £5 balance transfer fee. It makes more sense to spend any remaining balance in the UK, perhaps by ordering an Amazon gift card for yourself online.

There are daily, monthly and annual caps on the amount you can load onto the card, the amount you can spend and the number of transactions you can make, but they are unlikely to inconvenience 99% of users.

What fees will I pay?

You may think that this all sounds too good to be true, at least for the first six months whilst the card is free.

After all, you earn 1 Avios for every £2 / €2 / $2 you spend and there are no FX fees on your € or $ spending. Where is the catch?

If you spend in £ in the UK:

There is no catch. You load the card in Sterling, you spend in Sterling and you earn 1 Avios for every £2 you spend.

If you didn’t qualify for the Barclaycard Avios Mastercard, this is a great way to earn Avios on your Sterling spending. You can’t go wrong for the first six months, whilst the card is free, but after that you should do the maths to see if the £2.99 monthly fee makes sense.

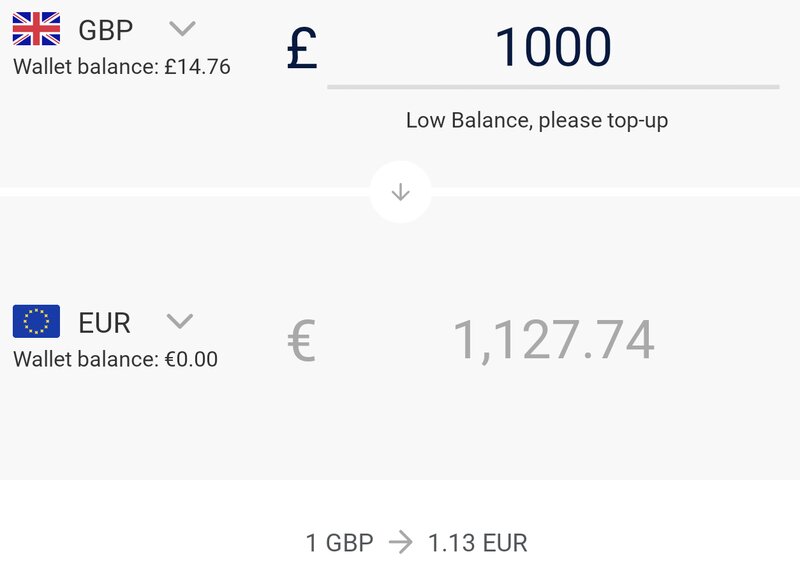

If you spend in $ or € outside the UK:

When you move money from your £ ‘wallet’ to your $ or € wallet, the exchange rate is not great. Here is an example from a day when the spot rate was 1.16:

Similarly, the $ rate was offering $1.18 to the £1 on a day when the spot rate was $1.21.

This means that, whilst transactions made in € or $ are FX-free themselves, you are still paying roughly 3% to move your ‘wallet’ currency out of Sterling in the first place.

If you spend in other currencies:

There is a 1.5% FX fee for transactions in currencies apart from Euro and US$.

Oddly, because these transactions work off the Mastercard exchange rate – which is only slightly away from the interbank rate – the fees are lower at around 2% all-in.

How do you apply for the British Airways Prepaid Mastercard?

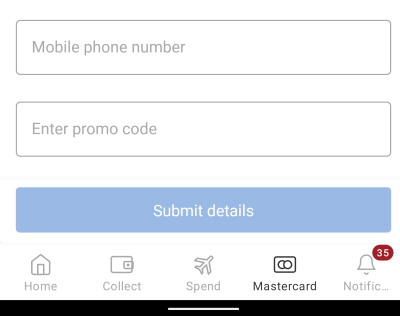

It’s simple. You must be at least 18 years old, a UK resident, a member of British Airways Executive Club, have a UK debit card and have the British Airways Executive Club Rewards app on your smartphone.

Open up the British Airways Executive Club Rewards app, click the Mastercard logo in the menu at the bottom and you’re away.

You will need your passport or driving licence to hand in order to compete the application and you will need to submit a very short video of your face.

Don’t forget to use promo code HFP2022 to get the higher Head for Points welcome bonus of 3,000 Avios!

You can find out more and see the full T&C on this page of ba.com, but you need to apply via the British Airways Executive Club Rewards app.

Conclusion

You can pick up a very easy 3,000 Avios by giving the new British Airways Prepaid Mastercard a go.

It is a good product for anyone who wants to earn Avios from their non-Amex card spending in the UK and didn’t get accepted for the Barclaycard Avios Mastercard.

The maths is trickier for FX spending, because of the loading limits, so you need to compare this product with whatever else you are currently using for overseas spending.

Thanks to IAG Loyalty for making this special sign-up bonus available to our readers. Remember that you need to apply by Sunday night, 14th August to pick up the 3,000 Avios bonus.

Full terms and conditions for the Head for Points promotion:

1.1 For the British Airways Prepaid Mastercard, 1,500 Avios welcome bonus will be awarded to your BAEC account if you have held your Card for 90 days and have spent a minimum of either £500, $500 or €500 in any one currency within 90 days of activating your Card. ATM transactions do not apply.

1.2 An additional 1,500 Avios will be added to your BAEC account if you use the promotor code (HFP2022) on the Head for Points website between 11 July – 14 August 2022

1.3 This is an additional joining bonus and will only be valid if the code (HFP2022) is input at the time of applying for the British Airways Prepaid Mastercard through the British Airways Executive Club Rewards app and will not be accepted at any later date

1.4 The bonus payment will be added to your account within 30 days after the 90 day period has elapsed and providing all criteria has been met

1.5 The bonus can only be used once per individual and per BAEC account

1.6 If we suspect any suspicious activity surrounding this bonus, we may trigger an investigation, during which time your account will be locked and any points relating to this promotion may be removed

Comments (117)