BA slashes the cost of transferring Avios between members by up to 90% – opens new opportunities

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Credit where it’s due. In a move that has been given zero publicity – in fact, I’ve no idea how long ago this happened – British Airways has slashed the cost of transferring Avios between any two members of the Executive Club.

This opens up some interesting new opportunities if you want to transfer Avios to someone else and may also change your view of being in a Household Account.

Transferring Avios from one person to another was always a big con

One of the biggest rip-offs in the frequent flyer world – and British Airways was by far not the worst offender here – is charging members to transfer miles from one person to another.

Even though no new miles are being issued you would historically expect to pay at least 50% of the price of buying ‘fresh’ miles.

This is the pricing that British Airways used to have:

1,000 to 6,000 Avios – £25

7,000 to 12,000 Avios – £65

13,000 to 18,000 Avios – £100

19,000 to 24,000 Avios – £140

25,000 to 27,000 Avios – £175

I mean …. taking £175 off you purely to move miles from one account to another was a joke. It was 98% profit for British Airways, with the other 2% being swallowed by credit card costs.

However …. 98% of nothing is, of course, £0, and I am hoping that very few people decided that paying this much made sense.

What is the new British Airways pricing for sharing Avios?

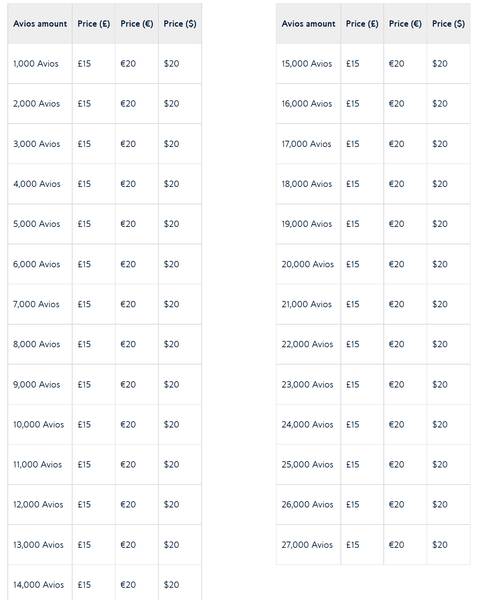

Take a look on ba.com here. This is it:

Yes, a flat £15 fee up to your annual transfer limit of 27,000 Avios to any one person.

(For clarity, transfers remain totally free for Gold members of British Airways Executive Club. This benefit is now less valuable than it was given that you are only saving £15.)

This is not a typo. I was tipped off to this change by a reader who had just paid £15 to transfer 25,000 Avios to his wife, and wasn’t actually aware that the pricing used to be different. He thought we didn’t write about it because we didn’t know about it, whilst the truth was that we didn’t write about it because the pricing was a joke.

The only other bits of small print are:

- transfers must be in multiples of 1,000 Avios

- you can only transfer out a maximum of 162,000 Avios per year, with no more than 27,000 Avios sent to a single account

- limits are per calendar year, not your Executive Club membership year

Full credit to BA here ….

This is a great move by British Airways. As well as being ‘fair’ (and trying to leg over your members with rip off pricing is never a good look, as I wish other schemes would realise), this may actually be revenue neutral or even revenue positive.

Once word gets around, I would expect Avios sharing to become more popular. A lot of £15 fees may be more lucrative than a handful of £175 fees.

How can you take advantage of this change?

There are various new opportunities that open up when you can transfer up to 27,000 Avios to or from yourself for just £15.

For example:

- even for sums as low as 3,000 Avios, it would be worth paying the transfer fee for any friend or family member who had earned a handful of Avios they didn’t want

- you may be able to persuade family members to take out credit cards with you making the qualifying spend and later paying to transfer the sign up bonus into your British Airways Executive Club account (eg American Express Preferred Rewards Gold has a bonus of 20,000 Membership Rewards points – worth 20,000 Avios – and is free for a year, whilst Barclaycard Avios Plus has a 25,000 Avios bonus)

- if you have an Executive Club Household Account purely because you are trying to use up some Avios belonging to a family member, you could now break up the Household Account and pay £15 to get the Avios from that person into your account

I’m sure there are other opportunities as well which may suit your particular circumstances.

You can share Avios with someone else, at the new low price of a flat £15 fee, via this page of ba.com.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (68)