Astonishing 70,000 Avios sign-up bonus for the British Airways Premium Plus American Express!

Links on Head for Points may support the site by paying a commission. See here for all partner links.

UPDATE – APRIL 2024: This article is now out of date, but don’t worry. We produce a monthly directory of the top UK travel credit card offers – please click HERE or use the ‘Credit Cards’ menu above. Thank you.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Keep up to date with the latest UK credit card bonuses by signing up for our free daily or weekly newsletters.

I’ve never seen anything like it. British Airways has just launched an exclusive 70,000 Avios sign-up bonus for the British Airways Premium Plus American Express card.

This is, frankly, shocking. I’ve never seen anything like it in all these years.

Just as surprising is a sign-up bonus of 20,000 Avios on the free British Airways American Express card.

You can learn more about the cards in our British Airways Premium Plus American Express review here and our free British Airways American Express review here.

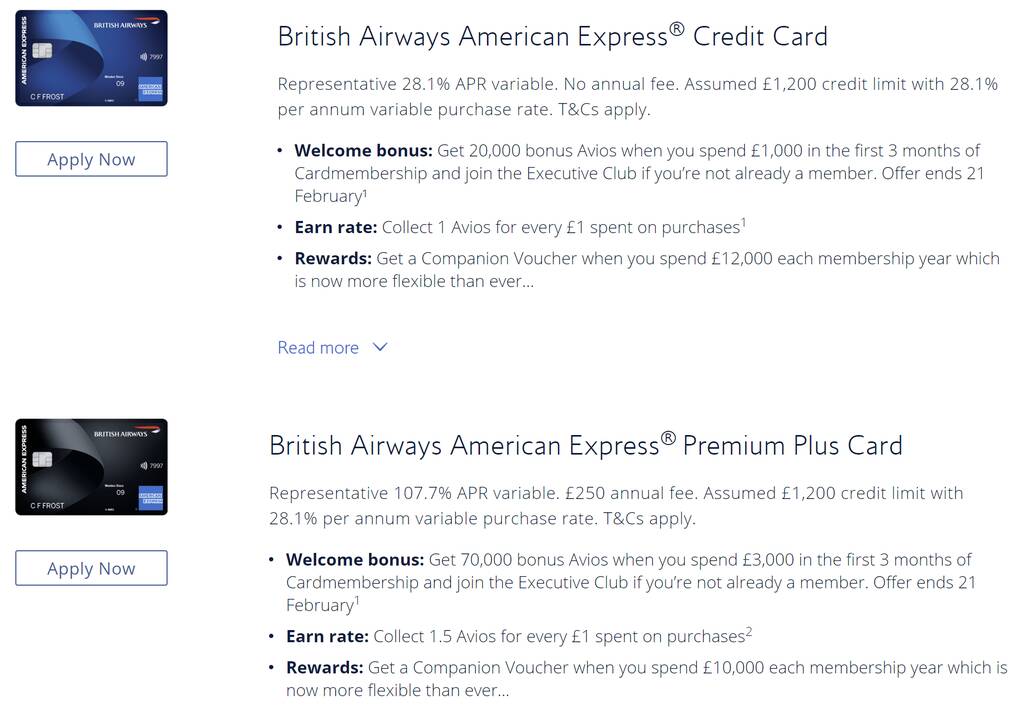

Here is the legally required interest rate information on the two cards:

British Airways American Express:

The representative APR is 31.0% variable.

British Airways Premium Plus American Express:

The representative APR is 139.9% variable, including the annual fee. The representative APR on purchases is 31.0% variable.

Yesterday we wrote about a new ‘open to all’ bonus of 35,000 Avios for the British Airways Premium Plus card. There was no special bonus launched on the free card.

I need to stress that we were not told in advance about this (far) better ba.com exclusive deal. American Express had provided us with details of the 35,000 Avios offer but nothing else. There was even a formal press release circulated to the media on the 35,000 Avios deal on Tuesday evening. No-one bothered to mention that a much better offer was available.

Full details are on this page on the BA website. You must be logged in to see it.

This is what the BA website shows when logged in. You can see this under ‘Avios credit cards’ on the home page:

Get a limited time 70,000 Avios sign-up bonus!

For British Airways Premium Plus, if you sign up by 21st February, you can earn a sign-up bonus of 70,000 Avios when you spend £3,000 in the first three months.

I cannot stress how crazy this offer is. If ANY member of your family qualifies for this bonus, I would persuade them to jump in.

What is even more impressive is that the spending requirement is unchanged. You only need to spend the usual £3,000.

What are 70,000 Avios worth?

This is our main article on what Avios points are worth. We generally say that you should expect at least 1p when used for premium cabin flights.

However, even in the worst possible scenario – that you convert to Nectar points and spend them in Sainsburys, at Argos or at eBay.co.uk – your 70,000 Avios are worth £467 of Nectar credit. Not bad for a sign-up bonus …..

Do you qualify for the 70,000 Avios bonus?

Remember that you are only eligible for the sign-up bonus on the Premium Plus card if you have NOT held a British Airways American Express (free or Premium Plus) card in the past 24 months.

You ARE eligible if you currently or have held The Platinum Card, Preferred Rewards Gold card, Green card, Nectar card, Platinum Cashback cards, Marriott Bonvoy card, American Express Rewards Credit Card, Business Platinum or Business Gold cards.

You ARE eligible if you are currently a supplementary cardholder on a British Airways American Express card held by someone else, but have not held a card in your own name in the past 24 months.

The bottom line is that if you haven’t had either of the British Airways American Express cards in the past 24 months, you will qualify for the 70,000 Avios.

What about the free British Airways American Express card?

Clearly 20,000 Avios on the free card – requiring a spend of £1,000 in three months – is also exceptional.

However, with a 70,000 Avios bonus on the table with the Premium Plus card, I don’t see why you would want to bother with the free card unless the £3,000 spend target is a problem.

Note that the rules for getting the bonus on the free card are tougher than on the British Airways Premium Plus American Express. The rule is that you cannot have had ANY personal American Express cards in the past 24 months.

The Premium Plus card has far looser rules – you only need to have gone 24 months without any British Airways American Express card.

Conclusion

I have no idea why British Airways has decided to offer such a ludicrously generous offer but only tell people about it via its own website.

The offer runs to 21st February. I strongly recommend you jump in if you can.

The application page is on the BA website here.

If you want to know, we did an article on the core benefits of the British Airways Premium Plus American Express card here. If you don’t want to pay an annual fee, a similar article on the benefits of the free British Airways American Express card is here.

Want to earn more points from credit cards? – April 2024 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Virgin Atlantic Reward+ Mastercard

15,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending.

Barclaycard Select Cashback Business Credit Card

1% cashback uncapped* on all your business spending (T&C apply) Read our full review

Rob

Rob

Comments (567)