Uber adding a 1.5% currency conversion fee – but you may want to pay it

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Uber has found (yet another) way of making more money from you.

To be fair, some readers may find this valuable. For others, it will be a poor deal.

The company has added ‘dynamic currency conversion’, with a 1.5% fee, by default.

Historically, if you used the Uber app outside the UK, you were billed in the currency of the country where the ride took place.

If your credit card has a 2.99% foreign exchange fee, this means that you will pay an extra 2.99% to Visa, Mastercard or American Express.

For rides in:

- United States

- Canada

- Eurozone

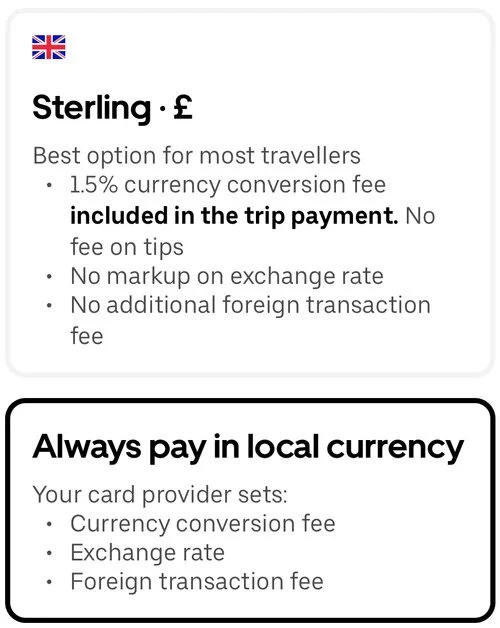

…. a new system has now been turned. You can see the details by clicking on this tile in the app:

By default, Uber will translate your fare into Sterling, presumably at the interbank rate, and add a 1.5% surcharge of its own.

You can turn this off by going clicking the tile above in the app and changing the option on this screen:

You can navigate to this screen directly via Account – Wallet – Preferred Currency.

Should you accept Uber’s 1.5% currency conversion fee?

The answer is ‘no’ if:

- you are charging your ride to a card with 0% foreign exchange fees (eg a Virgin Atlantic Mastercard in the Eurozone)

- your employer will pay you back for your ride and your credit card gives bonus points for spending in foreign currency (eg American Express Preferred Rewards Gold, HSBC Premier)

You should accept Uber’s 1.5% fee if:

- you are charging your ride to a credit card which charges the standard 2.99% foreign exchange fee

Even if your credit card gives you bonus points for foreign spending, the bonus points you get are unlikely to justify paying the extra 1.49% FX fee over Uber’s 1.5% fee for paying in Sterling. Pay the 1.5% to Uber instead.

If you decide to accept the Uber fee, keep an eye on it. It may be 1.5% today, but it could easily creep up to 2.99% or even 5% tomorrow.

If it rose to 2.99%, I’d turn it off. I’d rather, say, American Express got my 2.99% and used the money to continue to fund decent card benefits than have Uber pocket it for doing nothing. If it goes beyond 2.99%, you should clearly turn it off.

Comments (40)