British Airways fees for credit cards and seat selection increasing

Links on Head for Points may support the site by paying a commission. See here for all partner links.

The British Airways credit card fee increased yesterday from £4.50 to £5 per booking. This is the first increase since the fee was introduced in 2009 (was it really so long ago?).

Despite this, British Airways still claims that it does not recover its entire credit card costs. Arguably this is a moot point, since it is still cheaper than accepting cheque payments or running city centre ticket offices to receive cash.

Customers could use a debit card, of course, but would have no protection if BA went bust and would fail to receive the travel insurance benefits that come with most credit cards. BA would also lose business, especially for higher priced tickets, to online travel agents who do take credit cards – but also take a commission from BA.

The lucky residents of many other countries in the drop-down menu on ba.com still seem to be exempt from payment …..

At least BA has not gone down the Virgin Atlantic route with a flat charge of 1.5% whatever the total, which is a killer on long-haul bookings. The BA fee is also per booking and not per passenger.

The seat selection fee also crept up a few weeks ago without most people noticing.

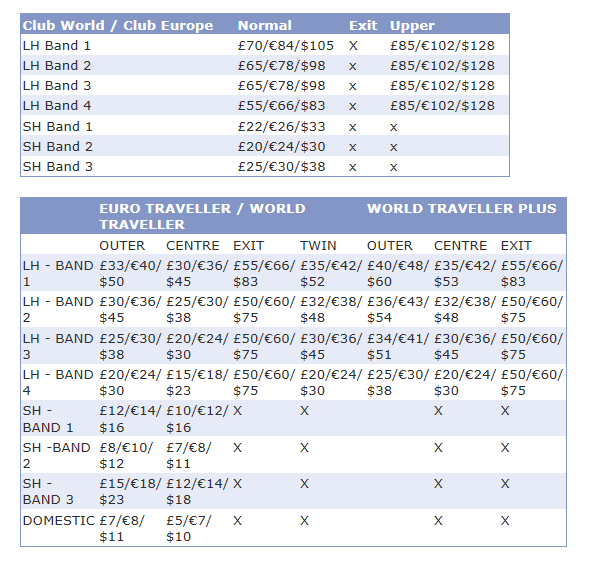

The current British Airways seat selection fees can be seen in this chart:

Given the huge number of BA routes, it is impractical to list which flights fall into which band. You can make a pretty good guess, though, based on how far you are flying.

LH is long-haul, SH is short-haul, ‘Upper’ refers to the top deck of a Boeing 747.

I am stunned that there are people paying £85 EACH WAY PER PERSON to prebook seats on a long-haul flight, but clearly this is proving to be a good revenue generator for British Airways. It may be playing on the naivity of very occasional premium flyers, however, since anyone who flies more than two long-haul Club World trips per year is likely to have Silver status (and free seat selection) in any event.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (52)