Did you know lastminute.com lets you refund non-refundable flights?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

The price gap between refundable and non-refundable flights is normally huge, as we all know. The risks of buying a non-refundable flight can be partly offset by travel insurance, but that doesn’t cover every possible reason for cancelling.

Sometimes you don’t need to travel anymore for reasons which insurance doesn’t cover.

Broken up with your partner? Lost your job? Got a new job? Reward availability opened up? Found a better flight deal via a Head for Points article? Simply changed your mind about going? Your travel insurance isn’t paying out.

lastminute.com offers a little-known ‘no excuses needed’ insurance policy called Full Flex for non-refundable flights. I’m sure you can see how this could be useful.

Oddly, Full Flex is very rarely discussed, even though lastminute.com has offered it for at least two years now. I don’t know of anyone who has ever used it, yet alone claimed on it.

(EDIT: there is a comment below from a reader who did use this, and claimed on it. He received his refund voucher immediately once he had called to cancel.)

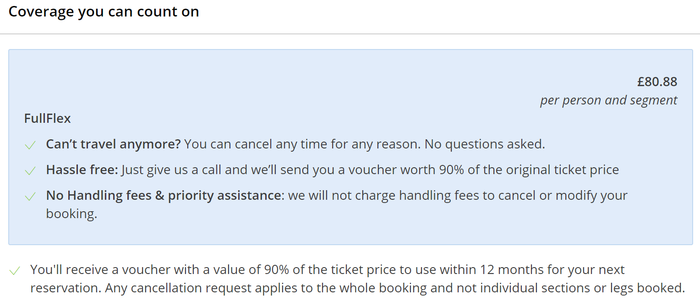

Take a look at the screenshot below (click to enlarge).

I have priced up a Virgin Atlantic business class ticket to New York for March. The cost is £1,959.

For an extra £80.88 per person, each way, I can turn my ticket into a ‘virtual’ refundable one:

As the lastminute.com site says:

- Can’t travel anymore? You can cancel any time for any reason. No questions asked.

- Hassle free: Just give us a call and we’ll send you a voucher worth 90% of the original ticket price

- No Handling fees & priority assistance: we will not charge handling fees to cancel or modify your booking.

- You’ll receive a voucher with a value of 90% of the ticket price to use within 12 months for your next reservation. Any cancellation request applies to the whole booking and not individual sections or legs booked.

You won’t get your refund in cash. It will come – within 48 hours of requesting cancellation – in the form of a lastminute.com gift voucher, valid for 12 months against a flight booking. This is hardly a massive restriction in my view, given what you are being offered.

In my example, the extra cost was 8.5% of the original ticket price. This appears to be standard, looking at various examples. Note that lastminute.com does NOT include the cost of Full Flex premium in calculating the 90%, which means:

- You book a flight for £1,000

- You pay (roughly) £1,085 including Full Flex insurance

- You get £900 back if you choose to cancel, in the form of a lastminute.com flight voucher

Doing the maths including the premium, you are only getting back 83% of what you paid – although that still isn’t bad.

The option comes up during the payment process, once you have entered your name and address and after the page encouraging you to add car hire. Note that the maximum claim is €5,000. As this is an insurance policy you are allowed to change your mind within 14 days and get your premium back.

The rules appear straightforward and, if you want to lock in a good deal but are not 100% certain of making the dates, this could be a real option.

The only snag I can see with Full Flex is that war, natural disaster and the like are not covered – you cannot cancel if a problem breaks out at your destination. This could be a risk as the insurer would not pay even if the event was not your reason for cancelling.

For absolute clarity, Full Flex does NOT turn your ticket into a ‘real’ flexible one. You cannot change the date or routing for free as you could with a ‘real’ fully flexible ticket. Neither does it give you the additional airline miles or tier points that a ‘real’ fully flexible ticket offers.

The ONLY benefit you get (but it is a very good benefit) is the ability to cancel your flight without question at any point for a 90% refund.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to maximise your miles when paying for flights (September 2025)

Some UK credit cards offer special bonuses when used for buying flights. If you spend a lot on airline tickets, using one of these cards could sharply increase the credit card points you earn.

Booking flights on any airline?

The American Express Preferred Rewards Gold Credit Card earns double points (2 Membership Rewards points per £1) when used to buy flights directly from an airline website.

The card comes with a sign-up bonus of 20,000 Membership Rewards points. These would convert to 20,000 Avios or various other airline or hotel programmes. The standard earning rate is 1 point per £1.

You can apply here.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 40,000 points, FREE for a year & four airport lounge passes Read our full review

Buying flights on British Airways?

The British Airways American Express Premium Plus Card earns double Avios (3 Avios per £1) when used at ba.com.

The card comes with a sign-up bonus of 30,000 Avios. The standard earning rate is 1.5 Avios per £1.

You do not earn bonus Avios if you pay for BA flights on the free British Airways American Express Credit Card or either of the Barclaycard Avios Mastercards.

You can apply here.

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

Buying flights on Virgin Atlantic?

Both the free Virgin Atlantic Reward Mastercard and the annual fee Virgin Atlantic Reward+ Mastercard earn double Virgin Points when used at fly.virgin.com.

This means 1.5 Virgin Points per £1 on the free card and 3 Virgin Points per £1 on the paid card.

There is a sign-up bonus of 3,000 Virgin Points on the free card and 18,000 Virgin Points on the paid card.

You can apply for either of the cards here.

Virgin Atlantic Reward Mastercard

6,000 bonus points, no fee and 1 point for every £1 you spend Read our full review

Virgin Atlantic Reward+ Mastercard

36,000 bonus points and 1.5 points for every £1 you spend Read our full review

Rob

Rob

Comments (79)