IT’S BACK: Get £20 for free if you have a Monese account (only 4 minutes needed)

Links on Head for Points may support the site by paying a commission. See here for all partner links.

It’s back! Monese ran this offer a couple of weeks ago and it has returned. You can buy a £100 gift card – for Amazon or other retailers – for £80. A lot of readers took advantage but a lot more missed it when the codes ran out. I recommend you jump in ASAP.

How the Monese gift card promo works

Monese is the online banking app which has a partnership with Avios – albeit that the partnership has not gone much further, so far, than letting you view your Avios balance alongside your financial balance.

I know that 2,000 HFP readers have a Monese account following our recent “Win 1 million Avios” competition. If you didn’t win, here is £20 as compensation.

If you don’t already have a Monese account, you can use my refer-a-friend code of ROBE820. You will receive a £5 credit plus a further £15 when you’ve spent £500 on your card. (I think that is how it works – it doesn’t actually tell me anywhere what you get!)

If you are reading this on your phone, the download link is here.

How to get your free £20

Monese is letting you buy a £100 shopping gift card for £80.

By far the easiest option is to buy an Amazon gift card and add it to your Amazon account for future use (it is valid for 10 years!).

Here is a step by step guide to how to do it. As you can see from the time stamps on the screenshots, it only took me four minutes to buy and redeem each gift card – and it would have been quicker if I wasn’t taking and uploading screenshots.

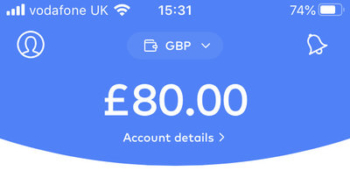

Step 1: Make sure you have £80 in your Monese account

I withdrew £80 from my linked HSBC account and it arrived instantly:

You must load the £80 before you add the promo code below, otherwise you will get an error message.

Step 2: Go to ‘Promotions’, which is under the menu in the top left corner (the ‘head’ icon)

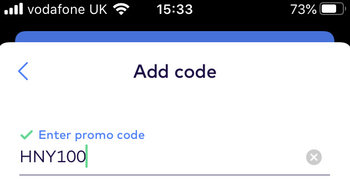

Step 3: Add the code HNY100:

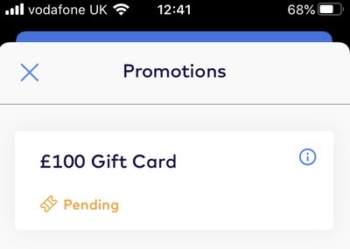

…. which will lead you to this screen:

Step 4: Click on your messages (the ‘bell’ in the top right corner)

You can then activate your gift card:

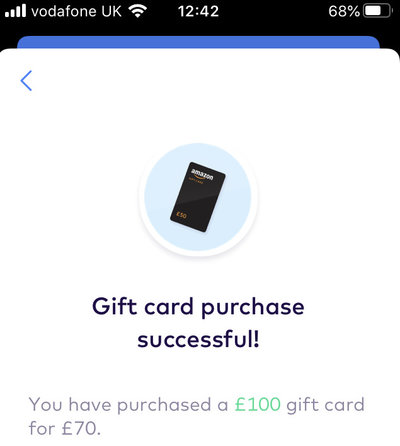

Ignore the £70 reference in the image below which is from November. Your screenshot will show you paid £80.

Step 5: Choose the gift card you want

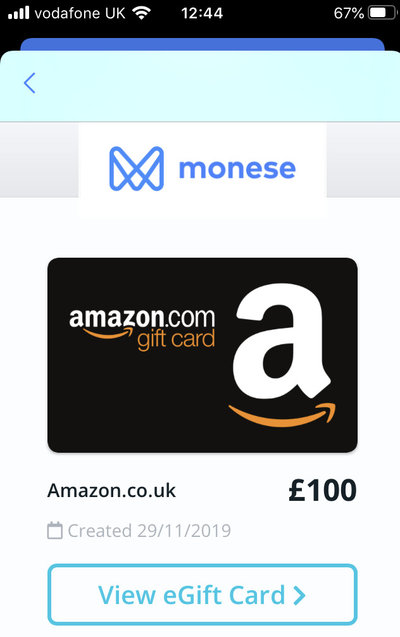

You can choose from Amazon, Argos, Asda, Caffe Nero, Cineworld, Costa, Currys ….. and that is just A-C! For an easy life, take an Amazon gift card (valid for 10 years):

Step 6: Click here to go to the page of the amazon.co.uk where you redeem electronic gift cards

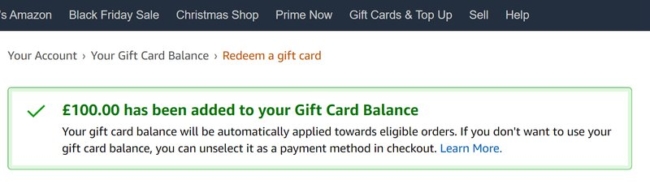

Enter your code:

And that’s it. £20 saved.

I hope the free £20 makes up for not winning our Monese competition. I also hope this works for you if you missed out in November.

If you’re not already a Monese account holder, you can download the app here.

Want to earn more points from credit cards? – April 2024 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending.

Barclaycard Select Cashback Business Credit Card

1% cashback uncapped* on all your business spending (T&C apply) Read our full review

Rob

Rob

Comments (68)