A secret tip for Marriott Bonvoy American Express cardholders

Links on Head for Points may support the site by paying a commission. See here for all partner links.

The Marriott Bonvoy American Express Card is a good niche product with one stand-out feature – holding it earns you 15 elite nights in Marriott Bonvoy each year, credited to your account in early January.

This means that Platinum, the key status level to have because it unlocks lounge access, decent upgrades and guaranteed 4pm check-out, only needs 35 nights in a year instead of 50.

There is one additional core benefit which I wasn’t fully exploiting until a reader tipped me off.

As regular readers will know, Marriott Bonvoy runs regular cashback deals with American Express, usually twice per year.

These are usually along the lines of £100 cashback when you spend £400 at selected UK / European Marriott Bonvoy hotels over a certain period. Cumulative spend counts.

If you have a Gold, Platinum or British Airways American Express card, you are likely to have this offer available for registration via the app or Amex website.

Marriott Bonvoy Amex cardholders get a better deal

Marriot has always ensured that holders of the dedicated Marriott Bonvoy American Express Card got a better deal.

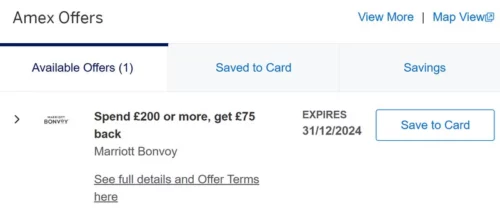

Of late, whenever this offer has run, Bonvoy cardholders have got an improved version – typically £75 cashback when you spend £200 at the same list of participating hotels.

£200 is obviously easier to spend than £400, even if the total cashback is a little lower.

But what I didn’t know ….

What I didn’t know, until it was pointed this out in our comments, is that supplementary cardholders on the Marriott Bonvoy American Express Card get the same deal.

This is very attractive, and makes the £95 annual fee on the Marriott Bonvoy American Express Card even easier to justify.

Not wanting to miss out on £75, I put this to the test and applied for a supplementary card for my wife.

At present, American Express is offering 3,000 Bonvoy points if you add a supplementary cardholder to your Marriott Bonvoy American Express Card. You must apply via this link. If you are yet to apply for the card, do NOT add a supplementary cardholder during the application process – wait and use this link later.

The process worked fine and I had received my 3,000 bonus points by the time I received the card in the post.

I registered my wife’s card online and waited. It takes a while for cashback offers to appear on new American Express cards, often a couple of weeks. I made a single test purchase with it just so Amex knew it was active.

(EDIT: this article was written in November 2024. There may not be a cashback offer running at the time you read this – they have typically run twice per year.)

And then, this popped up:

The first cashback offer on my wife’s new Marriott Bonvoy American Express supplementary card was the ‘£75 back when you spend £200 with Marriott’ offer.

Remember that hotels have no problem splitting bills at check-out amongst multiple credit cards. If you and your partner both had this offer and spent £400 on a Marriott stay, you could each pay £200 on your respective cards and get the cashback twice.

So, in summary:

- if you have the Marriott Bonvoy American Express Card, it is a no-brainer to issue a free supplementary card to your partner – you get 3,000 points for doing so and you will double-up on any Marriott cashback deals

- if you DON’T have the card, you may be more tempted now you know that you will be able to double-up on Marriott cashback credits via a supplementary card – although, of course, there is no guarantee that these offers continue to run in 2025

If you want to learn more about the key benefits of the Marriott Bonvoy American Express Card, take a look at this article.

Our full review of the Marriott Bonvoy American Express Card is here and you can apply here.

The representative APR is 53.3% variable, including the annual fee. The representative APR on purchases is 29.7% variable.

Rob

Rob

Comments (59)