The battle for the future of Heathrow Airport is not just about a third runway

Links on Head for Points may support the site by paying a commission. See here for all partner links.

The Government has received at least two – and potentially four or more – proposals for the expansion of Heathrow airport through the construction of a third runway.

Only two of the proposals have been made public, from Heathrow Airport Limited (the current airport operator) and Arora Group, a property company that owns several hotels and a large amount of land in and around Heathrow.

You can see my article looking at the HAL proposal in more detail here with a few references to the Arora proposal as well.

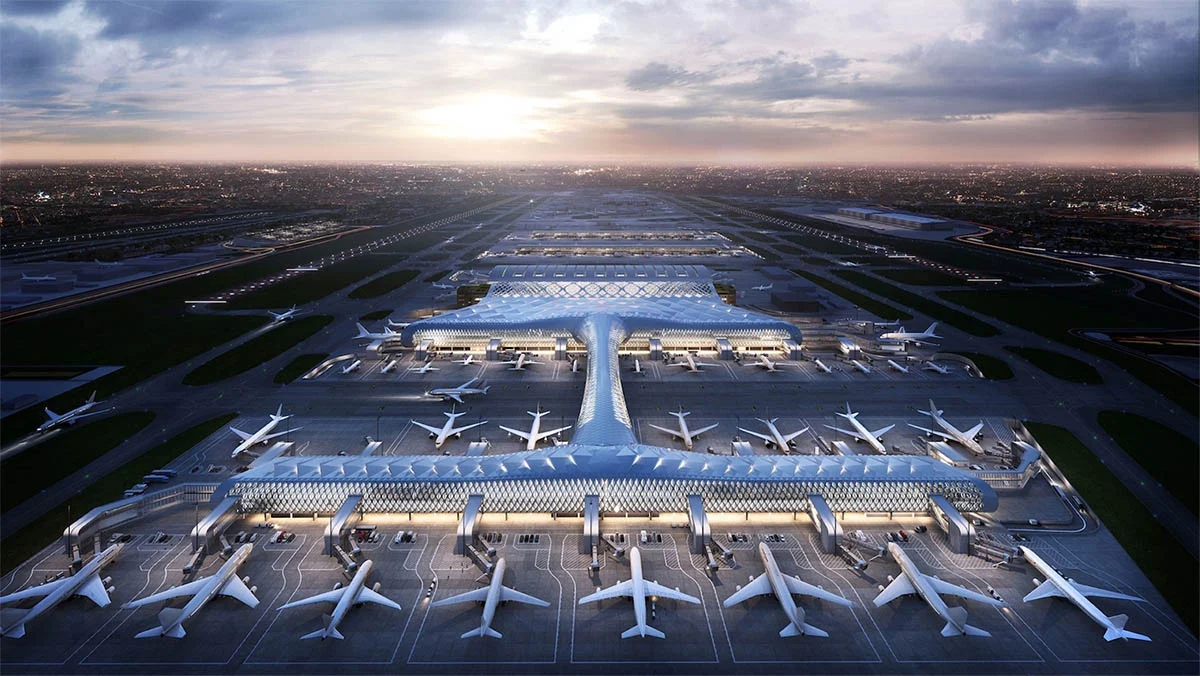

Both plans will cost upwards of £25 billion, with Arora pitching its shorter third runway proposal as a more cost-efficient option. Heathrow’s own proposal comes in at £33 billion for the third runway and new terminals.

Comparing the proposals is a bit of a challenge. For a start, not all of them have been made public; my understanding is that there may be one or two others that have not been announced.

Even comparing the Heathrow and Arora proposals is a challenge with a lot of key information, such as eventual terminal configuration and number of gates, not yet public.

What is very clear is that there is a lot more at stake than just a third runway.

For a start, both groups propose a suite of projects. In Heathrow’s case it’s a third runway, plus new terminal buildings, plus upgrades and extensions to Terminal 2 in the Central Terminal Area.

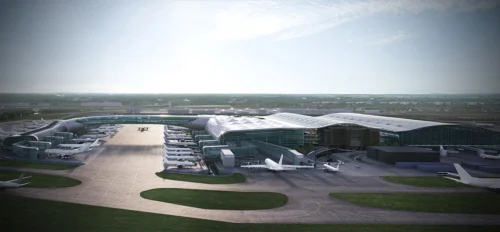

Arora’s plans, meanwhile, call for a shorter third runway plus a new single terminal building west of Terminal 5 which would form an airport transport hub.

It’s clear that the Government’s request for proposals has resulted in multiple options with substantially different scopes.

But the timing of this project, with the Government hoping for spades in the ground by the end of this parliament (2029) has also kicked off discussions about the airport’s future as a whole.

Last week, The Times (paywall) revealed that Arora’s proposals included provision for a third party to operate the new Terminal 6 and third runway, rather than the existing owner of the airport.

It was a sentiment that Carlton Brown, CEO of the Heathrow West proposal and former chief financial officer of the Arora Group echoed on a phone call with me.

This should come as no surprise, of course. Arora Group is a founding member of the ‘Heathrow Reimagined’ campaign. Together with IAG and Virgin Atlantic, they want to reform the way the airport is regulated and funded.

At present, under a system dating back to the late eighties, Heathrow pitches its proposed passenger charges to the Civil Aviation Authority. Each five year funding period is negotiated between the airport, the regulator and its tenants – the airlines – based on the predicted costs and passenger forecasts.

In some cases, as we saw coming out of covid, this encourages Heathrow to underestimate the number of passengers it expects in order to target a higher per-passenger fee.

The latest five year funding period began in 2022 and the airport has just fired the starting gun on the ‘H8’ funding period to begin in 2027. It proposes a £10 billion ‘investment’ funded by a 17% increase in passenger fees.

Heathrow Reimagined says that the existing model is broken. On the same day that Heathrow revealed its proposals, British Airways CEO Sean Doyle said that “Today, Heathrow is the most expensive airport in the world” and that passenger charges would double under the airport’s £49bn scheme. “We continue saying that we need a change in the regulatory model in order to have a runway that can be affordable.”

Crucially, the campaign has not said how it wants the regulatory model to be fixed; it only calls on the CAA to conduct an “urgent and fundamental review” into how the airport is regulated and funded.

This is not just something that the airport’s customers are calling for. Heathrow itself admits that “an appropriate regulatory framework needs to be put in place – one that encourages growth and investment while remaining affordable for customers – to secure many tens of billions of private capital from equity shareholders and from debt investors.”

So on 18th July, the CAA commenced its review of the model, including considering “credible alternatives and different regulatory models used for other UK and international infrastructure projects.”

It means that, whilst the Department of Transport pores over pages of third runway proposals, the CAA is conducting a review of the fundamental operating model of the airport itself. After years of holding patterns, at least two major reviews are taking place at the same time.

Of course, the way the airport is operated will have a crucial impact on how a third runway is funded. It seems key that the CAA makes a decision before the Government settles on its preferred proposal for a third runway.

The CAA says it is hoping to publish a working paper for consultation in the autumn of this year, which it says will “align with the UK Government’s timetable for updating the Airports National Policy Statement.”

This ANPS document is crucial for the third runway, as this is what sets out the Government-sanctioned means of expansion. It expects to run public consultations on the plans in early 2026, allowing it to make a final decision on the ANPS later in the year and, probably, allow for a Commons vote on the issue.

The bottom line is that there are a huge number of moving parts surrounding Heathrow expansion, not just around the infrastructure itself but also around the very way it works.

Of course, none of this takes into account what happens if a third runway is built. How will the newly-released slots be allocated amongst airlines? IAG and British Airways would want them to be handed out on a pro-rata basis, thereby maintaining its dominant holding (BA owns just over 50% of current Heathrow slots.)

I can only assume that other airlines – Virgin Atlantic included – have very different views. easyJet CEO Kenton Jarvis has already staked a claim for a substantial number of slots, potentially closing its Gatwick operation.

Any decision would have a major impact on the building works, as ultimately any new terminal buildings must be suitable for the new tenants. It’s no good building a new terminal designed for long haul operations only for it to be used by short haul airlines.

All these questions, and more, need to be answered sooner rather than later if expansion is to adhere to the Government’s deadline. Getting a new runway operational by 2035 will be no mean feat and requires a multitude of moving parts to move in lockstep.

Not something the UK has been particularly good at recently – but I suppose we can always hope this is the turning point?

Comments (8)