Get 300 free Flying Blue miles from Opinion Rewards Club

Links on Head for Points may support the site by paying a commission. See here for all partner links.

I’m sure this isn’t a new offer but I hadn’t seen if before until a reader flagged it. Opinion Rewards Club is a ‘points for surveys’ scheme run by the Air France / KLM Flying Blue scheme.

EDIT: Opinion Rewards Club closed in August 2020

Whilst I know some people love them, I usually find ‘points for surveys’ sites to be a bad deal long term due to the time it takes up. However … they are usually worth joining for the sign-up bonus.

Opinion Rewards Club offers 300 Flying Blue miles when you sign up and complete your first survey. You need to be a UK / US / France / German / Netherlands resident to join. Future surveys earn ‘a minimum of 10 miles’ which – assuming you value those at 10p – is a pretty poor use of your time by any standards …..

How to earn Flying Blue miles from UK credit cards (April 2024)

Air France and KLM do not have a UK Flying Blue credit card. However, you can earn Flying Blue miles by converting Membership Rewards points earned from selected UK American Express cards.

These cards earn Membership Rewards points:

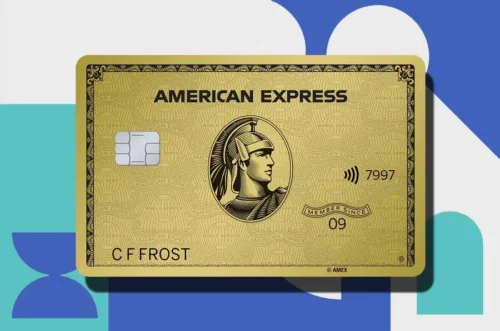

- American Express Preferred Rewards Gold (review here, apply here) – sign-up bonus of 20,000 Membership Rewards points converts into 20,000 Flying Blue miles. This card is FREE for your first year and also comes with four free airport lounge passes.

- The Platinum Card from American Express (review here, apply here) – sign-up bonus of 40,000 Membership Rewards points converts into 40,000 Flying Blue miles

- American Express Rewards credit card (review here, apply here) – sign-up bonus of 10,000 Membership Rewards points converts into 10,000 Flying Blue miles. This card is FREE for life.

Membership Rewards points convert at 1:1 into Flying Blue miles which is an attractive rate. The cards above all earn 1 Membership Rewards point per £1 spent on your card, which converts to 1 Flying Blue mile. The Gold card earns double points (2 per £1) on all flights you charge to it.

Rob

Rob

Comments (56)