Why Hilton’s proposed new UK reward credit card could be one of the best

Links on Head for Points may support the site by paying a commission. See here for all partner links.

UPDATE – SEPTEMBER 2025: This is an old article, and the credit card information given is likely to be out of date.

To learn about current credit card bonuses, benefits, terms and interest rate information, take a look at our directory of the top UK travel credit card offers – please click HERE or use the ‘Credit Cards’ menu above. Thank you.

Keep up to date with new UK credit card bonuses by signing up for our free daily or weekly newsletters.

Hilton Honors sent a few members a questionnaire yesterday seeking their opinion on two new UK credit card options. And, it has to be said, it looks promising.

I have written before that Hilton is known to be working on a new product to replace the existing Barclays product, now closed to new applicants. The two scenarios being circulated are both attractive, and one could be great for high spenders.

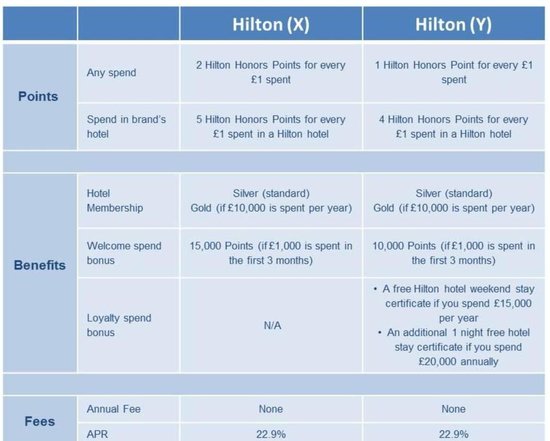

Here are the two options:

Let’s summarise this briefly:

Neither scenario has an annual fee (surprising, because in the new 0.3% interchange environment, a fee is one of the few ways to generate revenue)

The proposed sign-up bonus is pretty good for a free card, being worth £33-£50 for £1000 spend

The proposed earning rate for spending at Hilton properties is excellent (4-5 points per £1)

All cardholders get Silver status in Hilton Honors, with Gold (free breakfast) for spending £10,000 in a year

The earning rate would be either 2 points per £1 (worth about 0.66p – very good for a Visa / Mastercard in the current environment) or, far more interesting, 1 point per £1 PLUS a free weekend night voucher at £15,000 and ANOTHER free weekend night voucher at £20,000

Let’s do the maths.

For someone who spends £20,000 on the proposed 2nd version, you would receive:

20,000 Hilton Honors points, worth £66

Gold status in Hilton Honors, which we’ll assume is worth £100 to the average leisure guest over a year

TWO free weekend nights which – if they can be used at any Hilton Group hotel, including the top Conrad and Waldorf Astoria options – could be valued at £500 between them

This gets you £666 of benefits for £20,000 of spending. This is an attractive 3.3% return.

The proposed 1st version is better for low spenders but less attractive to high spenders. All you receive is 2 Hilton Honors points per £1 spent, which I value at 0.66p, so a 0.66% return on your spending. This goes up to 1.66% if the cardholder spent £10,000, earned Hilton Gold status and got £100 of value from the free breakfasts.

How does this compare to other cards on the market?

This is how I value the long-term spending benefits on the airline and hotel credit cards still available to new applicants. To understand my calculations, read this article.

- British Airways American Express Premium Plus – 10.1% back on first £10,000

- British Airways American Express (free version) – 6.1% back on first £20,000

- IHG Rewards Club Premium Mastercard – 2.3% back on first £10,000

- Generic cashback Visa or Mastercard – 0.5% back, usually in vouchers

The free Virgin Money Reward Mastercard varies by status:

- Base Virgin Flying Club member – up to 2.4% on first £20,000

- Silver Virgin Flying Club member – up to 3.4% on first £20,000

- Gold Virgin Flying Club member – up to 6.4% on first £20,000

The £160 Virgin Money Reward+ Mastercard also varies by status:

- Base Virgin Flying Club member – up to 4.4% on first £10,000

- Silver Virgin Flying Club member – up to 6.3% on first £10,000

- Gold Virgin Flying Club member – up to 12.3% on first £10,000

As you can see, if Hilton Honors went with the 2nd proposal above:

It would be more generous for a high spender than the IHG Rewards Club Premium Mastercard

It would be more generous than the free Virgin Money Reward Mastercard if you don’t have Virgin Flying Club status

I have a proposed tweak though ….

I accept that Hilton Honors may not want to launch a card which requires £20,000 of expenditure to unlock all of the benefits. It excludes a lot of the potential market.

I would be tempted to ‘do an IHG’ and have two variants:

as ‘Option X’ above, a free card earning 2 points per £1, giving Silver status to everyone and Gold at £10,000

a revised ‘Option Y’ with an annual fee of, say, £75 but with a higher earning rate of 2 points per £1 plus the two free night vouchers for spending £20,000

My revised ‘Option Y’ is actually a better deal for Hilton than their ‘Option Y’ except when dealing with ultra-high spenders. One way around this would be to reduce the earning rate to 1 point per £1 after spending, say, £50,000 per year.

On £20,000 of annual spend they would be giving out 20,000 additional Hilton Honors points but they are getting a £75 fee – albeit the card issuer will want a cut.

Importantly, both of the cards I outline above would be more attractive than their respective IHG Rewards Club variants. The free card would also be more attractive than the Marriott Rewards Mastercard, assuming that it returns to the market next month with the same benefits package (1 point per £1, no long-term spend incentive) as the old version.

Conclusion

If Hilton Honors does go ahead and launches a free Mastercard / Visa product offering two free weekend nights EVERY YEAR for spending £20,000, I think it would have substantial appeal to Head for Points readers.

A product which got you a free 2-night weekend break every year at Hilton Venice, Conrad London St James, Waldorf Astoria Rome, Waldorf Astoria Berlin etc would be very tempting.

It isn’t that clear cut of course. I am assuming that the free night voucher can be used at any hotel, which may not be the case. Restricting it to weekend use also makes it less flexible.

Make no mistake though – I would be getting one of these cards if they did come to market.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Hilton Honors points and status from UK credit cards (September 2025)

There are various ways of earning Hilton Honors points from UK credit and debit cards. Many cards also have generous sign-up bonuses.

There are two dedicated Hilton Honors debit cards. These are especially attractive when spending abroad due to the 0% or 0.5% FX fee, depending on card.

You also receive FREE Hilton Honors status for as long as you hold the debit cards – Gold status with the Plus card and Silver status with the basic card. This is a great reason to apply even if you rarely use it.

We reviewed the Hilton Honors Plus Debit Card here and reviewed the Hilton Honors Debit Card here.

You can apply for either card here.

NEW: Hilton Honors Plus Debit

10,000 bonus points, Hilton Gold status and NO FX fees Read our full review

NEW: Hilton Honors Debit

2,500 bonus points, Hilton Silver status and 0.5% FX fees Read our full review

There is another way of getting Hilton Honors status, and earning Hilton Honors points, from a payment card.

Holders of The Platinum Card from American Express receive FREE Hilton Honors Gold status for as long as they hold the card. It also comes with Marriott Bonvoy Gold, Radisson Rewards Premium and MeliaRewards Gold status.

We reviewed The Platinum Card from American Express in detail here and you can apply here.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 160,000 Hilton Honors points! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

You can also earn Hilton Honors points indirectly with:

- American Express Preferred Rewards Gold Credit Card (20,000 bonus Amex points)

- The American Express Rewards Credit Card (10,000 bonus Amex points)

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 80,000 Hilton Honors points! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

and for small business owners:

- The American Express Business Gold Card (20,000 bonus Amex points)

- The American Express Business Platinum Card (50,000 bonus Amex points)

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 120,000 Hilton Honors points! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 240,000 Hilton Honors points! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

The conversion rate from American Express to Hilton Honors points is 1:2.

Rob

Rob

Comments (124)