Why is British Airways charging lower taxes to inactive Avios members?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

A few readers have been in touch in recent weeks to highlight weird pricing behaviour by British Airways.

What was confusing is that I assumed there would be a common theme, but there isn’t. This article covers the oddest one.

British Airways is charging lower taxes on long-haul economy Avios redemptions if you are an inactive member of the Executive Club.

An ‘inactive’ member is someone who has not earned or spent 1 Avios in the previous 12 months. You will know if you are ‘inactive’ if you try to make a short-haul redemption and don’t see the usual Reward Flight Saver pricing options of £35 and £50 of taxes and charges.

How does British Airways change long-haul Avios pricing?

Rather than explain what I mean, it is easier to show you.

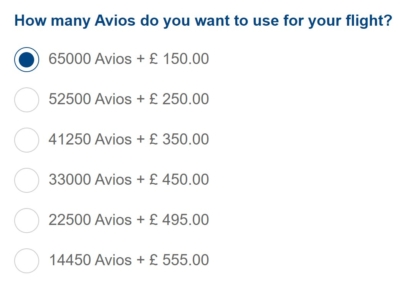

Here is the Avios pricing I see for an Economy redemption to San Francisco:

As you can see, the options run from 65,000 Avios + £150 through to 14,450 Avios + £555.

Let’s ignore whether this is good value or not for a flight in August – because it probably isn’t – and move on.

My imaginary friend Steve is going to come with me. He has an inactive Avios account – totally inactive, actually, as it has a zero balance because I only opened it 5 minutes ago.

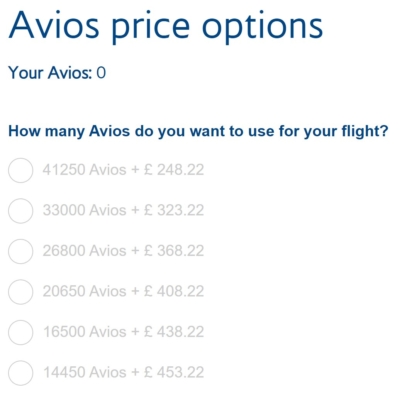

Let’s assume that Steve does really have a lot of Avios but this account has simply become inactive due to no activity over the last year, which is far from impossible at the moment. Here is what he sees:

Apologies for the light grey text above. This is due to ba.com changing the screen colour if you can’t afford the booking you are searching.

As you can just about see, the pricing ranges from 41,250 Avios + £248 to 14,450 Avios + £453.

Steve, as an inactive member, is getting a FAR better deal than me (or you).

I could pay 52,500 Avios + £250, whilst inactive Steve pays 41,250 Avios + £248.

I could pay 14,450 Avios + £555, whilst inactive Steve pays 14,450 + £453.

I am either 10,000 Avios or £100 worse off, depending on which pricing option I choose.

Conclusion

I have no idea what is causing this difference in Economy Avios flight pricing. It is also not clear who is ‘right’ – is the inactive member being undercharged, or are active members (the majority of us) being overcharged?

Unfortunately there is nothing you can do about it, unless you know someone with an inactive Avios account with enough points to book the flight you want.

Once they have booked it, of course, their account will stop being inactive and they won’t be able to get the same deal on their next booking ….

You just need to cough up the extra £100 or 10,000 Avios.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (September 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 80,000 Avios! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 40,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 120,000 Avios! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 60,000 Avios! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

The American Express Business Platinum Card

120,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

60,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Comments (63)