NEW: Earn 2 KrisFlyer miles per £1 spent abroad on the Currensea travel money card

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This article is sponsored by Currensea

Back in May we introduced you to the Currensea travel money card. Currensea is an interesting product for anyone who wants to minimise FX fees when spending abroad, but doesn’t want to get a dedicated 0% credit card specifically for travelling. Currensea is a Mastercard-branded debit card which means that it won’t impact your credit score.

Back in May, Currensea didn’t offer any miles or points – but the FX savings were arguably more valuable.

This has now changed. You can now earn 2 Singapore Airlines KrisFlyer miles for every £1 you spend in foreign currency on your Currensea card.

There are now two different ways of looking at Currensea:

- If you collect Singapore Airlines KrisFlyer miles, you can earn 2 miles per £1 when you spend abroad on your Currensea debit card. You will pay the same total cost as you would pay if you used a standard credit or debit card.

Or ….

- You can choose not to collect KrisFlyer miles, and pay just 0% or 0.5% in foreign exchange fees – depending on which Currensea card you get – compared to the usual 3%.

Put simply, Currensea takes your foreign exchange saving and will either leave the cash in your account or will ‘sell’ you some low cost KrisFlyer miles.

The KrisFlyer route is particularly attractive if you are recharging expenses to clients or your employer, or if you are purchasing something for your business which can be offset against tax.

You can switch between earning KrisFlyer miles and paying a lower FX fee on a transaction by transaction basis if you wish. This could be valuable if you only need a certain number of KrisFlyer miles or if you would prefer to pocket the cash savings on some transactions but not others.

How does Currensea work in practice?

It is, as I said earlier, a very simple process. You use your Currensea card in the same way as any other debit card.

- You make your purchase in local currency (any currency, globally)

- Your current account bank (Barclays, HSBC, NatWest etc) automatically confirms that you have enough money in your account and authorises the transaction

- The transaction goes through at either the interbank rate or the Mastercard rate, depending on the currency

- If you have chosen to earn miles, Currensea adds a 3% FX fee and awards you two KrisFlyer miles per £1 spent. If you have chosen to reduce your FX costs, Currensea adds a 0.5% fee if you have the free card or 0% if you have one of their paid cards.

- You get an automatic spend notification via the Currensea app, if you choose to install it

- The money is taken from your current account a few days later

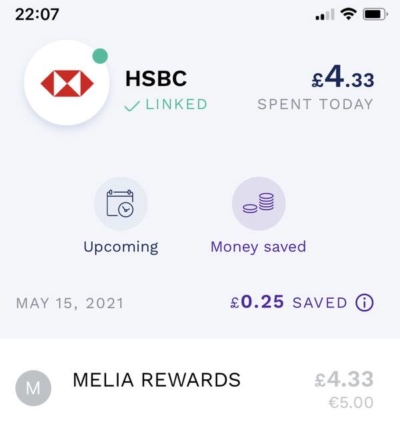

Here is an example I did earlier in the year which shows how the ‘0.5% FX fees’ style works. With no foreign travel in the diary, I decided to splash out and buy 1,000 MeliaRewards points for €5.

This is what you see in the Currensea app, which shows £4.33 scheduled to leave my HSBC account a few days later:

I checked the interbank rate after doing the transaction and, adjusting for the 0.5% FX fee, it did match the rate used by Currensea. There is a more detailed transaction analysis which shows the exact FX rate used.

A few days later, on the day specified in the original transaction confirmation, the charge hit my HSBC account:

What exchange rate does Currensea use?

Currensea offers 16 major currencies at the real (interbank) rate (EUR, USD, AUD, CAD, CHF, DKK, HKD, HUF, JPY, NOK, NZD, PLN, SEK, SGD, THB and ZAR) and an additional 164 currencies at the Mastercard rate, which is marginally away from interbank. On the free Currensea plan, you pay this rate plus 0.5%.

Note that, for the 16 currencies where Currensea uses the interbank rate, I am told that you will get a similar deal – even with Currensea’s 0.5% fee – to using a 0% FX credit card which uses the Mastercard or Visa rate.

Note that, unlike Curve, Revolut etc, there are NO ‘weekend surcharges’, ‘top-up fees’, ‘fair use fees’ etc etc. As I said at the start, this is a very simple and idiot-proof product with no hidden charges.

There are three versions of the Currensea card

The Currensea website is here. Whilst you apply online, it has an app which lets you monitor transactions on the go.

There are three products to choose from:

- a free card (totally free, there isn’t even a delivery fee) called ‘Essential’

- a £25 ‘Premium’ version

- a £120 ‘Elite’ version which has Avis ‘President’s Club’ status, use of the ‘Ten’ concierge service, access to Mastercard’s luxury hotel booking service (stays come with extra benefits) and LoungeKey airport lounge access (£20 fee per visit payable)

If you choose to reduce your FX fees, you will pay 0.5% on the free Currensea card and 0% on the Premium and Elite cards.

If you choose to earn Singapore Airlines KrisFlyer miles, you will earn roughly 2 miles per £1 on the free card and slightly more on the Premium and Elite cards.

The £25 version is better value if you would spend over £5,000 per year on the card, but frankly I’d suggest getting the free card to see if you like it and then upgrading later.

Can you use Currensea in the UK?

The card is not designed to be used in the UK – and there is no logical reason to do so, given that you can use your exising bank debit card for free – but you can do so if you wish. There is a daily limit of £250, however. You cannot use it for ATM withdrawals in the UK.

For clarity, you will NOT earn KrisFlyer miles if you use your Currensea card to make payments in £.

Do I have protection for my purchases?

Currensea is a debit card, not a credit card, so you don’t have the legal protection offered by Section 75. This is the same position you are in if you use Curve, Revolut or any other debit card, or indeed an American Express charge card.

You DO have Mastercard chargeback protection, which allows you to file a claim directly with Currensea. They will liaise with Mastercard for any disputed transactions and in most cases the coverage is very similar to section 75.

Who qualifies for a Currensea card?

To apply for a Currensea card, you must have a current account with one of the following banks:

Barclays, Bank of Scotland, First Direct, Halifax, HSBC, Lloyds, Nationwide, NatWest, RBS, Santander, TSB, Ulster Bank

It doesn’t work with any of the ‘challenger’ banks.

You apply here and it is a very simple process. You will need the sort code and account number for your current account to set up the direct debit.

When I applied, I had the card within three days. It is, as the images above show, a funky vertical shape. Activate it via the Currensea website or app and you’re away.

Conclusion

By gaining a ‘miles and points’ angle, Currensea should be more interesting to all HfP readers who collect Singapore Airlines KrisFlyer miles.

At 2 miles per £1, it is the most generous way of earning KrisFlyer miles from an ‘open to all’ UK payment card.

The timing is excellent for anyone who was hit by the recent move to devalue the transfer ratio between American Express Membership Rewards and KrisFlyer. This is how Currensea compares for earning KrisFlyer miles:

- Currensea (free) – 2 KrisFlyer miles per £1 spent (foreign currency payments only)

- American Express Platinum (£575) – 0.66 KrisFlyer miles per £1 spent both in the UK and overseas

- American Express Gold (£140 from Year 2) – 0.66 KrisFlyer miles per £1 spent on UK spending and 1.33 KrisFlyer miles per £1 spent in foreign currencies

- HSBC Premier (free, HSBC Premier account required with £75k salary requirement) – 0.5 KrisFlyer miles per £1 spent on UK spending and 1 KrisFlyer mile per £1 spent in foreign currencies

- HSBC Premier World Elite (£195, HSBC Premier account required with £75k salary requirement) – 1 KrisFlyer mile per £1 spent on UK spending and 2 KrisFlyer miles per £1 spent in foreign currencies

If you spend on any of the cards above – except HSBC Premier World Elite – when outside the UK to earn KrisFlyer miles, you should swap to Currensea for purchases in foreign currencies. It’s free, if you get the basic card, so you have nothing to lose.

You can find out more, and apply, on the Currensea website here.

Rob

Rob

Comments (37)