Introducing Yonder: a credit card that rewards Londoners with experiences

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This article is sponsored by Yonder

Yonder is a new rewards credit card on the market which is probably unlike anything you’ve seen before. It is “the rewards credit card for Londoners”, offering a very high rate of return on spending to redeem at selected London outlets.

We wanted to take a look and see how it might fit in with your credit card points strategy.

If you apply for a Yonder card, you will get your first month of membership for free and will immediately be credited with £50 to spend with one of four Yonder dining partners around London, with no spend limit to hit first. If you like dining out then it’s basically free money, so you may want to give the card a try.

You can find out more on the Yonder website here.

The interest rate on the card is 64.0% APR variable which includes the fee, based on a notional £1200 credit limit.

What is Yonder?

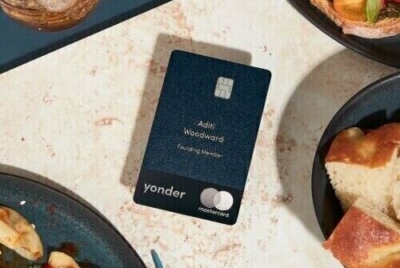

The Yonder card itself is a metal card, vertically set using a dark navy or ‘slate’ colour base.

Yonder is a lifestyle credit card with a points-based reward system. So far, so familiar. However, rather than convert the points to airline miles or hotel rewards, Yonder points are redeemed for fully paid meals (up to a limit) at a range of ever changing local restaurant and dining partners around London.

The restaurants are some of London’s most highly-rated venues, and not the Pizza Expresses and Giraffes typically available in loyalty programmes. Angelina, Kricket, Lina Stores, and Gunpowder are just a few of the well-respected and popular London restaurants where you can redeem your Yonder points.

Though the main focus of their rewards is dining, they have also partnered with Secret Cinema, 1Rebel and most recently HumanForest eBikes.

Currently, all partners are London-based, but Yonder does plan to expand.

How the Yonder credit card works

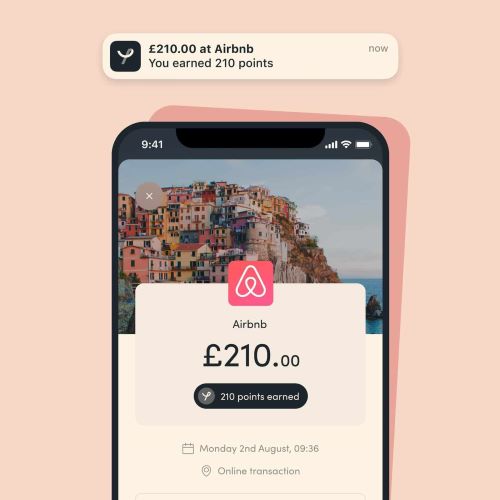

You earn 1 point (roughly 2.5p of rewards) for every £1 spent using the Yonder credit card.

You’ll earn up to 5 points per £1 (roughly 12.5p of rewards) when you use the credit card with selected Yonder partners.

1 Yonder point equates to approximately 2.5p of value, so spend £1000 and you’ll have £25 to spend on a Yonder experience.

Other Yonder credit card benefits

Alongside the rewards aspect of the Yonder card, it comes with some additional benefits:

- Travel Insurance: comprehensive travel insurance is included as a free benefit for all members (backed by AXA) and includes £0 excess, worldwide cover for the whole family, ski cover, car hire rental excess, baggage delays, medical, accidents and more

- It’s a Mastercard: it is accepted almost everywhere you can use a credit card, unlike American Express

- No foreign exchange fees: Yonder doesn’t charge any additional fees or charges while you spend abroad. You get the Mastercard rate

Yonder has a good reputation on Trustpilot, with almost all of their reviews being five stars based on strong customer service and the app experience.

Yonder has all of the other features you’d expect from a modern credit card, such as real-time transaction notifications, in-app freezing and unfreezing (handy if you think you’ve lost your card) and the ability to integrate the card with Apple Pay and Google Pay as soon as you’ve been approved.

Is there a Yonder credit card monthly fee?

Yes. Yonder costs £15 per month. However, anyone who downloads the Yonder app and applies via this link will get a one month free trial.

You will also get a £50 credit to spend with one of four selected Yonder partners. These are:

- Kricket

- Morito

- Lina Stores

- Mr Foggs

Unlike other card sign-up bonuses, you can spend your £50 credit straight away rather than waiting to hit a spend target.

How do you apply for a Yonder credit card?

The first thing you need to do is download Yonder’s app using the link here. You will be asked to go through an eligibility checker to see if you meet the Yonder criteria and once you’ve passed that, you go through a short application process.

Conclusion

There’s no getting away from the fact that Yonder has a clear demographic in mind and that demographic is a London-based young professional with cash to spend.

It is a simple proposition – Yonder is willing to give you roughly 2.5% of your card spending back in rewards, far more than any travel rewards card, as long as you are willing to spend those rewards at its carefully selected partners.

The £50 free credit for signing up has no strings attached. As the first month is free, it could be worth giving the card a go. Of course, as with all credit cards, only sign up if you intend to fully pay off the balance every month.

To ensure you get the one month free trial, please use this link here to download the Yonder app and apply.

Disclaimer: Head for Points is a journalistic website. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. Recommendations are based primarily on the ability to earn miles and points. The site discusses products offered by lenders but is not a lender itself. Robert Burgess, trading as Head for Points, is regulated and authorised by the Financial Conduct Authority to act as an independent credit broker.

Rob

Rob

Comments (91)