Emirates Skywards is planning a new UK credit card – here’s what they are thinking

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Emirates Skywards seems to have revived its plans to launch a new UK co-brand credit card.

This is a project that I know was being worked on before the pandemic (I know someone who worked on that one, and it even went as far as surveying members on preferred card designs) but was then dropped.

Someone has clearly now decided it is worth reviving.

A survey was sent to selected Skywards members on Friday:

“Emirates Skywards is considering launching a new credit card in the United Kingdom (UK). As a valued Skywards member in the UK, we would appreciate your time in completing a short survey to help us understand the credit card benefits and features that are important to you.”

The survey itself is nothing special:

- Who is your current primary payment card with?

- Which features from the list do you most like about that card?

- What rewards do you earn on that card?

- Would you be interested in having a co-branded Emirates credit card?

- Which of these benefits would you want? (earning miles, a sign-up bonus, lounge access, insurance, elite status, flight and holiday discounts, in-flight benefits etc)

Emirates already has some ideas …..

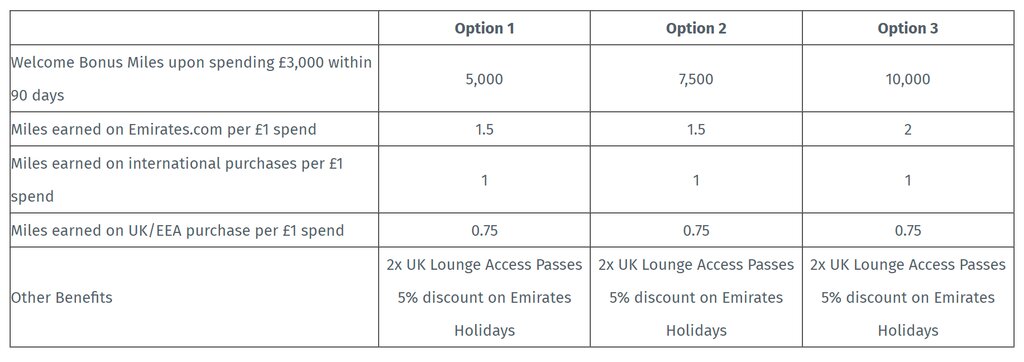

The survey includes three possible structures for a credit card (click to enlarge):

You’ll see that all offer 0.75 Skywards miles per £1 spent.

(The image below is one of the old UK Emirates Skywards credit cards, issued by MBNA.)

Under each option you are asked what annual fee you would pay. This is a bizarre question, to be honest, since virtually the only difference between the three options is the size of the first year sign-up bonus. After the first year, the three options are fundamentally the same.

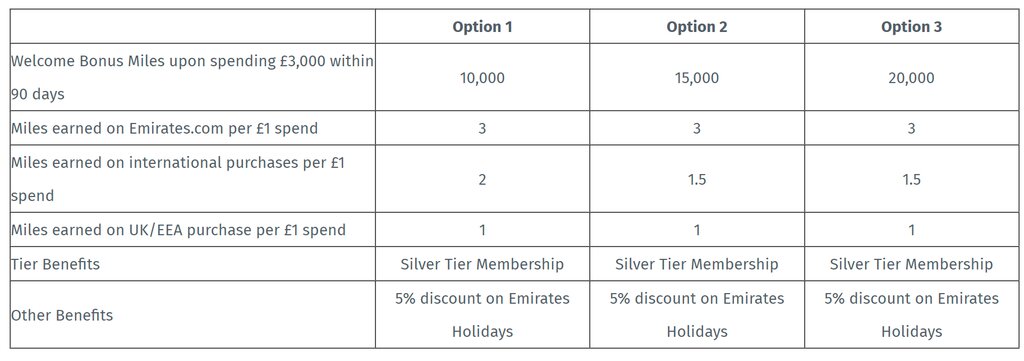

After I responded to that question I got this, which is more interesting from a reward perspective (click to enlarge):

However, you are still only getting 1 mile per £1 on core UK spending. Emirates wanted to know if £200+ would be an acceptable annual fee for such a card.

Is this proposition going to fly?

It’s not going to be easy, put it that way.

In the new world of 0.3% interchange fees, you need to think beyond the traditional concept of an arms-length partnership, where you simply sell miles to a bank partner.

For example:

- Barclaycard is using its Avios credit cards to bring in a young(er) and relatively wealthy group of people to the bank, as its core customer base continues to age. It is happy to take a loss on the credit cards if it means it can cross-sell other products, especially Barclays Premier.

- Virgin Atlantic formed a full joint venture company with Virgin Money to launch its credit cards. Instead of simply selling Virgin Points to the bank, the two companies have a complex deal which shares income from interest payments, FX spending and annual fees. This allows Virgin Red to sell points to the JV very cheaply.

At the moment Emirates doesn’t give the impression of being willing to go this far. This is why the proposition outlined in this survey isn’t competitive given the fees being suggested.

I assume that the Emirates customer base is heavily leisure driven and unlikely to be used to paying for credit cards.

I suggest that any new Skywards card needs to have a free option and, if there is a paid version on top, it should focus on benefits of interest to ‘once a year’ Emirates flyers – lounge access, priority check-in, priority boarding etc. The hard 3-year miles expiry rule may also need to be waived.

Emirates needs to see any UK card as a way of enhancing customer loyalty and not simply as a way of selling miles to a bank.

In the meantime, we have a complete guide to earning Emirates Skywards miles from UK credit cards which you can find here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Emirates Skywards miles from UK credit cards (August 2025)

Emirates Skywards does not have a UK credit card. However, you can earn Emirates Skywards miles by converting Membership Rewards points earned from selected UK American Express cards.

Credit cards earning Membership Rewards points include:

- American Express Preferred Rewards Gold Credit Card (review here, apply here) – sign-up bonus of 20,000 Membership Rewards points converts into 15,000 Emirates Skywards miles. This card is FREE for your first year and also comes with four free airport lounge passes.

- The Platinum Card from American Express (review here, apply here) – sign-up bonus of 50,000 Membership Rewards points converts into 37,500 Emirates Skywards miles

- The American Express Rewards Credit Card (review here, apply here) – sign-up bonus of 10,000 Membership Rewards points converts into 7,500 Emirates Skywards miles. This card is FREE for life.

Membership Rewards points convert at 4:3 into Emirates Skywards miles which is an attractive rate. The cards above all earn 1 Membership Rewards point per £1 spent on your card, which converts to 0.75 Emirates Skywards miles

The American Express Preferred Rewards Gold Credit Card earns double points (2 per £1) on all flights you charge to it, not just with Emirates but with any airline.

Rob

Rob

Comments (84)