Generous Avios Balance Boost promo running to Monday – buy at 0.92p

Links on Head for Points may support the site by paying a commission. See here for all partner links.

British Airways launched ‘Avios Balance Boost’ in June 2023.

It is a surprisingly good value way of buying Avios.

Put simply, you can buy a lump sum of Avios equivalent to 100%, 200% or 300% of the Avios you have earned in the last 30 days. The cost can be as low as 0.92p per Avios.

Until Monday, a flash offer makes it substantially easier to qualify to buy up to the annual 300,000 Avios cap.

What does it cost to use Avios Balance Boost?

You can find Avios Balance Boost on the usual ‘buy Avios’ page here.

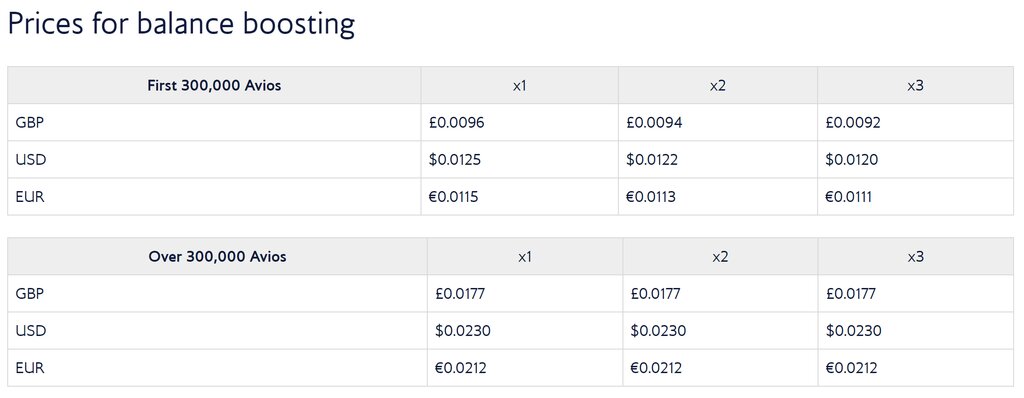

Here is the standard price list:

Unless you are trying to buy over 300,000 Avios via Balance Boost, which is unlikely unless you are trying to boost a chunky credit card sign-up bonus or made a large transfer from American Express Membership Rewards, you will pay between 0.92p and 0.96p per Avios.

The 300,000 Avios cap is based on your Boost purchases over a calendar year and not per transaction.

How does Avios Balance Boost work?

Before we go into this new flash offer, let’s summarise how Avios Balance Boost works.

When you go into Avios Balance Boost you will see a list of all of your eligible transactions from the last 30 days.

You can either select individual transactions, select entire categories (eg ‘Credit Cards’) or select everything.

You will then be shown your pricing options for doing a x1, x2 or x3 boost based on the price list above.

What sort of transactions qualify for Avios Balance Boost?

You can boost:

- Avios earned from the BA shopping portal

- Avios earned from credit card spending

- Avios earned from flights

- Avios earned from ‘hotels and travel’ eg Uber

According to the terms and conditions, you CANNOT boost Avios obtained via:

“balance transfers from other airlines [presumably Qatar Airways or Finnair Avios transfers], Nectar exchanges, Avios shared or gifted by other members and previously bought Avios.”

Other inbound transfers, from American Express Membership Rewards, HSBC Premier, Heathrow Rewards etc will count for boosting.

You can only boost a transaction once.

What is the special offer?

Until Monday night (3rd February), British Airways is running a special offer.

There are two big changes:

- you can boost ALL of the Avios you earned in 2024, instead of just the last 30 days

- you can boost up to 4x the Avios you earned, instead of the usual 3x

…. with two restrictions:

- the annual cap of 300,000 Avios via Avios Balance Boost remains in place

- you can’t reboost a transaction which was previously boosted

Here’s the bottom line: for anyone who earned 75,000 Avios from qualifying transactions in 2024, you can (until Monday night) buy up to 300,000 Avios for 0.92p each.

Don’t forget that there is a 300,000 Avios cap on what can be boosted at the special rate. If you are shown a price that is higher than 0.92p per Avios then it’s because you will be over the 300,000 Avios cap.

If you earned more than 75,000 Avios last year, you need to unselect transactions until you have reduced the total to be boosted to 75,000 Avios or fewer. If you don’t, you will be paying too much.

Conclusion

If you are in the market for Avios, this is an excellent deal at 0.92p each.

Of course, however low the price, we don’t recommend buying Avios when you don’t have a specific plan to use them. The risk of devaluation is always there.

You can access Avios Balance Boost here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (September 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 80,000 Avios! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 40,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 120,000 Avios! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 60,000 Avios! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

The American Express Business Platinum Card

120,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

60,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (112)