Get cheap lounge access and 0% FX fees with the Lloyds Bank World Elite Mastercard

Links on Head for Points may support the site by paying a commission. See here for all partner links.

We don’t usually cover credit cards which don’t earn points or miles on HfP. The clue, after all, is in the site name!

However there are two key features of the Lloyds Bank World Elite Mastercard which make this the exception to our rule and make it worth considering:

- it has 0% FX fees for your first five years – there are NO ‘miles and points’ credit cards which offer 0% FX fees globally

- it is the cheapest way to get a ‘full’ Priority Pass for two people, allowing you and a nominated second person to get free access to 1,400 airport lounges and £18 per person credits at many airport restaurants

Here’s the key legal stuff:

Representative 55.0% APR variable based on an assumed £1,200 credit limit and £15 monthly fee. Interest rate on purchases 22.94% APR variable.

You do not have to bank with Lloyds to apply for this card.

The card website is here.

What does the Lloyds Bank World Elite Mastercard offer?

Instead of miles and points, you receive cashback at an attractive rate when you spend on the Lloyds Bank World Elite Mastercard.

You will receive:

- 0.5% cashback on your first £15,000 of spending in each card year

- 1% cashback on all spending above £15,000 in each card year

To save you doing the maths, you breakeven on the £15 per month fee after spending £25,500 in a card year. However, the card is well worth considering even if you won’t spend that much because of its strong benefits.

There is an excellent airport lounge benefit

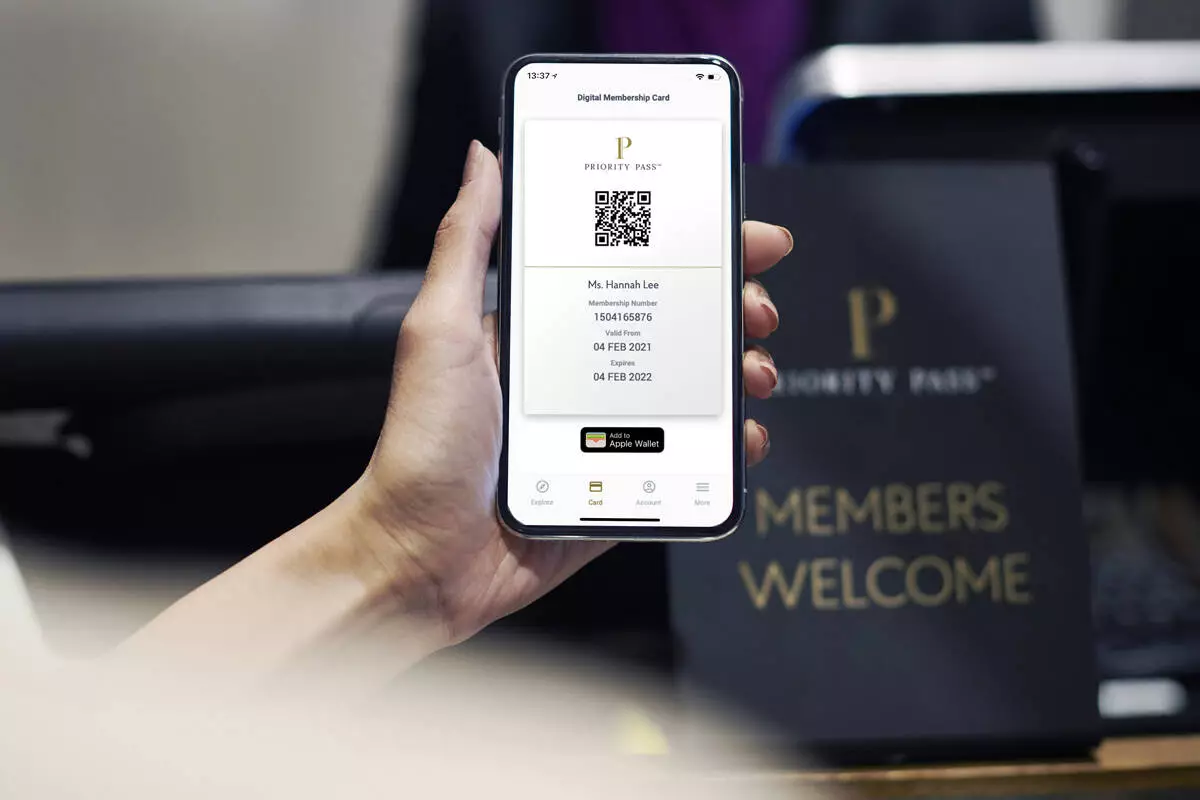

Most readers will be familiar with the Priority Pass airport lounge network. If you’re not, go to its website and search for the airports you use on a regular basis. You will see what lounges and restaurants are available.

You will receive free, unlimited, access via the Priority Pass scheme to 1,400 airport lounges.

This is for you as the main cardholder. However, you can add a second free supplementary holder to your credit card who will also receive a Priority Pass.

Additional guests, including children, are charged at £24 per lounge visit.

This version of Priority Pass includes £18 restaurant credits

Many UK lounges are now very busy at peak times, but you can often get around this by paying £6 to reserve a guaranteed slot. You will rarely struggle to access Priority Pass lounges anywhere else globally, except for certain US airports.

The problem with ‘full’ UK lounges goes away with this version of Priority Pass though. Instead, you can head to an airport restaurant and spend up to £18, with Priority Pass paying your bill.

If you eat with the holder of your free supplementary cardholder who has their own Priority Pass, you would receive £36 between you.

Lloyds Bank is one of the few UK financial institutions to offer a version of Priority Pass which includes the £18 restaurant credits as an option. You do NOT get these credits if you receive your Priority Pass via American Express Preferred Rewards Gold or The Platinum Card from American Express.

This article from December looks at the UK airport restaurants where you use your £18 food and drink credits. We will run an updated version of it soon.

I would highlight the two options at London City Airport – Juniper & Co and Soul & Grain – because London City does not have any airport lounges at all, independent or airline-operated.

What other benefits are there?

You can take advantage of free fast track security at selected airports. Gatwick, Luton, Stansted, Manchester and Glasgow all participate, amongst others – see here for details and look for airports showing the suitcase symbol. (The main and supplementary cardholders are free, additional guests can be added for a fee.)

You can access special offers via Mastercard’s Priceless website, including some especially for World Elite cardholders. This includes, for example, 12% off flexible Heathrow Express tickets and 15% off easyJet Plus membership.

Is this a good card to use when travelling?

Yes, very much so.

The Lloyds Bank World Elite Mastercard has 0% FX fees globally. This is guaranteed for the first five years of holding the card.

There are no credit cards with 0% foreign exchange fees worldwide which earn airline or hotel points. The nearest you can get is 0% FX fees in the Eurozone with the two Virgin Atlantic credit cards.

If you travel outside the Eurozone and want a 0% FX option, this card will be cheaper to use than any ‘miles and points’ credit card you may have.

You will receive cashback on your FX spend too!

Conclusion

Unsurprisingly, it is very rare that Head for Points recommends a credit card which does not offer any miles or points!

However, the Lloyds Bank World Elite Mastercard has two things in its favour which could make it a worthwhile addition to your purse or wallet.

At £180 per year, it is THE cheapest way to get a Priority Pass for two people for airport lounge access via a credit card, with the added benefit of including the airport restaurant benefit. You can’t even buy an ‘unlimited use’ Priority Pass directly from the company itself for this little.

With 0% FX fees globally, it also offers you an FX benefit that no ‘miles and points’ card you have can match. Using a 0% FX fees card easily outweighs the value of the points you would earn from using any other credit card with the industry standard 2.99% FX fee.

Paying the £15 per month card fee to unlock the lounge and restaurant benefits for two people is a pretty good deal if you are a regular traveller, and that is before you factor in savings from paying 0% FX fees globally and using the airport fast track benefit.

Click here to learn more about the Lloyds Bank World Elite Mastercard and here for the application form.

Disclaimer: Head for Points is a journalistic website. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. Recommendations are based primarily on the ability to earn miles and points. The site discusses products offered by lenders but is not a lender itself. Robert Burgess, trading as Head for Points, is regulated and authorised by the Financial Conduct Authority to act as an independent credit broker.

Rob

Rob

Comments (69)