NEW: Amex Platinum (and Bus Plat) holders can pre-book UK airport lounges for FREE

Links on Head for Points may support the site by paying a commission. See here for all partner links.

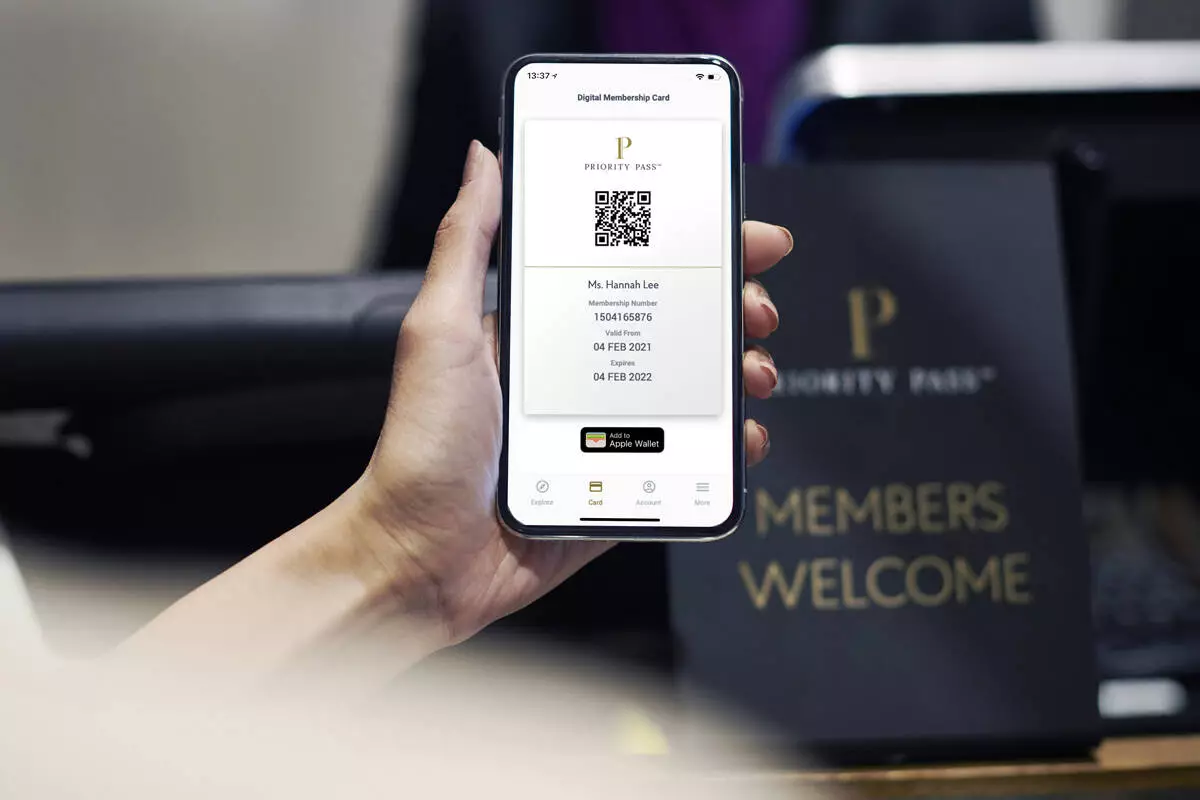

Good news! After a successful trial last year, American Express has brought back airport lounge pre-booking to allow you to make the most of your Priority Pass benefit.

Effective immediately, holders of The Platinum Card and The American Express Business Platinum Card can pre-book selected UK airport lounges for free.

This benefit is guaranteed to run until at least the end of 2027.

Full details are on the Priority Pass website here.

How many lounges can you pre-book?

If you have The Platinum Card or The American Express Business Platinum Card you will have received FOUR pre-booking credits which need to be used by 31st December 2025.

You need one credit per person entering the lounge, so a couple would require two credits.

For 2026 and 2027, you will receive EIGHT pre-booking credits on 1st January.

Here is an important point: unlike the trial last year, supplementary cardholders DO NOT receive their own pre-booking allowance.

How do you pre-book an airport lounge?

You need to download the Priority Pass app and register your card.

Search for a participating lounge and you will see a button which allows you to prebook.

Note that, due to an IT bug, pre-booking will not be possible for some people (including myself). You will find that, irrespective of whether you use the app or website, it is impossible to enter an email address to receive the necessary 2FA code.

What is the small print?

There are a few rules to note:

- the primary cardholder must be one of the guests – you cannot pre-book for other people if you are not there yourself

- you can reserve a lounge slot up to three months in advance

- pre-booking credits do NOT carry forward if unused in any calendar year

- a credit is counted as ‘used’ at the time of booking, not the date of your visit. If you book in December 2025 for a lounge visit in January 2026, the credit is taken from your 2025 allowance.

- pre-booking credits will be returned if the booking is cancelled more than 48 hours before arrival. Cancellations within 48 hours of arrival, or no-shows, will result in the credit being forfeited.

- credits will not be returned, irrespective of when a booking is cancelled, if the original booking was made in the previous calendar year (eg if you book in December 2025 for a January 2026 flight and cancel the booking after 1st January 2026, the credits will not be returned)

Am I guaranteed to be able to pre-book?

No.

Some lounges do not release pre-booking slots at peak times. This is usually when an airline has pre-booked some or all of a lounge for its own passengers.

Which lounges are participating?

This is the list of participating lounges, with links to the relevant pre-booking page on the Priority Pass website:

| Lounge Name | Airport |

| Northern Lights Lounge | Aberdeen |

| Aspire Lounge | Belfast George Best City |

| Aspire Lounge | Birmingham International |

| Aspire Lounge (South) | Birmingham International |

| No1 Lounge Birmingham | Birmingham International |

| Aspire Lounge (Gate 16) | Edinburgh |

| Upper Deck | Glasgow |

| Aspire Lounge | Humberside |

| Aspire Lounge | Inverness |

| Aspire Lounge | Liverpool John Lennon |

| No1 Lounge Gatwick – South Terminal | London Gatwick |

| No1 Lounge Gatwick – North Terminal | London Gatwick |

| My Lounge – North Terminal | London Gatwick |

| My Lounge – South Terminal | London Gatwick |

| Club Aspire Lounge – South Terminal | London Gatwick |

| No1 Lounge Heathrow – Terminal 2 | London Heathrow |

| No1 Lounge Heathrow – Terminal 3 | London Heathrow |

| My Lounge – Terminal 3 | London Heathrow |

| Club Aspire Lounge – Terminal 5 | London Heathrow |

| No1 Lounge Luton | London Luton |

| My Lounge | London Luton |

| Aspire Lounge – Terminal 1 | Manchester |

| Aspire Lounge – Terminal 2 | Manchester |

| Aspire Lounge | Newcastle International |

| Spitfire Lounge | Southampton |

Plaza Premium lounges are NOT available for pre-booking via Priority Pass. This is a blow but – since No1 Lounge opened in Heathrow Terminal 2 – Heathrow Terminal 4 is the only UK airport terminal where Plaza Premium is the only independent option.

Clubrooms lounges are NOT included. This is a change from the trial last year.

HfP has reviewed most of the lounges listed above. Our index of UK airport lounge reviews is here.

Conclusion

This is a good step forward for holders of The Platinum Card and The American Express Business Platinum Card.

It’s a shame not to see Plaza Premium included, especially as it would improve capacity at Heathrow Terminal 5. With many British Airways flyers losing their Silver status next April, there will be a surge of people looking to use the two independent lounges – and only Club Aspire is available via this deal.

You can find out more about the offer – and check the current list of participating lounges, if you are reading this after the original date of publication – by visiting this page of the Priority Pass website.

PS. As a reminder, click here to learn more about The Platinum Card sign-up offer of 50,000 Membership Rewards points, which converts to 50,000 Avios.

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

Rob

Rob

Comments (190)