How much money will British Airways lose running the ‘Avios only’ flight to Cape Town?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This is a guest post by Oliver Ranson, who runs the fascinating Airline Revenue Economics blog on Substack.

You can read Oliver’s previous HfP articles, “How we built the first business case for the award-winning Qatar Airways Qsuite“, here, “Why the disappearance of First Class is down to bad marketing, not lack of demand” here and a similar article to this one on the Avios-only flight to Dubai here.

You can sign up to receive Oliver’s future articles by email here. You will usually receive the first half by email with the rest available to paid subscribers. The paid level has a seven day free trial, and it is cheaper if you sign up via a web browser rather than the Substack iOS app due to Apple’s cut being added on.

This article has been edited slightly by HfP for house style. Over to Oliver:

British Airways’ Avios-only flights have become an established feature of the airline’s business. They were first offered in April 2023 and started small – Geneva and Sharm-el-Sheikh were first – operated by two-cabin single-aisle planes without flat-beds.

BA has also run twin-aisle Avios-only services. I costed BA’s Avios-only 2024 autumn half-term special to Dubai when it was released, which HfP also re-published.

An Avios flight to Caribbean sun-spot Barbados flew in February 2025. Abu Dhabi, just down the road from Dubai but probably harder to fill, operated Avios-only in Easter this year.

Now British Airways has launched what may be the most impressive Avios-only flight yet. It is their flight to Cape Town leaving on 20th December this year and returning just under two weeks later on 2nd January 2026.

This really is peak-of-the-peak for leisure travel. Other long-haul Avios-only services were in school half-term holidays.

On Dubai and Abu Dhabi there will have been some corporate traffic displaced by the points bookers. Cape Town is right over Christmas. Almost everyone on these flights will be off on holiday. Fares would have been through the roof.

I have taken the opportunity to build a new-and-improved version of my pricing model to figure out the economics of the Cape Town Avios exclusive. It builds additional elements into the previous model.

Avios Group Limited, the loyalty arm of BA’s parent company IAG, will almost surely be paying British Airways for the seats at market rate. My model estimates they may have had to pay BA more than £1 million to offer the deal.

The idea is that proving to Avios collectors that they can make impressive and aspirational redemptions attracts more people to the scheme.

The Avios business has certainly been booming. Some highlights from the company’s 2024 annual report are:

- £363 million profit on £1,585 million revenue, earning 22.9% pre-tax margin

- £301 million revenue growth 2022 to 2023 (23.4%)

- Avios earning grew 24% in 2024

- Avios redemptions grew 20% in 2024

Bringing in new customers with the Cape Town flight helps propagate this growth of a high-margin product.

So how much might Avios Group Limited be paying BA? Read on to find out .…

Why Cape Town & why now?

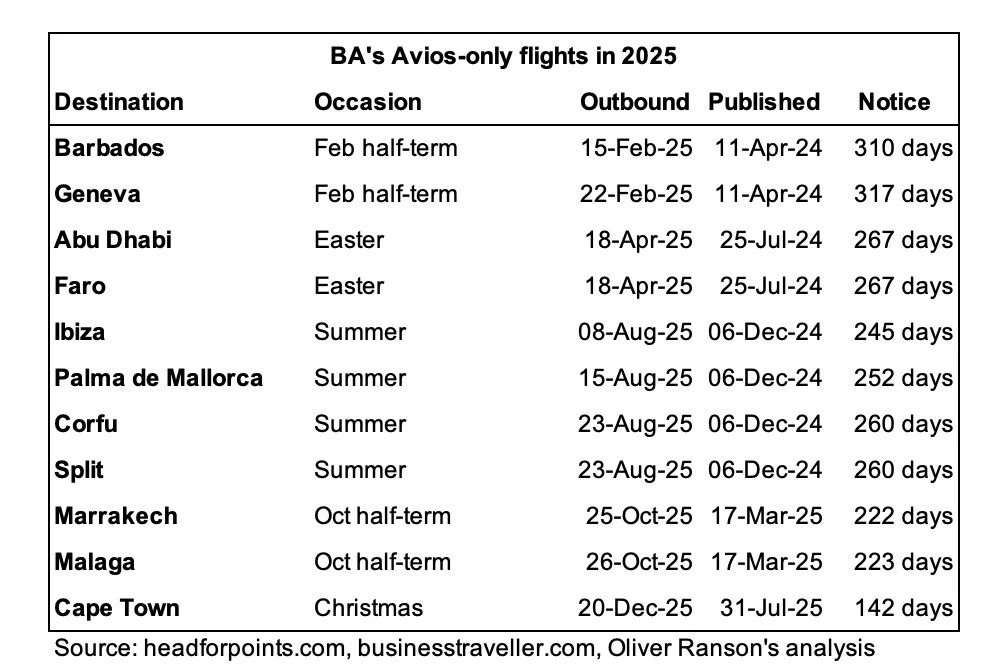

2025’s Avios-only flights are shown in the table below:

Take a look at the ‘notice’ column, which shows how many days in advance the Avios-only flights were released. All other Avios-only flights in 2025 were released far ahead, between 222 and 317 days. The average is 262 days.

The Cape Town flights have been released 142 days ahead, a bit under five months. There was much less notice than the other Avios-only flights.

Why? I think there are two possible reasons:

- Other Avios-only flights might have generated large numbers of bookings and cancellations – narrowing the booking window a bit might help cut down on speculative bookings – although the flights sell out so quickly that it makes sense to ‘book now and ask [your partner] questions later’

- Summer holidays were in full swing on 31st July as state schools broke up on 22nd July but private schools started their holidays some time earlier (my old school on 27th June) – many private school parents may have already finished their summer holidays by 31st July and will be thinking about their next break

It is not clear whether or not BA’s Avios-only flight had a lightly booked load before the announcement. The flight is one of a pair that operates on the days in question. Based on fare class availability, the second flight looks almost booked out. My guess is that BA has moved existing cash ticket holders onto the other flight.

Jetting off to South Africa at Christmas time is a premium price proposition. The sort of thing done by people who do not blink at dropping £25,000 on four Club World seats. (£25,000 is not hyperbole, as I will show below.)

Even with Avios-only flights, Cape Town is still a financial stretch for many. Hotels at Christmas are correspondingly costly – a standard room at the Mount Nelson for the period of this trip would cost you over £20,000. Even a more modest option like The Westin Cape Town is £5,000 per room.

Yet some passengers will find a holiday that was previously financially impossible now within their reach. That will make them feel warm and fuzzy about British Airways. They will keep their co-brand credit card and keep preferring BA for business travel.

Others will genuinely save cash that they would otherwise have spent. They will be grateful and there is a good chance they may spend the money on more BA flights in the future.

The model I used to cost Avios-only flights to Dubai

If you have read my article on costing BA’s Avios-only flights to Dubai you can skip this section. It explains how that model worked.

I have a little technique I use that takes published fares and calculates a ‘best-guess’ estimate of how much revenue particular flights and routes can generate for airlines. I call it the ‘shelf’ principle.

Imagine you are in a shop looking at the things for sale. Items on the bottom shelf are often the cheapest. You need to look for them and reach down to pick ‘em up. But because they are cheap and the Law of Demand applies, many people will. So items on the bottom shelf sell at low prices but in high volume.

Now consider the top shelf. That is where the priciest items tend to be. Everyone can see them, but not everyone wants them. So the shop puts them above your hands and you need to reach up if you want one. The top shelf has low volume but high prices.

Finally, imagine of the middle shelf. It is eye level and in easy reach – desirable real estate. It has all your favourite brands on, but maybe you do not always buy your favourite. The middle shelf has mid-range volume and mid-range prices.

So ….

- Bottom shelf – high volume, low prices

- Top shelf – low volume, high prices

- Middle shelf – mid-range volume, mid-range prices

All three shelves probably generate the same revenue. Or margin, since this is retail. The key idea is that each shelf contributes equally.

It is the same with a well-run airline fare structure. Our best guess as observers is that each fare class, or revenue booking designator as we say in the trade, contributes an equal amount of revenue.

Drawbacks of my Dubai model

In one respect my Dubai model probably over-estimated the revenue which BA would otherwise have earned on their Avios-only flight to Dubai.

It used London originating fares which should be more expensive than fares from other markets which BA would also have sold. I have corrected for this in the Cape Town model.

In another respect my Dubai model probably under-estimated the revenue opportunity cost. It assumed that all fare classes were represented.

This may have been valid to some extent for Dubai – large corporates and travel agents might have access to discounted fares that book into higher buckets. I do not think it is valid for Saturday trips to Cape Town at Christmas, where I would expect everybody to be paying full whack.

What is BA charging for similar flights around Christmas time?

BA wants the following fares for direct, non-stop flights +/- 2 days to Cape Town. These include BA’s surcharges but do not include UK Air Passenger Duty, other taxes and airport charges:

- £12,341 to £16,555 in First

- £6,292 in Club World

- £4,144 to £5,133 in World Traveller Plus

- £2,716 in World Traveller

Fares from European airports are lower, reflecting BA’s price premium for passengers starting their journey in the UK. Looking at Paris, Amsterdam and Frankfurt, I see:

- £13,186 to £17,533 in First – slightly higher than ex-London

- £5,553 to £9,086 in Club World – potentially around £1,670 lower than ex-London

- £2,605 to £3,290 in World Traveller – potentially around £310 lower than ex-London

I struggled to price up a World Traveller Plus itinerary from Europe – I tended to get Club World instead.

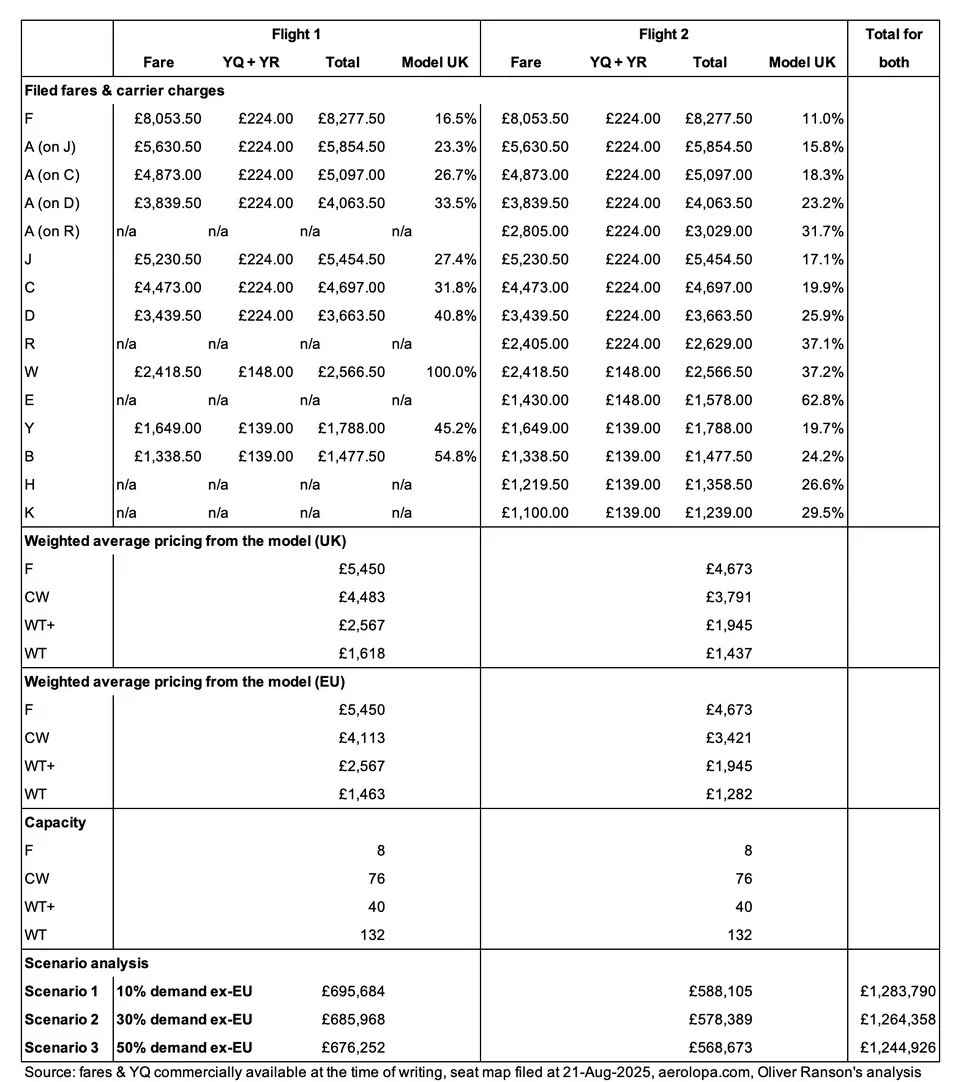

I then evaluated three scenarios, based on the percentage of travellers who would have bought tickets starting in Europe (not the UK) and so paid a lower fare:

- 10% demand ex-EU

- 30% demand ex-EU

- 50% demand ex-EU

Now for the results. Depending on the scenario, the value of both outbound and return flights together is between £1.2 million and £1.3 million. Click to enlarge:

Note how due to slightly less favourable inventory availability the pre-Christmas flight is more valuable than the post-New Year flight. This makes sense – not every Cape Town traveller will want to be in Cape Town for so long but Christmas rather than New Year could easily be the priority for most.

We also do not know how many bookings BA has already received for Cape Town Christmas services.

It is possible that it has received many and that there was more favourable (for the consumer) inventory availability earlier in the year. This would mean that my estimate is too high.

There are not many seats left on BA’s second Cape Town flights of the day, suggesting that some passengers may have been moved over.

However my personal experience of evaluating desirable Christmas flights is that fares are always near the top of the range at the time of release. People may buy them in advance or not but the seats are always sold at expensive prices in the end. This gives me some confidence that I should not be out by too much.

But please remember .… it’s only a model! We can be virtually certain, however, that British Airways has sacrificed at least £1m of revenue to run this Avios-only flight.

If you found this interesting, you may enjoy these other articles on my Substack. One article can be read for free and the rest are available via the seven day free trial subscription:

Comments (40)