-

For those interested in high blood pressure / hypertension stats – lots of referenced figures here – https://www.bloodpressureuk.org/news/media-centre/blood-pressure-facts-and-figures/

In terms of the OP’s original comment, just goes to highlight how important it is to carefully read insurance terms. Especially if considering travel which could result in large claims – which are probably the ones insurers will do their upmost to wriggle out of paying. For context of this site, also worth checking for ‘air miles’ exclusions that are present with a number of the main underwriters.

just before jdb jumps on my post, I’m guessing statins can be prescribed to people for reasons other than hypertension.

Statins are not prescribed for hypertension.

thanks, I clearly know exceptionally little about statins, not my area of expertise. I also know very little about high blood pressure either.

Thanks @ronniesmithy for highlighting this. I have valued the Platinum card based on the insurances so this does suggest I finally cancel and find my own insurance, especially as we have a cruise coming up. If Amex’s insurers are using things like blood pressure medication to escape expensive claims then it’s not for me.

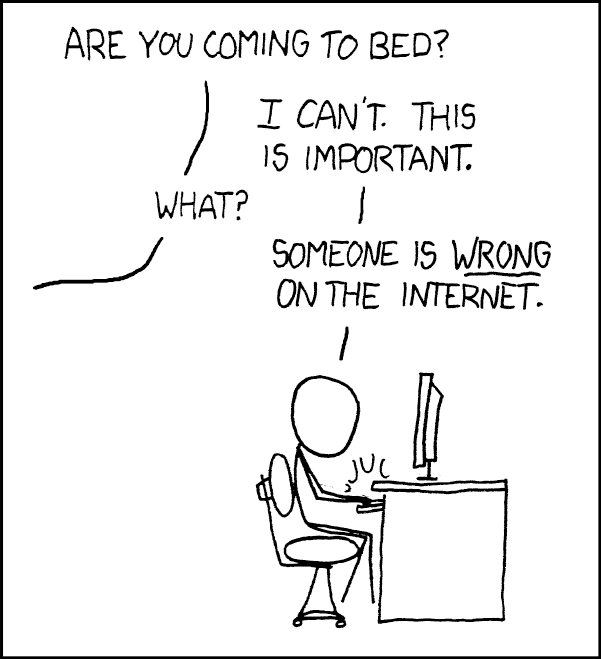

As for this follow-ups, good grief. Does everything have to descend into

Certainly, Insurance is not a reason to keep the Platinum and I would value it as zero in terms of offset to fees (you may be able to claim in some capacity but to all intents, I class it as not covered). Obviously weigh up the other benefits of the card. Personally, I have Platinum and Nationwide Flexplus and pay a bit extra to have minor conditions covered as I travel to the US fairly regularly and no insurance there would be catastrophic.

… you risk ending up in the same position as someone who’s had a botched boob job in Turkey and has to resort to crowd funding to pay the bill and get home, and then expects the NHS to sort out the rest!

Hey, I asked you not to tell anyone about my boob job.

Certainly, Insurance is not a reason to keep the Platinum and I would value it as zero in terms of offset to fees (you may be able to claim in some capacity but to all intents, I class it as not covered). Obviously weigh up the other benefits of the card. Personally, I have Platinum and Nationwide Flexplus and pay a bit extra to have minor conditions covered as I travel to the US fairly regularly and no insurance there would be catastrophic.

Someone with no pre-existing conditions would obviously value the plat offering quite differently or are we suggesting it’s a dud product overall

Certainly, Insurance is not a reason to keep the Platinum and I would value it as zero in terms of offset to fees (you may be able to claim in some capacity but to all intents, I class it as not covered). Obviously weigh up the other benefits of the card. Personally, I have Platinum and Nationwide Flexplus and pay a bit extra to have minor conditions covered as I travel to the US fairly regularly and no insurance there would be catastrophic.

Someone with no pre-existing conditions would obviously value the plat offering quite differently or are we suggesting it’s a dud product overall

Agreed, but with NICE recently lowering the thresholds for people who should initiate treatment for hypertension or hypercholesterolaemia, it’s likely that a lot of people will find this policy useless. The general frustration on here seems to be Amex’s unwillingness to move with the times and allow a flexible policy where one can upgrade the policy to include pre-existing conditions.

The thing is, this travel insurance benefit of the Amex Plat in that case wouldn’t be much different from the Priority Pass benefit of the card. Both those benefits look great but in the UK market turn out to be difficult to use.

Wait…am I reading this right? Like many people, I take statins voluntarily on the basis that I am heart healthy and have a very low risk of a heart attack but want to reduce that risk even lower. So I’m not in fact covered by Platinum insurance at all for any health related issue? If so I had NO IDEA!

Wait…am I reading this right? Like many people, I take statins voluntarily on the basis that I am heart healthy and have a very low risk of a heart attack but want to reduce that risk even lower. So I’m not in fact covered by Platinum insurance at all for any health related issue? If so I had NO IDEA!

You certainly wouldn’t be covered for any cardiovascular related claim. With other claims, if they feel that there is the slightest possibility that it could be linked to hypercholesterolaemia, they will refuse to pay. It’s easy to link things in the medical world. e.g. What happened – you fell and broke your arm. Their hypothesis – blood vessel narrowing could have caused you to feel dizzy and led to the fall, you’re not covered.

Wait…am I reading this right? Like many people, I take statins voluntarily on the basis that I am heart healthy and have a very low risk of a heart attack but want to reduce that risk even lower. So I’m not in fact covered by Platinum insurance at all for any health related issue? If so I had NO IDEA!

It’s not quite that you aren’t covered for anything medical but that the burden is put back on you to show that whatever medical incident occurred didn’t relate to the fact you take statins, because even though I think you are saying that you take such medication voluntarily, that would still fall within the definition of ’pre-existing conditions’ as cited below. The problem as @Cranzle says above is that a huge range of serious medical issues could be tied to cardiovascular. This makes it very uncertain, if you had a claim on this policy what would be claimable and what they might refuse to pay.

This makes a policy that’s clearer about what is/isn’t allowed and permits common pre-existing conditions and medications to be covered or the sorts of policies where you have to make a declaration for which you would probably get pre-clearance much more satisfactory.

As above, not many people can realistically rely on this policy for themselves and/or their families. It’s something Amex really needs to address.

“Pre-existing Medical Condition(s)” means any past or current Medical Condition (other than those on

the Accepted Conditions list which is available by visiting americanexpress.com/uk/insuranceportal) which, during the 2 years prior to You booking a Trip, has given rise to symptoms or for which any form of treatment or prescribed medication, medical consultation, investigation or follow-up/check-up has been required or received; and any cardiovascular or circulatory condition (e.g. heart condition, hypertension, blood clots, raised cholesterol, stroke, aneurysm) that has occurred at any time prior to You booking a Trip.Someone with no pre-existing conditions would obviously value the plat offering quite differently or are we suggesting it’s a dud product overall

And that was me and the value is about 150 quid for multi-trip insurance that includes US and Caribbean. But the OP’s post reminded me of the terms which I’d not worried about before in that my wife got hypertension meds only recently. If Amex are putting the burden of proof on the customer that a pre-existing condition did not result in claim, then that has now become too much of a risk for me.

I’m not sure the burden of proof is necessarily on the customer, but certainly the insurance companies own medical team will make an (informed?) assessment and could deny payment for treatment due to a declared (or undeclared) existing condition that could be linked to the claim. There are similar clauses in all insurance policies, for the presence, for example, of alcohol in any claim. If you fell over and broke your arm because you were drunk, then they could refuse to pay. how much alcohol is too much though? Nobody will say.

I’m not sure the burden of proof is necessarily on the customer, but certainly the insurance companies own medical team will make an (informed?) assessment and could deny payment for treatment due to a declared (or undeclared) existing condition that could be linked to the claim. There are similar clauses in all insurance policies, for the presence, for example, of alcohol in any claim. If you fell over and broke your arm because you were drunk, then they could refuse to pay. how much alcohol is too much though? Nobody will say.

But should it not be possible to insure yourself against drunken injuries?

@vzzbuckz – re alcohol, it’s not the same because it is explicitly referenced in the policy and it tells you the permitted amount whereas in respect of pre-existing conditions it is effectively by omission, but more importantly leaves a cardholder uninsured in circumstances most might expect to be covered.

Just had an email from Amex promoting/introducing their travel insurance.

Not studied the details yet, but a couple of things I spotted were annual multi-trip age range 18-69, single trip 73.

Up to 90 days.

Winter sports and cruise add-ons.

Also claims to cover a “limited range of pre-existing medical conditions.”

Might put my stuff in later just to see what the terrible quote is!

Laughably it states “Medical conditions shouldn’t stop you from travelling the world”

Well, it does if you have The Platinum Card, unless you pay for cover outside of AmEx.Silly question – if i have meds for high blood pressure, does it make sense to get a standalone policy for me and use the amex one for the rest of my family?

Silly question – if i have meds for high blood pressure, does it make sense to get a standalone policy for me and use the amex one for the rest of my family?

That’s one option, but I guess you need to be sure the Plat card still adds up when you have to buy a separate policy for yourself. If you qualify for HSBC Premier, the free travel insurance that comes with that account allows high blood pressure as a pre-existing condition. It offers family cover and some sections like travel disruption/inconvenience are better than Plat.

The packaged policies from Nationwide Flex and Virgin Money (now part of NW) are pretty good – the former will charge around £50 extra for high BP but it does include things like AA if you are paying for breakdown cover.

Amex has rather cheekily relaunched standalone travel policies suggesting Plat cardholders with pre-existing conditions might like to buy one… poor form.

Silly question – if i have meds for high blood pressure, does it make sense to get a standalone policy for me and use the amex one for the rest of my family?

The price comparison websites let you compare by entering conditions that apply to each traveller so I plan to use that. I doubt the price difference is very much at all given that the premiums I found were about 175-250 quid.

Talking of travel insurance, this article on the BBC news website today shows how careful you need to be of even seemingly big insurance companies:

Talking of travel insurance, this article on the BBC news website today shows how careful you need to be of even seemingly big insurance companies:

That was on the Today programme a few minutes ago as well. Axa is totally outrageous without a thought for the patient and gets particularly difficult the moment the bills start escalating. I know someone who had a similar experience, so the family is struggling with the incident while having to battle Axa. They get very bureaucratic and hide behind people you can’t speak to. They make desktop medical assessments without speaking to or communicating with the treating clinicians. Just a horrible situation. I had a run in with them about not getting prior authorisation in an emergency.

Axa is of course the current provider for Amex Plat insurance administration although to save money it’s moving to Europ Assistance that some say is worse.

Silly question – if i have meds for high blood pressure, does it make sense to get a standalone policy for me and use the amex one for the rest of my family?

The price comparison websites let you compare by entering conditions that apply to each traveller so I plan to use that. I doubt the price difference is very much at all given that the premiums I found were about 175-250 quid.

Yes but what I mean is, I have the Amex platinum one which wouldn’t cover me. (high blood pressure). But presmuably I just need a standalone policy, not one for the rest of my family who will still be covered by that?

olisl wrote:

Silly question – if i have meds for high blood pressure, does it make sense to get a standalone policy for me and use the amex one for the rest of my family?The price comparison websites let you compare by entering conditions that apply to each traveller so I plan to use that. I doubt the price difference is very much at all given that the premiums I found were about 175-250 quid.

Couple of points. There’s a price comparison site specifically for those with pre-existing conditions (medicaltravelcompared-dot-co-dot-uk). The screening forms all seem to follow one of two formats so it makes sense that they can centralise it like this. Sadly pre-existing conditions have been a part of my life for the last three decades so I’m well used to the process and the wild swings seen in price between provider and from one year to the next for the same condition.

Also note if you do split it across two policies, you may find that if you have to cancel owing to a pre-existing condition, any payout won’t cover the rest of the group. That’s abnormal against a traditional policy but something I noticed in my last renewal documents (from Ageas).

- You must be logged in to reply to this topic.

Popular articles this week: