Mobile app-only bank Monese launches an exclusive partnership with Avios Group

Links on Head for Points may support the site by paying a commission. See here for all partner links.

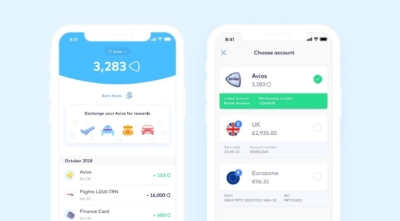

The globally-connected banking service Monese has launched an exclusive partnership with Avios.

Back in December we wrote about how Avios Group had joined a £60m funding round for Monese and asked whether this was going to lead to an Avios earning partnership.

This week we got some answers. Monese and Avios have announced that users can now link their Avios account to their Monese account and see their Avios earning and spending in the app. For now you cannot earn and spend via Monese, but watch this space …..

What is Monese?

Monese is a globally connected banking service that was founded in 2013 by Norris Koppel. It aims to simplify the process of getting a bank account in Europe. It’s a ‘mobile app only’ bank that gives users a £ and a € account allowing them to bank like a local across the UK and Europe. Accounts can be opened within two minutes with a photo ID and a video selfie.

The company launched its banking product in 2015 and has currently 800,000 users in 30 countries and supports 12 languages. Customers are currently moving $3 billion through their Monese accounts each year.

How does Monese work?

You can find full details of how Monese works on its website.

In summary, there are three different plans to choose from.

- Starter – FREE

- Plus – £4.95 / month

- Premium – £14.95 / month

What are Monese’s key feature?

Monese accounts are linked to a contactless Mastercard that is accepted in 200 countries and territories. Users can make unlimited transactions with their card, but depending on the plan there might be charges for ATM usage and foreign exchange transactions.

Monese accounts can be operated like a traditional current account with your salary paid in. If you don’t want to do this, you can also top up your balance from another bank account or with cash using PayPoint or over the counter at a Post Office.

Introducing the new Avios partnership

This week Monese and Avios launched the first stage of their partnership. Users can now link their Avios account to their Monese account and track their Avios earning in the same app as their banking balance. This includes Avios earned from flights, via the e-store and any Avios earned from credit cards.

The app currently lists your last five Avios transactions and Monese is working on increasing this.

What does the future hold for Monese and Avios?

In the coming weeks Monese will introduce further benefits for Avios collectors. There will be various earning and spending opportunities including earning Avios for referring friends to Monese and earning Avios by paying for items with your Monese debit card.

Customers will also be able to send Avios to their friends as long as they have a Monese account.

Norris Koppel, CEO and Founder at Monese, says about the Avios partnership:

“We are delighted to be announcing this partnership with Avios, following our successful Series B fundraise. We serve a fast-growing and incredibly international audience who travel the world for study, work, family, or retirement. We’re proud to offer customers a smart, portable and seamless way to manage their lifestyles, as well as their finances. We know that these customers would value an easy and simple way to track and maximise Avios alongside their finances and travel. In the coming months, our Avios offering will become even smarter and stronger and it will help our customers make better decisions, wherever they may be in the world.”

Andrew Crawley, CEO, Avios Group, believes:

“Partnering with Monese is a significant move to making it even more convenient for customers to track their Avios while on the go. As Avios can be collected and spent in over 190 countries, we understand the need to have a banking account that’s as mobile as its customers. We look forward to working with Monese on our exciting plans to make collecting and spending even more rewarding.”

If you are reading this on a mobile device, you can get the Monese app by clicking here.

You can find out more about the company on its website here.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (204)