Win 1,000,000 Avios with Head for Points and Monese

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Monese, the online bank, is giving away 1 million Avios to SIX people.

We GUARANTEE that one of them will be a Head for Points reader.

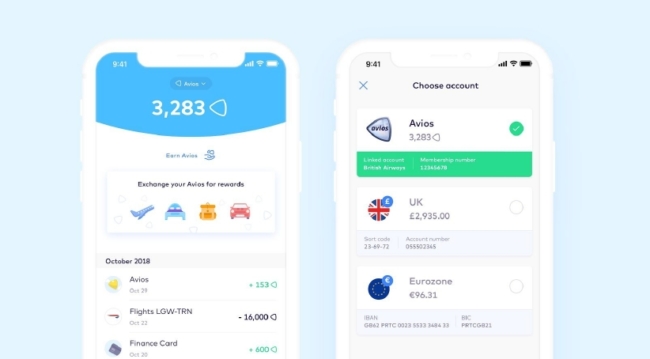

Since February Monese, the online banking app, has been able to link with your British Airways Executive Club account and display your Avios balance. It looks like this and is quite cool (click to enlarge):

It was the beginning of an interesting new partnership between Monese and Avios, which has invested in a shareholding in the fintech company.

To celebrate this partnership, Monese is giving away 1 million Avios to six lucky winners. One is guaranteed to be a Head for Points reader – and it could be you. This is one of the most valuable competitions we have ever run.

If you are reading Head for Points we probably don’t need to tell you the value of 1 million Avios. If you want to go somewhere, and a oneworld airline flies there, you will be able to go, and go in style – and you can take quite a few friends with you. (Taxes and charges are almost certain to apply although there may be some obscure oneworld route somewhere that doesn’t add them.)

Couple your 1 million Avios with a British Airways American Express 2 for 1 voucher and you would really be laughing – earn a 2-4-1 voucher each year and your 1 million Avios would get you and your partner a decent annual holiday in Club World for the next 5-10 years.

What is Monese?

Monese, founded in 2013, aims to simplify the process of getting a bank account in Europe. It’s a ‘mobile app only’ bank that gives users a £ and a € account allowing them to bank like a local across the UK and Europe.

Accounts can be opened within two minutes with a photo ID and a video selfie. (This does work, I set up an account for myself in record time without leaving my desk.) You can read a full analysis of Monese on our recent article about the banking service here.

How can I win 1 million Avios?

The good news is that this competition is open to new AND existing Monese customers based in the UK, excluding NI.

No purchase is required.

If you’re a new Monese customer:

If you are new to Monese, you must download the app and register for an account with the invite code ‘H4PTAMIL’ before Friday 30th September. You can download the Monese app here or visit your local friendly app store. You need to add the code during the sign-up process when prompted.

Monese offers three different account tiers. All are equally eligible for the competition – so it is OK to sign up for the free tier.

If you’re an existing Monese customer:

All you have to do is add the promotional code ‘H4PTAMIL’ in the ‘Promotions’ tab of the Monese app, which you will find by clicking the ‘head’ icon.

Finalising your entry

To finalise your entry into the competition you must add some money to your Monese account via a debit card. £10 is fine. You can withdraw this back to your existing bank account at any point or withdraw it via an ATM.

If you are an EXISTING Monese account, you need to add some new money to your account or have some other activity on your account, such as making an ATM withdrawal or making a purchase with your Monese debit card.

Once you’ve done this, you need to link your British Airways Executive Club account number to Monese. This can be done inside the app by logging into your British Airways account – go to ‘Add Account’ via the ‘head’ icon in the top left corner. You can now use the Monese app to keep an eye on your Avios balance and your recent transactions.

So, a reminder, this is what you need to do:

download the Monese app …. then

add the invite code H4PTAMIL during the registration process …. then

add a nominal sum to your account which you can easily withdraw again later …. then

link your Monese account to your Avios account

The last day to download the Monese app and complete the entry criteria is 30th September. One winner will be chosen from all entrants who use the Head for Points code of H4PTAMIL. The winner will be notified on 15th October.

The full terms and conditions of the competition are here. Note that entry is restricted to residents of the UK excluding Northern Ireland. Don’t blame Monese for this – Northern Ireland has its own competition laws. You must be over 18 and you are limited to one entry per person.

Good luck. One lucky Head for Points reader is going to have a pretty cool autumn I think.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (September 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 80,000 Avios! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 40,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 120,000 Avios! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 60,000 Avios! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

The American Express Business Platinum Card

120,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

60,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rhys

Rhys

Comments (152)