Amex launches new Membership Rewards spend bonuses for October – check yours

Links on Head for Points may support the site by paying a commission. See here for all partner links.

American Express has launched a new round of spend bonuses for holders of its Membership Rewards cards, primarily Preferred Rewards Gold and The Platinum Card.

You can register for these on the American Express website or in the app. It will be under the ‘Offers’ tab and you need to click ‘Save’ to register.

These offers do not start until 1st October.

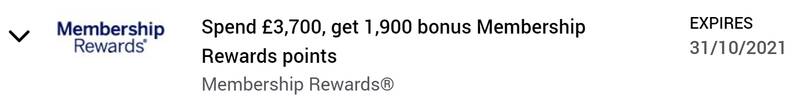

As you can see here:

…. the 1st October start date is not made clear unless you read the small print. You may potentially want to hold back some major expenditure for a couple of weeks if you can in order for it to count.

What sort of bonuses are on offer?

They vary by individual.

My wife’s Gold card, as you can see above, offers 1,900 bonus Membership Rewards points for spending £3,700. It won’t be happening.

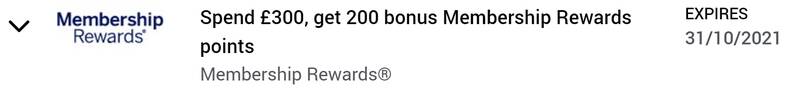

My Platinum card has a totally different offer:

Yes, a whopping 200 points for spending a whopping £300. In fairness, at least I will trigger this one. I won’t be trying to do £3,700 in a month onto my wife’s Gold card and I’m not sure why Amex thinks I possibly could.

Meanwhile, Rhys got 2,500 bonus Membership Rewards points for spending £2,500 on his American Express Rewards Credit Card (ARCC). It seems rare to get one this generous.

Don’t incur any costs to hit these bonuses

Looking at my own targets as well as those of other HfP readers, it seems that most people are getting, roughly, an extra 0.5 to 0.66 Membership Rewards points per £1 spent.

The worst I have seen reported by a reader is 1,800 points for spending £7,000.

This may not even be enough to make the card a better choice than something else in your wallet.

More importantly, do NOT spend money abroad purely to ensure you hit your target. There is no way that the 3% foreign exchange fee added by American Express justifies the small number of bonus points.

I DID recently put a large holiday bill onto my British Airways American Express card, but the maths was totally different. I was offered 10,000 Avios for spending £5,000 which, with the base Avios, was worth 17,500 Avios for a £5,000 spend. I was happy to pay the FX fee on this basis.

An extra fraction of a Membership Rewards point, on the other hand, won’t do the trick.

You can register for this offer on the Amex website. Don’t forget that it doesn’t start to count your spending until 1st October.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – September 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 80,000 Avios! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 40,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

Virgin Atlantic Reward+ Mastercard

36,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 120,000 Avios! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 60,000 Avios! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

The American Express Business Platinum Card

120,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

60,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (114)