BIG NEWS: Marriott Bonvoy is introducing dynamic hotel award pricing

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Marrriott Bonvoy came out with a lot of announcements yesterday, all of which are important. We have split them into two articles – click here to read about how your Marriott Bonvoy status and any outstanding vouchers will be treated.

The really big news is here. Marriott is joining Hilton and IHG in scrapping its reward chart in favour of what it is calling ‘Flexible Point Redemption Rates’.

The change means that redemption pricing will now be driven by the cash cost each night. Fixed peak and off-peak pricing has been scrapped, effectively eliminating sweet spots where the cash price is high but the cost of a redemption is capped.

In many ways it was just a matter of time before Marriott Bonvoy followed Hilton Honors and IHG Rewards, which have switched over to the pricing method in the past three years.

There are pros and cons to this approach but, if done badly (there is no sign that Marriott is doing it well) it signals the end of ‘aspirational’ redemptions.

In truth, IHG doesn’t have many ‘aspirational’ hotels so their move to revenue-based redemptions was less of an issue. Marriott has a huge luxury portfolio and this could get messy.

How will Marriott’s flexible pricing work?

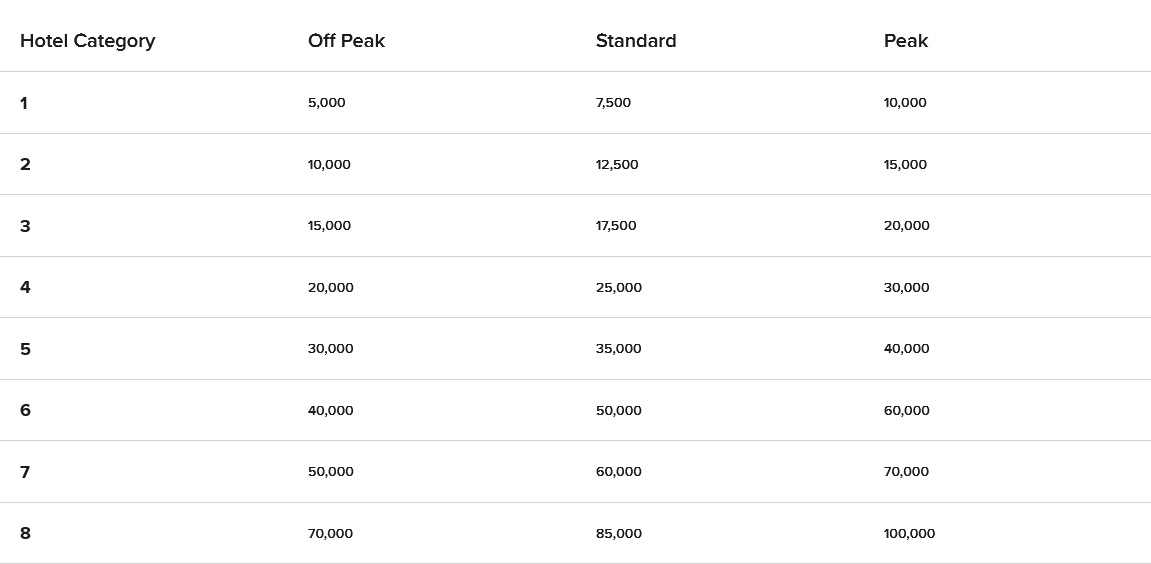

To recap, here is the current Marriott Bonvoy award chart, which is still valid until March 2022:

Marriott Bonvoy is phasing in the new pricing over the next two years.

Stage 1:

In March 2022, the transition to flexible pricing will begin. The existing award chart will be retired.

For stays during 2022, almost all hotels (97% apparently) will offer reward pricing within their current price bands.

For example, Category 8 hotels currently cost either 70,000 or 85,000 or 100,000 points per night. For bookings made from March 2022, the price will – in 97% of cases – be somewhere between 70,000 and 100,000 points.

The net result should be modest for most people.

Stage 2:

From 2023, reward pricing will vary even further.

The exact wording we were given is:

“For stays in 2023, members can expect to see rates that will be both above and below a hotel’s 2022 range.”

There will no longer be a maximum redemption price – prices are not capped – and will “closely follow” the cash price.

It isn’t clear if this pricing will come into effect immediately in March 2022 for stays from 1st January 2023, or if it is something that will begin to appear later in 2022.

Let’s take St Regis New York, above, as an example of how things could go. We tend to value a Marriott Bonvoy point at 0.5p so let’s assume this rate remains.

Taking 11th May 2022 as a random example, a room costs 100,000 points as a Category 8. For cash, it is $1,361.

Assuming 0.5p per point, we can expect the room to increase to around 200,000 points.

What are the benefits of the new Marriott Bonvoy reward pricing?

Marriott is claiming that the move to dynamic pricing will increase reward availability:

“Flexible point redemption rates will mean that more rooms overall will be available for redemption stays because our hotels will be able to better manage room inventory.”

It is not clear, exactly, how or why this would work.

Marriott does not pay the hotel a fixed fee for each redemption. Instead, the money a hotel receives is dependent on how busy it is.

If the hotel is empty then Marriott will pay the hotel just enough to cover the costs of your stay – usually $25 to $150 depending on brand. It is literally meant to cover the cost of cleaning your room, bathroom amenities etc.

If the hotel is operating at a high capacity then Marriott will pay a much higher amount – closer to the cash rate during your stay – as you could be displacing a full-rate customer.

This model means that the hotel is fairly compensated during busier periods – when it could sell a room for cash – whilst also increasing occupancy during its quieter periods when it can up-sell you at its restaurant or bar.

Unless Marriott is going to pay the hotels more money for redemption bookings when they are not totally full, there is no reason to expect increased reward availability.

What is the downside of the new Marriott Bonvoy reward pricing?

There is a danger here that Marriott moves to an Accor-style model where each Bonvoy point has a fixed, immovable value. This would be a mistake, as it removes the ‘gamification’ element of the loyalty scheme and any potential sweet spots.

A key part of all loyalty schemes is the feeling that you have ‘beaten the system’ and found a high-value redemption. Giving each point a fixed cash value (eg. 0.5p) would remove this element and make Marriott Bonvoy a bit, well, boring.

You would get the same value for your points whether you are redeeming at dull hotel in Watford or St Regis Mardavall in Mallorca (review here, picture above). More importantly, there would be no incentive to save for bigger and better redemptions so you would have less of a reason to stay loyal to Marriott.

Accor and Nectar suffer from this. If your points balance doesn’t get proportionately more valuable the bigger it gets, there is no point in keeping it high. Accor’s recent push into high value ‘experiences’ redemptions is a way of encouraging people to build up a balance rather than redeem it ASAP.

(The airlines have this model cracked. You could redeem 9,500 Avios for an off-peak return to Amsterdam in Economy, but most Avios collectors know that it makes more sense to hold on. Wait for a few years and take an 80,000 Avios off-peak flat bed business class ticket to Dubai instead.)

The changes are likely to negatively affect the top hotels, and it’s hard to see how prices won’t go up more often than not. This is particularly true during peak periods when the hotel is likely to be busier and the cash rates significantly higher.

When Hilton went down this route, it played it smart. It retained the caps on reward pricing. You know, for example, that Conrad New York Downtown will never be more than 95,000 Hilton Honors points per night even on the most expensive cash night of the year.

On quiet nights, however, redemption prices fall. This allows people who do want to ‘redeem as they go’ to always be able to cash out for a fair, if not outstanding, valuation.

Is Marriott smart enought to take this route? Let’s see. It could follow IHG Rewards, where you can now see Holiday Inn Express properties selling for over 100,000 points per night on peak nights.

Conclusion

Unfortunately, yesterday’s announcement gave no sign at all that Bonvoy understands the value of keeping a cap on the redemption cost of each hotel.

There are, however, two things which may conspire to keep it ‘honest’.

The first is OTA reward schemes. For example, Hotels.com Rewards gives you a 10% rebate on the ex-tax cost of your stay. If Bonvoy points are seen to have less value than this, a guest with no status will start to book via third party channels where hotels pay commission rates of 20%+.

The second issue is the transfer rate from Marriott Bonvoy to frequent flyer schemes. This is 3:1 or, if you convert in chunks of 60,000 Bonvoy points, 12:5. If you value an Avios at 1p, it implicitly values a Bonvoy point at 0.42p. If you can’t get this value from a room redemption, members will start clearing out their balances into airlines – and this is a real cash cost to Marriott. Of course, it could also devalue the airline conversion rate ….

We will be returning to this topic many times in the coming months I’m sure. More importantly, in the short term, is Marriott’s other news about status extensions which you can read here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Marriott Bonvoy points and status from UK credit cards (August 2025)

There are various ways of earning Marriott Bonvoy points from UK credit cards. Many cards also have generous sign-up bonuses.

The official Marriott Bonvoy American Express Card comes with 20,000 points for signing up, 2 points for every £1 you spend and 15 elite night credits per year.

You can apply here.

Marriott Bonvoy American Express Card

20,000 points and 15 elite night credits each year Read our full review

You can also earn Marriott Bonvoy points by converting American Express Membership Rewards points at the rate of 2:3.

Do you know that holders of The Platinum Card from American Express receive FREE Marriott Bonvoy Gold status for as long as they hold the card? It also comes with Hilton Honors Gold, Radisson Rewards Premium and MeliaRewards Gold status.

We reviewed The Platinum Card from American Express in detail here and you can apply here.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 120,000 Marriott Bonvoy points! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

You can also earn Marriott Bonvoy points indirectly:

- American Express Preferred Rewards Gold Credit Card (20,000 bonus Amex points)

- The American Express Rewards Credit Card (10,000 bonus Amex points)

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 60,000 Marriott Bonvoy points! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

and for small business owners:

- The American Express Business Gold Card (20,000 bonus Amex points)

- The American Express Business Platinum Card (50,000 bonus Amex points)

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 90,000 Marriott Bonvoy points! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 120,000 Marriott Bonvoy points! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

The conversion rate from American Express to Marriott Bonvoy points is 2:3.

Rob

Rob

Comments (105)