Virgin Atlantic follows British Airways in increasing surcharges – and how to beat them

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Yesterday we ran an article on the additional £100 added to British Airways surcharges on Avios redemptions in Business Class.

Virgin Atlantic has also increased its surcharges. Oddly, Virgin Atlantic is charging the ‘unadjusted’ surcharges quoted by the British Airways website, which are incorrect and which drop sharply once you actually try to pay.

Here’s what I mean.

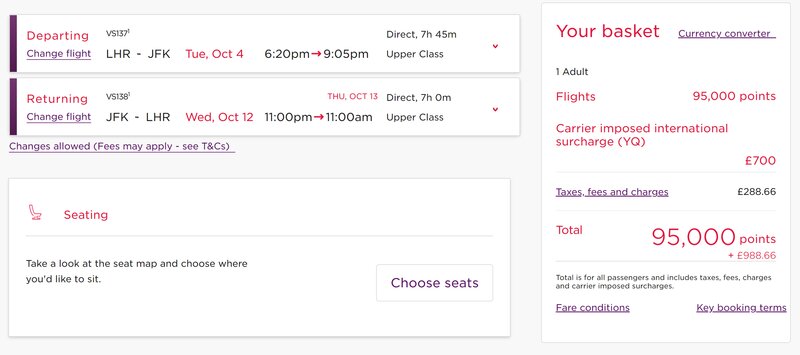

Virgin Atlantic is now charging a ludicrous £988 return on an Upper Class redemption from Heathrow to New York JFK. £700 of this is Virgin’s ‘carrier surcharge’.

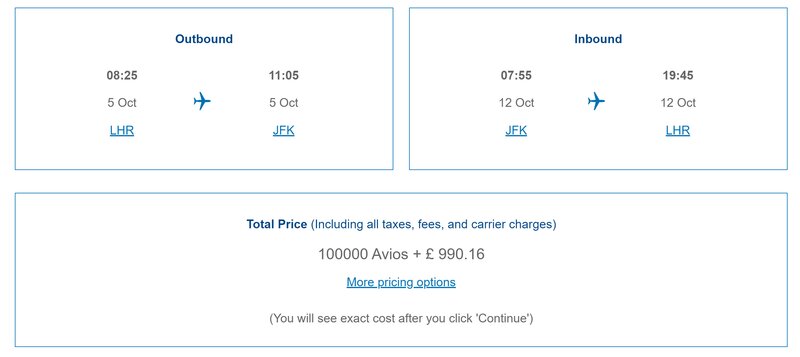

British Airways pretends to be charging the same amount:

…. but when you click through to pay it adjusts to the actual figure of ‘only’ £842:

For those not keen to pay such amounts, let me point you towards using Avios for Madrid to New York in Iberia’s Business Class.

You will pay just 68,000 Avios return on off-peak dates plus just £205 of taxes and charges:

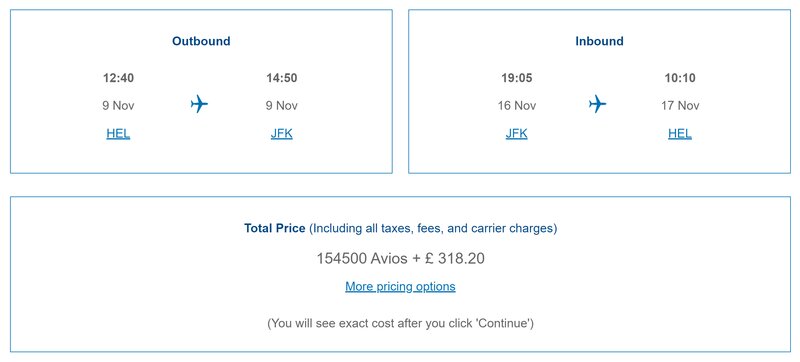

If you’ve never been to Helsinki, it may be a good time to check out Finnair’s fantastic new terminal and lounges, as well as taking a look at the city.

You’ll pay just £318 to use your Avios for a Business Class trip to New York on Finnair:

In theory you can also use Avios for low cost New York flights in business class on Aer Lingus, from Manchester, Dublin or Shannon. Availability in business class appears to be zero, however.

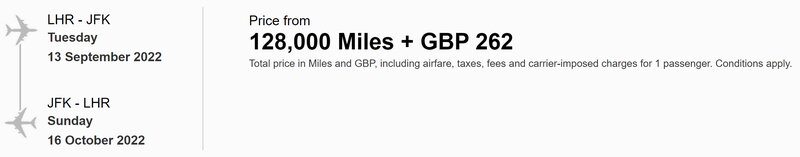

Moving away from Avios, you could use Emirates Skywards miles (potentially from American Express Membership Rewards) to fly direct from London to New York on JetBlue in their funky ‘Mint’ business class seat:

There is some good news from Virgin Atlantic

On the positive side, I had a quiet word with Virgin’s CEO Shai Weiss about Upper Class reward availability – or more exactly, the lack of it on routes except New York – on Tuesday when we were both at the same event.

Shai implied that he is aware of the issue and that changes were coming. Reading between the lines, Virgin Atlantic may be planning to follow British Airways and guarantee a fixed number of reward seats per flight. Let’s see what happens.

In other positive Virgin Atlantic news, the new $4.1 billion Airbus A330-900neo fleet is on track for delivery, starting later this year. We even have tentative dates for the launch party in the Summer. Watch this space ….

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Virgin Points from UK credit cards (July 2025)

As a reminder, there are various ways of earning Virgin Points from UK credit cards. Many cards also have generous sign-up bonuses.

You can choose from two official Virgin Atlantic credit cards (apply here, the Reward+ card has a bonus of 18,000 Virgin Points and the free card has a bonus of 3,000 Virgin Points):

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Virgin Atlantic Reward Mastercard

3,000 bonus points, no fee and 1 point for every £1 you spend Read our full review

You can also earn Virgin Points from various American Express cards – and these have sign-up bonuses too.

The American Express Preferred Rewards Gold Credit Card is FREE for a year and comes with 20,000 Membership Rewards points, which convert into 20,000 Virgin Points.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express comes with 50,000 Membership Rewards points, which convert into 50,000 Virgin Points.

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Small business owners should consider the two American Express Business cards. Points convert at 1:1 into Virgin Points.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Virgin Points.

Comments (63)