How does the Hertz and Amex Platinum ‘4 hour grace period’ work?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

If you are a regular or occasional car renter, it is worth being familar with one of the lesser known benefits of The Platinum Card from American Express.

Most people know that Amex Platinum comes with comprehensive car hire insurance. You don’t need to agree to anything that the rental company tries to sell you. I have claimed on this a few times over the years and never had a problem. The car hire company charges you and you reclaim the bill from American Express.

Platinum also comes with elite status at Hertz and Avis, although I don’t value this much. It is worth having if you regularly rent from busy depots as it usually allows you to ignore the queue and pick up your keys from a separate desk.

The Hertz ‘four hour’ deal is something totally separate from the Hertz status you receive via Amex Platinum. The benefit allows you to make your final rental day a 28 hour one.

Let’s imagine that you pick up a car at 10am on Friday to return at 2pm on Monday.

Car rental companies treat this as a four day rental.

With Hertz, as long as you use the Amex Platinum CDP code of 633306, it prices as a three day rental. This is because you get a four hour grace period on your final day.

Where is the four hour grace period available?

According to Hertz:

“A 4-hour no charge grace period before an extra day charge is applied when returning the vehicle in Hertz Corporate Europe locations, the U.S., Canada, Latin America, Middle East (with exception of UAE and Bahrain who offer 2 hours grace period) and selected European Franchise countries (see participating countries). Asia, with the exception of China, offers a 2-hour no charge grace period, except on optional extras like portable phones.”

For clarity, you need to make your original booking with the four hour grace period included. You can’t return the car four hours late and claim you shouldn’t be charged.

Here is an example.

Compare two bookings using the Amex Platinum code:

All of these quotes are taken from the UK Hertz website which is here.

This is a Hertz rental of exactly three days from Heathrow Airport using the Amex Platinum discount code, showing £141.25 as the price.

This is a Hertz rental of three days and four hours, using the Amex Platinum discount code:

As you can see, there is no price difference. It is still £141.25 due to the four hour American Express Platinum grace period.

Compare the same two bookings WITHOUT the Amex Platinum code:

To prove that the Amex code is making a difference, here is the same Hertz rental of exactly three days WITHOUT using the Amex Platinum discount code. You will see that the American Express Platinum code has saved us 10% (£15) which is OK but not a fortune.

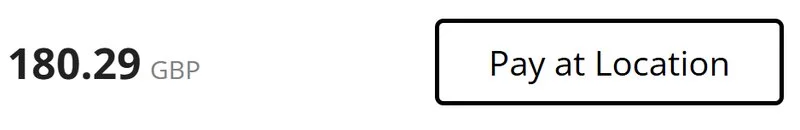

This is a Hertz rental of three days and four hours WITHOUT using the Amex Platinum discount code:

You will see that the price has shot up because you are now paying for a fourth day, even though you are returning the car just four hours into the fourth day. The total discount for using the Amex Platinum discount code on this trip is now a chunky (£180 vs £141) 22%.

Conclusion

The American Express Platinum / Hertz ‘four hour waiver’ seems like a very niche benefit, and one that you can easily overlook.

If it fits around your schedule, however, it can lead to substantial savings.

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (7)