Is the new Lloyds Bank World Elite Mastercard the cheapest way to a Priority Pass?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Lloyds Bank, which has had little to offer to the travel rewards market since it closed its Avios Mastercards some years ago, is dipping a toe back into the water.

It has launched a new World Elite Mastercard. Like the HSBC Premier World Elite Mastercard, it offers travel benefits in return for a monthly fee. Unlike the HSBC version, it does NOT offer miles and points for your spending. However, on the upside, you don’t need a bank account with Lloyds to apply.

The key benefit is that it offers the cheapest route I know of for getting a ‘full’ Priority Pass airport lounge card. It can also access the airport restaurant deals which are blocked on Amex-issued Priority Pass cards.

You can find out more here.

There is also a version of this card available under Halifax branding – see here. For simplicity I am just referring to the Lloyds Bank version here but both cards are identical.

What does the Lloyds Bank World Elite Mastercard offer?

The card website is here.

Representative 55.0% APR variable based on an assumed £1,200 credit limit and £15 monthly fee. Interest rate on purchases 22.94% APR variable.

The Lloyds Bank World Elite Mastercard comes with a £15 monthly fee. There is no sign-up bonus. You pay the standard 2.99% FX fee when you spend abroad.

With no sign-up bonus and the usual FX fees, you should look at the card purely in terms of whether the benefits you get are worth the £180 in annual fees.

You receive:

- 0.5% cashback on your first £15,000 of annual spend

- 1% cashback on annual spend above £15,000

- a full Priority Pass for yourself and your free supplementary cardholder

- airport Fast Track benefits

Forget the cashback benefit

If you are reading Head for Points, you are highly likely to have a credit card offering travel rewards which beats this card hands down.

The free Barclaycard Avios Mastercard, for example, offers 1 Avios per £1 spent. Anyone who knows how to get full value from Avios knows that 1 Avios per £1 is better than 0.5% cashback on your first £15,000 of annual spend.

What I’m saying is …. even if you get this credit card, I wouldn’t necessarily spend anything on it.

You would be getting it for the Priority Pass airport lounge benefit.

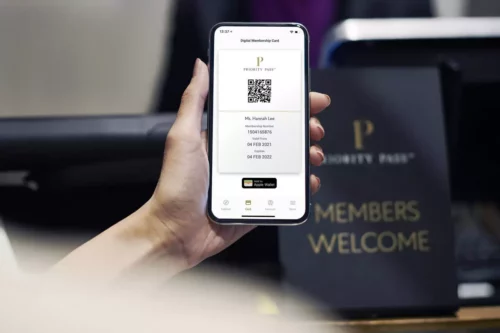

How does the Priority Pass airport lounge benefit work?

Your Lloyds Bank World Elite Mastercard comes with a Priority Pass airport lounge access card.

This allows you access to the 1,300 airport lounges in the Priority Pass global network. Importantly, it also gets you access the £15 restaurant credits which are available in many airports.

If you issue a free supplementary card to someone, they will also receive a free Priority Pass for themselves.

The ability to get the £15 restaurant credits sets this card apart from the version of Priority Pass offered by American Express with The Platinum Card.

Where does Priority Pass have restaurant deals in the UK?

Most readers of this article will be familiar with the Priority Pass airport lounge network. If you’re not, go to the website and search for the airports you use on a regular basis. You will see what lounges are available.

Many UK lounges are now full at peak times, but you can often get around this by paying £6 to reserve a guaranteed slot. You will rarely struggle to access a Priority Pass lounges anywhere else globally, except for certain US airports.

The problem with ‘full’ UK lounges goes away with this version of Priority Pass though. Instead, you can head to an airport restaurant and spend up to £15, with Priority Pass paying your bill.

Here are the current participating UK airport bars and restaurants:

London Heathrow

- Big Smoke Taphouse & Kitchen (T2)

- The Oceanic Pub & Kitchen (T3)

- The Globe Pub & Kitchen (T5)

You can also get free treatments at the two Be Relax Spa sites in Terminal 5.

London Gatwick

- Tortilla (North)

- Juniper & Co (North)

- The Breakfast Club (North)

- The Grain Store Cafe & Bar (South)

London City

- Cabin Bar

London Stansted

- The Camden Bar & Kitchen

London Luton

- Avalon Crafted Coffee

- Big Smoke Taphouse & Kitchen

- Nolito

Bristol International

- Starbucks

- Cabin Bar

- Tortilla

- Brigg & Stow

Cardiff

- Caffe Ritazza

Glasgow

- Bird & Signet

Manchester International

- Starbucks (Terminal 1)

- The Grain Loft (Terminal 1)

- PizzaLuxe (Terminal 1)

- Upper Crust (Terminal 1)

How does this compare with other ways of getting a Priority Pass?

Let’s compare the Lloyds Bank World Elite Mastercard package with some of the most popular alternatives:

The Platinum Card from American Express (£650, review here, apply here)

The Priority Pass version offered with The Platinum Card allows four people to enter a lounge without charge (you get two cards, each admitting two). You cannot access the restaurant benefits, however.

Whilst the card fee is high, you need to look at this in the context of the other benefits offered by The Platinum Card. These include £300 of annual dining credit and £100 of annual Harvey Nichols credit.

American Express Preferred Rewards Gold (free for Year 1, £195 thereafter, review here, apply here)

Amex Gold comes with a Priority Pass loaded with four airport lounge visits. These refresh each year when you renew your Amex Gold. Additional visits after your four free ones cost £24. You can use all four free visits yourself or share them with guests you accompany.

HSBC Premier World Elite Mastercard (£195, review here, apply here)

This is a very similar package to the Lloyds card. You get a Priority Pass for yourself, which includes the restaurant partners, and for £60 you can add a supplementary card for your partner. The total fee for a couple would be £255 vs £180 with Lloyds. More importantly, you need a HSBC Premier current account to apply. This requires a £75,000 income or a mortgage or investment product with the bank.

Buy a Priority Pass direct (£229 to £419, buy here)

Bizarrely, the Lloyds Bank World Elite Mastercard is a far cheaper way of getting a Priority Pass than buying one from the company. The version with unlimited lounge visits costs £419 – and you can’t bring any free guests (£24 extra each time). Even the restricted version with 10 lounge visits per year costs £229, and guests are charged on top.

How does the airport Fast Track benefit work?

It’s also worth mentioning the airport Fast Track benefit briefly. For full details, read this HfP article.

Last time we looked into this, it was available at:

- Aberdeen

- Glasgow

- Liverpool

- London Gatwick

- Luton

- Newcastle

- Southampton

It didn’t work for Belfast, Birmingham, Bournemouth, Bristol, Cardiff, Derry, Doncaster Sheffield, East Midlands, Edinburgh, Exeter, Humberside, Inverness, Isle of Man, Jersey, Leeds Bradford, London City, London Heathrow, London Stansted, Manchester, Newquay, Norwich, Southend or Teesside.

(EDIT: comments below suggest that Manchester, East Midlands and Stansted are now included.)

Conclusion

From the perspective of someone who collects airline miles or hotel points, there is nothing special about the new Lloyds Bank World Elite Mastercard in terms of the fee or cashback.

You can EASILY beat the combination of a £180 annual fee and 0.5%-1% annual cashback with something as straightforward as the free ‘1 Avios per £1’ Barclaycard Avios Mastercard credit card.

Where the card gets interesting is if you currently pay for a Priority Pass card, or are a regular user of airports with Priority Pass lounges or restaurants. £15 per month to unlock the lounge and restaurant benefits for two people is a pretty good deal.

I still wouldn’t spend on the card, however …. keep it in a drawer when you’re not in an airport, and put your spend onto a card with better rewards.

You can find out more about the Lloyds Bank World Elite Mastercard credit card here.

Disclaimer: Head for Points is a journalistic website. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. Recommendations are based primarily on the ability to earn miles and points. The site discusses products offered by lenders but is not a lender itself. Robert Burgess, trading as Head for Points, is regulated and authorised by the Financial Conduct Authority to act as an independent credit broker.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – August 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (83)