Tymit, the only company interested in new UK co-brand credit cards, walks away

Links on Head for Points may support the site by paying a commission. See here for all partner links.

You have probably never heard of Tymit, but for much of the last two years it seemed like it was going to play a big part in your life.

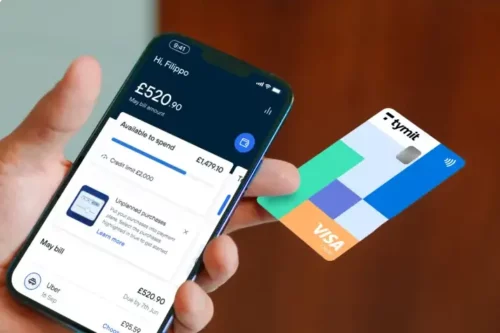

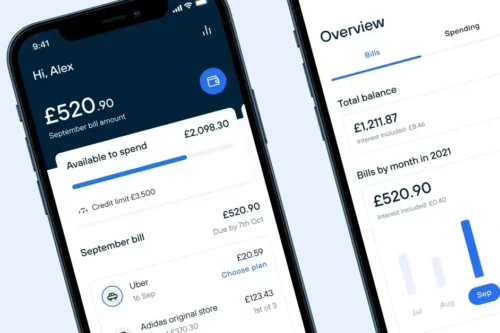

Tymit was a fintech start-up that wanted to cross Buy Now Pay Later with a traditional credit card.

Instead of letting you roll over your balance indefinitely, each transaction had to be either settled immediately at the end of the month (like a charge card) or split into three to 36 monthly payments. There was no option to roll over your debt indefinitely which in many ways was a good thing.

Tymit had launched a credit card under its own brand but knew that it needed to partner with big names to make an impact.

It closed its Tymit-branded card to new applicants during 2023 and, in an attempt to get customers to close their accounts, introduced a £6.99 monthly fee.

In February 2024 it launched two co-brand credit cards with Harley Davidson – see here. This wasn’t a totally crazy idea, because Harley owners have the same enthusiasm for their hobby as many miles and points collectors.

Tymit was also in discussions with multiple airline and hotel groups about launching co-brand Visa credit cards.

And then, very quickly, it all shut down. Despite only launching in February, the Harley Davidson credit cards were recently closed to new applications.

It was a major turnaround for a business that only completed its first major fundraising (£23m) in October 2022.

Tymit has now pulled the plug completely

While we’ve worked hard to explore all options to keep Tymit Credit running, we’ve unfortunately had to make the difficult decision to discontinue the service.

With the high interest rate environment and resulting increased costs of capital it’s sadly unsustainable to continue offering the service. As a result your Tymit Credit account will be suspended from making new purchases as of the 14th November 2024.

With subsequent closure of settled accounts starting from the 15th December 2024

We know this isn’t the news you were hoping for, this is disappointing for us too. Tymit Credit was designed to provide you with a new experience with more transparency and control than mainstream credit cards, and the whole team at Tymit worked very hard to live up to those expectations.

In all honesty, Tymit made a mistake by chasing travel co-brand deals. The company could only make money if you didn’t settle your charges immediately and instead decided to repay in three to 36 instalments.

Holders of travel co-brand credit cards are generally well paid professionals and do not pay interest.

It would have incurred huge costs in borrowing money to give cardholders a few weeks free ‘float’ before they settled their bill whilst generating virtually no interest income.

Tymit has a new mission

Tymit has, to use that terrible venture capital phrase, ‘pivoted’.

Here’s the new plan:

Now, we’re channelling this same pioneering spirit into creating the next generation of instalment experiences. Whether offered in-store or in the online checkout, Tymit instalment programs are already helping merchant partners win, keep and get closer to their customers — and always with control and financial peace of mind at the core of the offering.

The new plan won’t concern you. The problem is that Tymit was the only credit card company that I knew to be actively seeking travel co-brand deals in the UK.

For now at least, Currensea – with its new Hilton Honors debit card and a unique ‘no capital’ model (because it’s not lending money) – is the only game in town for any airline or hotel group wanting to launch a UK payment card.

Capital on Tap, meanwhile, continues to grow at leaps and bounds, supported by the generous interchange fees still available on small business credit cards. Why more travel groups have not launched SME cards remains a mystery.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – September 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 80,000 Avios! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

The Platinum Card from American Express

80,000 bonus points and great travel benefits – for a large fee Read our full review

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 40,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

Virgin Atlantic Reward+ Mastercard

36,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 120,000 Avios! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Gold Card is TRIPLED to 60,000 Membership Rewards points. This would convert to 60,000 Avios! The spend target is changed to £6,000 within three months of approval. The card remains free for the first year. T&C apply. Click here to apply.

The American Express Business Platinum Card

120,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

60,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (49)