How can ‘Plan It™’ Instalment Plans from Amex help spread the cost of your purchases?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This article is sponsored by American Express

If you have an American Express® Credit Card – as opposed to a Charge Card – you may have seen Plan It™ appear in the App or in your Online Account for a feature – Instalment Plans from American Express

This is a way of spreading the cost of an item over 3, 6 or 12 month instalments, with the monthly instalment plan amount added to your ‘minimum due’ you are required to pay on each statement.

I want to look at it in more detail today, with particular reference to how it impacts spending towards sign-up bonuses or annual vouchers.

Plan It can be used with any purchase of £100+ which has appeared on your current statement or posted to your Account but not yet appearing on a statement, and has not yet been paid off.

You don’t need to apply to use Plan It – it is on your Account if you’re eligible – and no additional credit checks will be undertaken if you choose to use it.

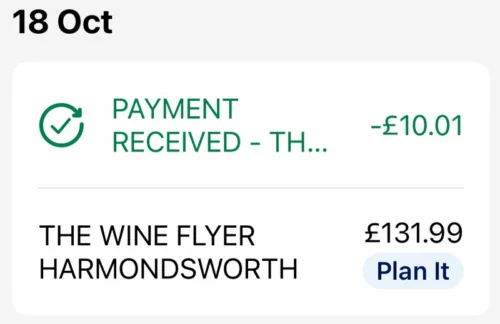

Suitable transactions will have a small ‘Plan It’ logo in your Amex® App on your eligible transactions. Here is one of the HfP team taking advantage of The Wine Flyer’s generous bonus Avios promotion last month:

How does Plan It Instalment Plans work?

Click on an eligible transaction of £100 or more and it will give you the option to split your payment into three, six or twelve equal monthly instalments.

Each monthly payment will appear on a future statement as part of the minimum monthly payment due.

There is no interest to pay but there is a monthly flat fee added.

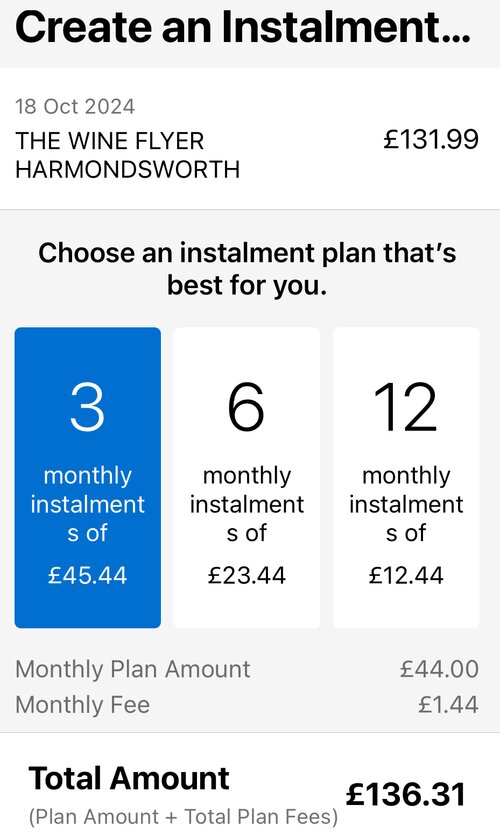

In the example below, the transaction above can be split into*:

- 3 monthly payments of £45.44 (total £136.31)

- 6 monthly payments of £23.44 (total £140.64)

- 12 monthly payments of £12.44 (total £149.28)

You can decide which eligible purchases you want to put into an instalment plan and select your choice of instalment period – 3, 6, 12 months for that purchase

How does this differ from paying interest and rolling over the charge?

In a word, certainty.

Many people are, understandably, wary of only making the minimum monthly payment on their credit cards and rolling over the balance. It is easy to lose control of what you owe.

With Plan It, you have full transparency – you know exactly how much you need to pay back, in your monthly instalments and fee. They are added to the minimum amount you have to repay each month. If you want to ensure that you clear your balance within a certain period, this is the way to do it.

There is an illustrative calculator on the Amex website which shows you the costs compared to a 30% purchases APR.

How does Plan It impact my spending towards sign-up bonus and annual vouchers?

Many HfP readers will be spending towards a sign-up bonus on a new American Express® Card or towards an annual voucher or reward, such as the British Airways American Express companion voucher.

It is important to understand how Plan It works in this scenario.

Basically, using Plan It has no impact on the effective date of a card transaction when it comes to qualifying for a sign-up bonus or annual voucher.

This has both good and bad sides. For example:

- if you need to spend another £500 within a month to trigger a sign-up bonus and you make a £500 purchase but decide to split it over three months with Plan It, your sign-up bonus is still triggered

- if you only need to spend £100 in the next month to trigger your British Airways American Express companion voucher, you cannot use Plan It to ‘push’ part of a large purchase into your next card year – the full transaction value will still count in the current card year

Conclusion

The best course of action with any credit card purchase is always to settle the bill immediately to avoid interest payments.

However, if you do find that you want to defer payment of a £100+ purchase whilst being committed to paying it off within a set period, Plan It is now there as an option.

You can find out more about Plan It on this page of the American Express website.

*For the purposes of this example, we have used an interest rate of 30% per annum. This may not be your personal rate and your actual rate may be more or less. The example assumes the monthly repayment is being made on the payment due date, and there are no other transactions on the Account. The total Plan It fee is based on the plan being created the day before the statement is generated and applied for each month of the duration of the plan.

Comments (99)