Review: What does the Harrods American Express charge card offer?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This is our review of the Harrods American Express card.

The Harrods American Express card is a little-known product which is not freely available, a little like the Vitality American Express card.

The Harrods American Express card is only available to Gold, Black and Platinum members of the Harrods Rewards loyalty scheme. You would need to spend £5,000 in the store in a calendar year to hit Gold status.

In the past, Harrods has occasionally emailed general UK members of Harrods Rewards, irrespective of status, with an invitation to apply. Unless such an email pops into your inbox, you should assume that you cannot get the card.

You can see full details for the card on the Harrods site here.

What does the Harrods American Express card offer?

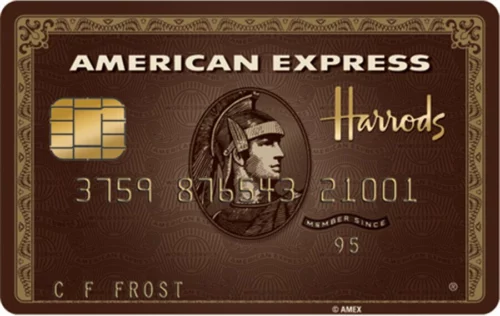

The Harrods American Express card comes in a metallic shade of brown (bronze?) as you can see above and below. I’ve never seen one in the flesh so I don’t know how classy the real thing looks.

Here are the headline features:

- The sign-up bonus is 5,000 Harrods Rewards points, worth £50, when you spend £3,000 within three months – it appears that you receive this irrespective of other American Express cards you hold

- There is an annual fee of £195

- It is a charge card, not a credit card – you must clear your balance each month

This is what you earn when you spend on the card:

- One Harrods Rewards point (1p) per £1 spent

- Two Harrods Rewards points (2p) per £1 spent in Harrods – for clarity, this is not including the Harrods Rewards points you’d earn from your Harrods spending regardless of the card you used

Does the Harrods American Express card have extra benefits?

Here are two additional benefits:

- You receive a £25 quarterly statement credit when you spend in Harrods in-store restaurants

- You receive CLUB 02 status in the Small Luxury Hotels of the World CLUB loyalty programme which we reviewed here

The restaurant benefit is, of course, worth having if you can use it.

The SLH benefit is, frankly, poor. You earn this status by staying just four nights with Small Luxury Hotels of the World and the benefits (mainly free breakfast) align with that.

The other benefits are more nebulous:

- Exclusive Harrods Rewards bonus points promotions

- Invitations to exclusive Harrods events

Are these events any good? We don’t know. It is worth mentioning that, about 10 years ago, I was gifted top-tier Harrods Black status for a couple of years.

This usually requires £10,000 of spend in a calendar year and was, at the time, the top tier. A Platinum tier, requiring £50,000 of annual spend, was recently added.

During that period, we were invited to a fair number of exclusive childrens events, often held in-store on a Sunday morning before the shop opened. I was also once invited to a dinner in the wine store hosted by Qatar Airways, which is where I met the Qatar Airways UK country manager and where our good relationship with the airline sprung from.

However …. it is not clear how charge card holders fit into the pecking order for events. The card is only for elite members of Harrods Rewards anyway, so holders would already be receiving some invitations.

Anything else worth knowing?

According to HfP reader reports, the Harrods American Express can be used in place of a standard Harrods Rewards card.

This means that, in theory, you could ask a cashier to swipe your Harrods American Express in order to credit your base points but then pay with a different card.

This feature is not confirmed anywhere on the card website.

Conclusion

The Harrods American Express card is an odd product – made even odder for still being a charge card and not a credit card.

There is, of course, going to be a lot of overlap between the Platinum and Centurion cardholder bases and those people who may be interested in a Harrods charge card.

Giving you 2% cashback on your Harrods spending (albeit in Harrods points) is not a bad reward. If you qualify to get the card then you are already Harrods Rewards Gold and spending £5,000+ in the store each year.

Of course, in terms of day to day rewards for non-Harrods spending, there are free American Express cards which can get you an equivalent 1% return on your spending (British Airways American Express, American Express Cashback Everyday, American Express Rewards Credit Card). You don’t need to spend £195 in annual fees. The three cards above also have more generous sign-up bonuses.

Perhaps the biggest benefit is having a novel card to show your friends (as I said, even I’ve never seen one in the flesh) at a far lower cost than American Express Platinum or Centurion.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – August 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (39)