How to ‘top up’ a Marriott Bonvoy hotel free night certificate

Links on Head for Points may support the site by paying a commission. See here for all partner links.

A long-awaited improvement to Marriott Bonvoy in 2022 was the ability to top up ‘fixed value’ free night vouchers.

In the US, multiple Marriott credit cards come with automatic free night certificates and many people have them. In the UK, there are only two ways to earn one:

- spend £25,000 per year on the Marriott Bonvoy American Express card and receive a voucher for a free night worth 25,000 points (roughly £125 of value)

- spend 75 nights per year in Marriott hotels and take a free night voucher worth 40,000 points (roughly £200 of value) as your ‘Annual Choice Benefit’

The problem with these vouchers is that the value you get has been whittled away by points inflation. Each year the quality of hotel you could get for your 25,000 or 40,000 points voucher got lower and lower.

With the UK Marriott Bonvoy American Express benefit, it was simply the wrong product. Not many people who can afford to spend £25,000 per year on the UK Bonvoy Amex are likely to spend much time in £125 hotels – which is what you’d get with a 25,000 points voucher – yet alone want to specifically redeem for a night in one.

To address this, Marriott now lets you top up your certificate with up to 15,000 points from your Bonvoy account. I used my 2023 one at the Le Meridien hotel at Dubai Airport for a very brief stopover, and my 2024 one – which nearly expired – on a 25,000 point mattress run to earn one elite night credit!

How does the Marriott Bonvoy free night voucher ‘top up’ work?

You can learn more about how to spend your free night voucher via this page of the Marriott website. Note that the T&C say that ‘non-iOS apps’ do not allow voucher redemption.

Here is an example of how it works using a free night voucher from the Marriott Bonvoy American Express card.

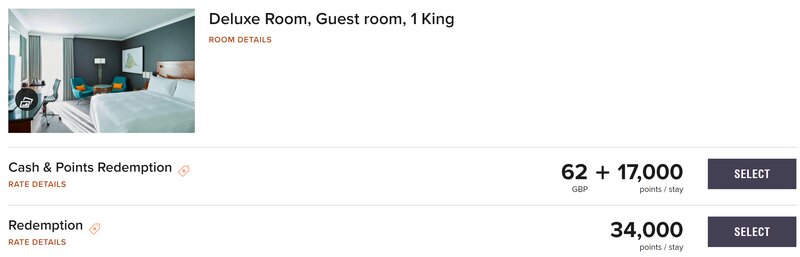

As I don’t currently have an unused voucher in my account, here are some old screenshots which show what happens when you try to use a 25,000 point voucher to book a 34,000 point night:

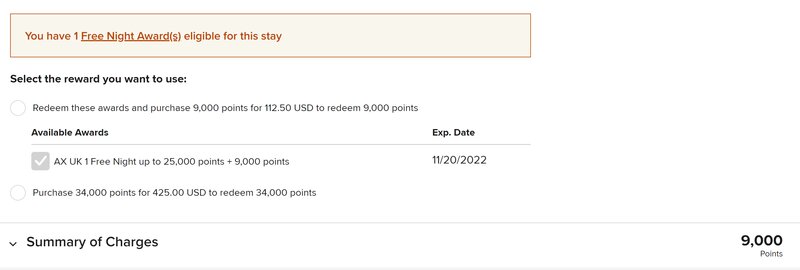

When you select a redemption, you get this:

If you choose to redeem your free night voucher, it deducts 25,000 points from the cost of the reward. You are then given the choice of buying 9,000 points to make up the difference, or redeeming them from your account.

Conclusion

This was a welcome move by Marriott. It’s still not perfect, of course.

The ability to top-up by 15,000 points seems to have been plucked out of the air. Why not let me book any room, and save 25,000 points on the cost? I can’t think of a single good reason not to do this, and one very obvious bad reason – it hurts people who only redeem for high-end hotels.

Marriott Bonvoy does now allow you to top up a free night voucher by up to 15,000 points and this makes the Marriott Bonvoy American Express slightly more attractive to high spenders who couldn’t see any realistic way of using a 25,000 points voucher.

You can apply here for the Marriott Bonvoy American Express card.

You can find out more about topping up a free night voucher on marriott.com here.

Rob

Rob

Comments (24)