Avios news: Club Iberia Plus renamed, tier points, NatWest BA cashback

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Three bits of BA and Avios related news:

Club Iberia Plus renamed after eight weeks

Of all the things I thought we may see backsliding on after the 1st April IAG loyalty changes, the one I didn’t expect was a rebranding at Iberia.

However, the powers that be have decided that Club Iberia Plus – the new name for Iberia Plus – made no sense.

The scheme has now been rebranded as ‘Iberia Club’.

Given how long rebrandings tend to take, this is quite an impressive turnaround given that its only eight weeks since Club Iberia Plus launched.

It’s goodbye to this:

and hello to:

The new British Airways tier point system in action

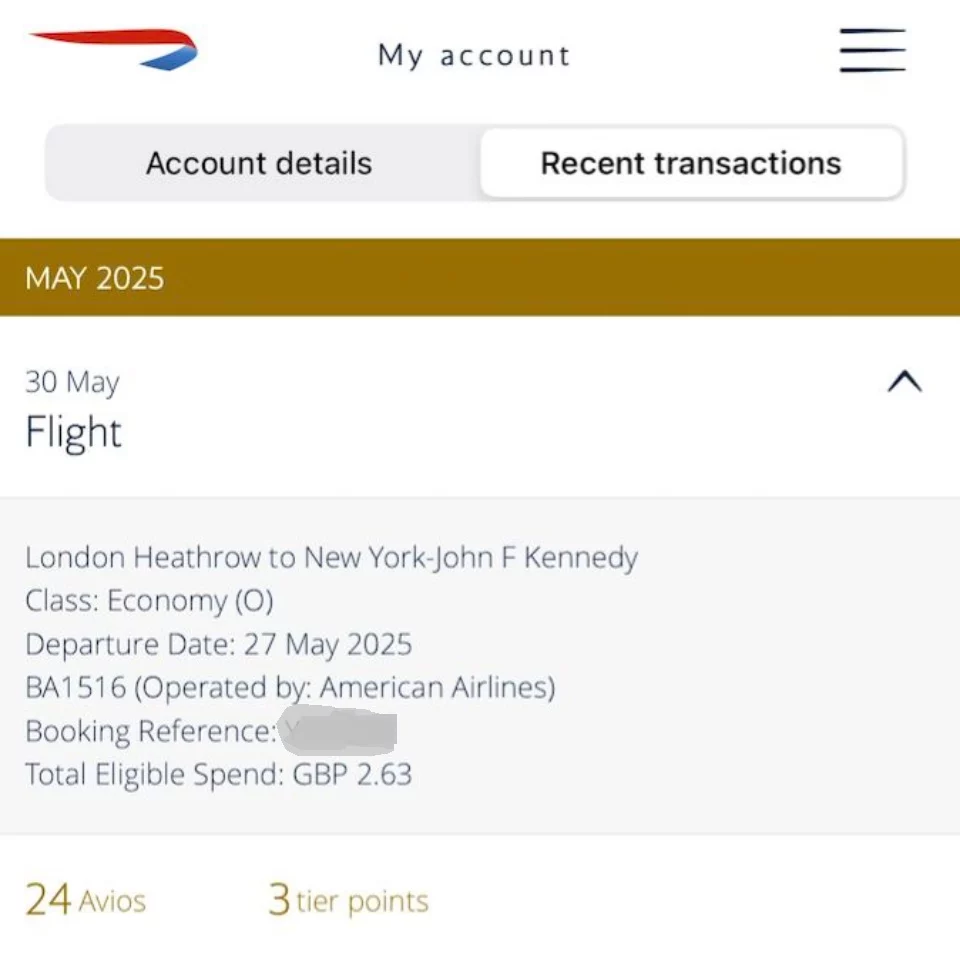

I saw this image on LinkedIn yesterday and thought it was worth sharing, for anyone who hasn’t taken a British Airways long haul economy flight recently.

This is from a start-up founder who travels between London and New York regularly – but only in discounted economy, because his company is still in start-up mode.

His trips used to get him to Gold, hence the Gold tint to the statement.

This is what he got from his last trip (click to enlarge):

Yes, 24 Avios and 3 tier points for this one way flight.

This means that he will need to fly between Heathrow and JFK over 3,300 times, return, this year in order to earn 20,000 tier points to retain his Gold card. That’s tricky.

You can argue whether BA should care if someone taking 12-15 return flights to New York in economy each year is worth keeping as a customer, but this particular one is – unsurprisingly – leaving in search of status elsewhere.

£100 British Airways cashback for NatWest cardholders

NatWest has been running a British Airways cashback deal for its Mastercard credit card holders (debit cards seem to be accepted too) for the last few weeks, although we’ve only just seen it.

There are two offers:

- you will earn £100 cashback on £500 of BA flight spend to ‘a non-UK or EU destination’, booked by 30th June

- you will receive an additional 5% cashback (up to £100) on ANY OVERSEAS SPEND in ‘a non-UK or EU destination’ by 31st October

There are a couple of quirks here:

- you must register in advance via this page and, more importantly, you must register at least 48 hours before making your booking

- the website is talking complete nonsense when it says ‘you get £100 cashback on flight bookings to non-EU destinations’. There are PLENTY of non-EU destinations excluded in the small print if you dig deep enough, for example Norway and Switzerland. Mastercard is going to be getting a lot of complaints ….

- you qualify for the 5% cashback on general foreign spending even if you don’t trigger the British Airways element of the cashback

You can find out more on the Priceless website here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Comments (134)