What’s the cheapest route to BA Bronze status given the THREE tier point bonuses available?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Now that we finally have details of the British Airways American Express Premium Plus tier points offer (click here for our article – I won’t repeat myself), we can play a little game.

As Amex cardholders will know, British Airways has also given a one-off bonus of 500 tier points to Premium Plus cardholders.

You can also continue to earn bonus tier points on all British Airways flights booked until the end of the year.

Putting all these together, how easily can you earn Bronze status in The British Airways Club?

Bronze status requires you to earn 3,500 tier points by 31st March 2026.

If you maximise the American Express offer, you will receive 2,500 tier points.

You have received 500 free tier points from British Airways if you are a Premium Plus cardholder. This takes you to 3,000 tier points.

Let’s remind ourselves of the bonus tier points offer, which is on ba.com here. You MUST register for this – it is not automatic.

This is what you receive per segment, so double these numbers for a return:

| Euro Traveller (exc Basic Economy tickets) | 75 bonus tier points |

| Club Europe | 175 bonus tier points |

| World Traveller | 150 bonus tier points |

| World Traveller Plus | 275 bonus tier points |

| Club World | 400 bonus tier points |

| First | 550 bonus tier points |

Looking at this, the easiest way of getting the 500 tier points you need for Bronze status via flying – assuming you don’t want to ‘waste’ £500 buying 500 points via SAF credits – is probably one return flight in Club Europe.

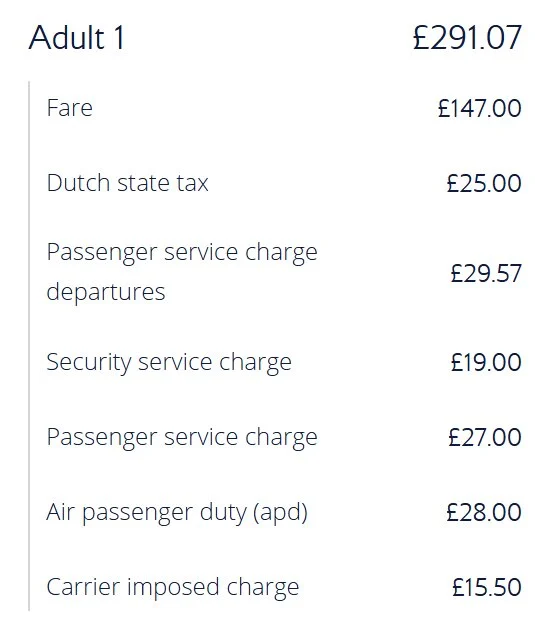

Here’s a typical Club Europe trip to Amsterdam, with a headline price of £291:

Now, of the breakdown above, ONLY the base fare and ‘carrier imposed charge’ count for tier points. You don’t earn 291 tier points from this flight, you earn 147 (base fare) + 16 (carrier charge) for a total of 163 tier points.

The real value is in the tier point bonus. As per the table above, you earn 175 bonus tier points per segment as long as you are registered for the offer.

The total tier points from the flight are therefore:

- From the flight itself = 163 tier points

- Bonus points – 2 x 175 = 350 tier points

- TOTAL = 513 tier points

Add to this ….

- 2,500 tier points from your American Express spending between now and 1st February

- 500 bonus tier points given to you yesterday by British Airways

…. and you are at 3,513 tier points. You’ve earned Bronze status for the period up to 30th April 2027.

What are benefits of British Airways Bronze status?

Not much, of course, EXCEPT for free seat selection seven days before travel for you and everyone else on your booking.

Given how much British Airways charges for long haul seat selection – over £100 per person, each way, in Club World on most routes – it can be a worthwhile saving if you would otherwise have paid.

The other key benefits are:

- 1 extra Avios per £1 spent (7 per £1) on British Airways and selected partner flights

- Club World, Club Europe or oneworld equivalent business class check in desks, regardless of your flight class

- priority boarding

- 5% discount on almost all purchases at The Wine Flyer

The official ba.com page outlining the benefits of Bronze status is here.

Conclusion

I am not seriously suggesting that this is a realistic option for the majority of HfP readers.

However, for those people who can put £25,000 through their British Airways American Express Premium Plus card between now and the end of January, you have the opportunity to get Bronze status in British Airways Club for surprisingly little (flying) effort.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better.

To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (August 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rhys

Rhys

Comments (131)