Avios changes – is the Lloyds Avios Rewards credit card now more valuable?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

UPDATE – JULY 2025: This is an old article, and the credit card information given is likely to be out of date.

To learn about current credit card bonuses, benefits, terms and interest rate information, take a look at our directory of the top UK travel credit card offers – please click HERE or use the ‘Credit Cards’ menu above. Thank you.

Keep up to date with new UK credit card bonuses by signing up for our free daily or weekly newsletters.

The Lloyds Avios Rewards credit cards (my full review of the card is here) have not been hugely successful since they were launched by avios.com. The poor customer service offered by Lloyds has disguised the fact that cards do have good reasons to hold them.

The lack of foreign exchange fees on the cards is almost unique in the UK credit card industry saving you 3% on every transaction you make on the card outside the UK.

What is GENUINELY unique is that you also earn Avios points on those transactions. No other card in the UK offers zero foreign exchange fees AND rewards.

That isn’t what this article is about, though. It is about one of the other perks of the Lloyds Avios Rewards credit cards – the upgrade voucher.

On the £24 version of the card, you receive an upgrade voucher for spending £7,000. On the £150 Premier version of the card, you receive an upgrade voucher for spending £5,000 – this lower target does not by itself justify the fee on the Premier card.

If you are a typically a solo traveller, the upgrade voucher may be more useful to you than the 2-4-1 voucher issued with the British Airways American Express card.

The vouchers are not, in fact, ‘upgrade vouchers’. What they do is allow you to book a redemption in World Traveller Plus, Club World or (for short-haul) Club Europe for the Avios points of the class immediately below.

There does NOT need to be Avios availability in the lower booking class, only in the class you will be flying in.

The voucher lets you upgrade one return flight or two one-way flights. If you want to upgrade two one-way flights, they MUST be done in the same booking with both passengers travelling together. You CANNOT upgrade one one-way flight now and another flight next month as the voucher expires as soon as it is used once.

Whilst the voucher is only valid for 12 months, you only need to BOOK within this period.

How many Avios can you save?

At present, the mileage benefit from using the voucher is limited. Taking London to San Francisco as an example, it would only save you 25,000 Avios points. That is the difference between a Club World and World Traveller Plus return redemption.

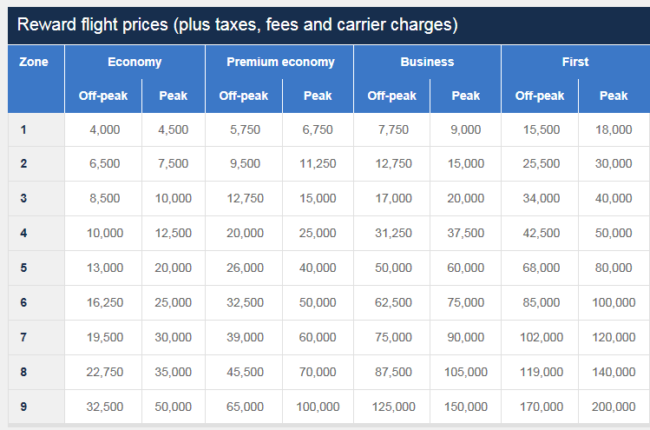

Let’s remind ourselves of the new BA redemption chart from April 28th:

California is Zone 6.

Off-peak, the Lloyds voucher would now save you 60,000 Avios points return. A Club World redemption would be 125,000 Avios whilst World Traveller Plus is reduced to 65,000.

At peak times, the voucher would save you 50,000 Avios points return. A Club World redemption would be 150,000 Avios whilst World Traveller Plus is 100,000.

Whilst best suited to a solo traveller, the Lloyds voucher would also make a decent dent in the Avios points required for a couple when used for 2 x one-way tickets on the same flight.

There is no rush to go out and get the Lloyds Avios Rewards card – you might as well focus on maximising sign-up bonuses and booking what you can before April 28th. Once we get past that date, however, I may start to give the Lloyds card more coverage.

In particular, one thing we need to think about is this – for a couple, does it now make more sense in some scenarios to have two Lloyds Avios Rewards cards than one BA Premium Plus Amex card? This is a topic to which I will return.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (106)