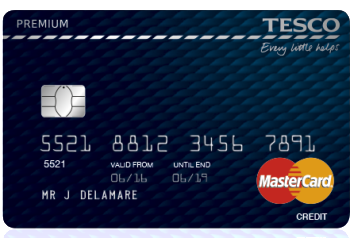

Is the Tesco Premium Card – the most generous Avios Visa / Mastercard – worth £150?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

It is now coming up to a year since Tesco Bank surprised us with the Tesco Premium Credit Card and its suitably premium £150 annual fee.

This is the most generous way of earning Avios from a Visa or Mastercard which is widely available. The only better option is HSBC Premier World Elite but this has very strict wealth criteria.

You can check out the details here. The representative APR is 56.5% variable, including the fee, assuming a £1200 credit limit.

Frustratingly, Tesco has created a product which could work well for a few people but not for the majority. My general impression is that most people should give it a miss in its current incarnation but, if you are lucky, it may make some sense.

Is it worth a £150 annual fee? Let’s take a look at the benefits in turn:

1 Clubcard point for every £1 you spend on the card in Tesco plus a 5,000 point bonus if you spend £5,000

Let’s imagine that you DO spend exactly £5,000 per year in Tesco. This may be possible if you do all of your grocery shopping there and have a large household or always buy your fuel there.

On that basis, you would earn 8,750 more Clubcard points (21,000 Avios) per year using the Premium Credit Card than you would with the free Tesco Clubcard credit card which gives 1 point for every £4 you spend in Tesco and has no bonus.

That comparison is no longer the best one to use, though. The Tesco Bank debit card now also gives 1 Clubcard point per £1 spent in Tesco, so we really should be comparing this credit card with that. As the earning rate is the same, the only extra benefit for your £150 fee is the 5,000 Clubcard points (12,000 Avios) bonus for spending £5,000 in Tesco.

I can recommend this card if you easily spend £5,000 per year in Tesco purely because of these 5,000 extra Clubcard points. That would get you 12,000 Avios or 12,500 Virgin Flying Club miles which justifies most of the fee.

Comprehensive travel insurance for you and your family

This covers immediate family members under the age of 70 and includes 17 days of Winter Sports cover.

If you currently pay for travel insurance then this would have some value. If you have it via another source – mine comes from American Express Platinum – then you won’t.

Depending on your age and whether you do ‘winter sports’, a bargain basement family policy will cost between £50 and £70. If you are not leaving Europe, you will pay less. That said, the moneysavingexpert.com ‘top pick’ (based on generosity of terms and payout history) is from LV and costs £110 per person for global cover.

You need to decide what value, if any, you place on this benefit.

1% enhanced exchange rate when you buy travel money

I would value this at nothing, as I believe that I would still get a better deal using my 0% FX fee Post Office credit card or my 1% fee Curve Card for purchases abroad (Curve can be a better deal despite the 1% fee as you earn points on your linked card). To get a small amount of cash, using an ATM using a normal debit card with a 3% fee is still likely to be a better deal.

What I don’t know is a) whether currency purchases are treated as a ‘purchase’ if charged to the credit card or b) if so, whether it counts towards the £5,000 to trigger the 5,000 Clubcard points bonus. If the answer to these questions was ‘yes’ then it would improve the offer.

1 Clubcard point for every £4 you spend on the card outside Tesco

The current Mastercard and Visa offers on travel credit cards are weak which enhances this offer. Converted to Avios, you would be getting 0.6 Avios per £1 based on 0.25 Clubcard points. Excluding the HSBC Premier World Elite card – which is tricky to get – this is the highest earning Avios rate for a Visa or Mastercard.

Remember that Tesco rounds down every transaction to the nearest £4, so a £7.99 transaction only earns 1 point and a £3.99 transaction earns nothing.

However ….. I would value 0.6 Avios at 0.6p at best. The Hilton Honors Visa (which is free) earns 2 Hilton HHonors points per £1 spent which I would value at 0.7p. Annual fee cards such as Virgin Flying Club Black or Emirates Elite earn 1 mile per £1 spent on the Mastercard / Visa element whilst the Lufthansa Miles & More card is free and earns 0.75 miles per £1.

Conclusion

In the year since it was launched, this card has actually got worse and not better. It originally offered a discount voucher on British Airways Club Europe flights, now scrapped.

When Tesco sharply increased the Clubcard earning rate on the Tesco Bank debit card last month to 1 point per £1 in Tesco, it made the Tesco Premium card – which now has the same rate but charges a high fee – look worse by comparison.

As I said initially, there is no easy answer as to whether the Tesco Premium Credit Card works for you.

If you spend £5,000 per year in Tesco, the annual bonus of 5,000 Clubcard points (12,000 Avios) almost offsets the fee

If you buy stand-alone travel insurance, the policy offered by this card may be good enough to replace it

If you have substantial Visa or Mastercard spend outside Tesco, earning 0.6 Avios per £1 is not a bad deal given the competition

We then come to the sticky question of a sign-up bonus. There isn’t one. Tesco Bank offered 5,000 Clubcard points for a period last year. This means you need to ask:

Even if the card would work for me, should I sit it out until Tesco throws in a few thousand Clubcard points for getting it?

All in all, the card compares poorly with the HSBC Premier World Elite Mastercard. Your £195 fee gets you 40,000 Avios for spending £12,000 in the first year, airport lounge access, 1 Avios per £1 spent and (via the HSBC Premier current account) travel insurance. However, with HSBC Premier restricted to people with large sums invested with HSBC or a high salary, you may not have the option.

Want to earn more points from credit cards? – April 2024 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending.

Barclaycard Select Cashback Business Credit Card

1% cashback uncapped* on all your business spending (T&C apply) Read our full review

Rob

Rob

Comments (36)