Earn miles on HMRC tax bills via American Express, Curve, Miles & More and Revolut

Links on Head for Points may support the site by paying a commission. See here for all partner links.

When HMRC stopped accepting personal credit cards for tax payments in January 2018, it was a blow for many HfP readers who used the Inland Revenue to rack up a substantial number of miles and points.

Even a relatively small business like Head for Points has a chunky liability when you factor in our VAT payments, PAYE and my own personal tax and national insurance – over 70p of every £1 HfP receives goes to the Government.

The good news is that there are still various ways to earn miles and points when paying your 31st January self-assessment tax bill or your February VAT bill.

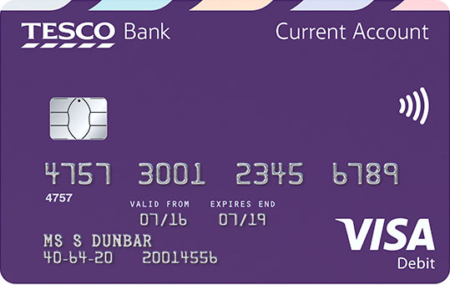

METHOD ONE – Via a debit card, using a Tesco Bank current account

Not a lot of people know that, if you have a Tesco Bank current account, you earn Clubcard points when you use your DEBIT card.

Surprisingly, the rate is OK – 1 Clubcard point for every £8 you spend. 1 Clubcard point is worth 2.4 Avios, 2.5 Virgin Flying Club miles, 3p of Hotels.com credit or various other deals.

You cannot earn points when using a Tesco Bank debit card to pay a ‘financial services institution’. You won’t earn anything paying off your credit card bill or transferring money into a savings account. HMRC is NOT classified as a financial services institution.

For every £1000 of tax you pay, you would earn 125 Clubcard points which is 300 Avios. There is no fee to pay as this is a debit card, but of course you do need a Tesco Bank current account.

Unfortunately, Tesco Bank is no longer accepting new applications for its current account. If you don’t already have one, it is too late, unless Tesco Bank decides to re-open the product with identical benefits.

METHOD TWO – Via an American Express card, using Billhop

We have covered Billhop a couple of times and a lot of readers have used it.

Basically, Billhop pays your bills for you – directly into the bank account of the recipient – and charges your credit or charge card. The transaction goes through as a purchase. You earn miles and points and it counts towards spend bonuses such as the British Airways American Express 2-4-1 voucher.

Registration with Billhop is free – see here – so you have nothing to lose by signing up and seeing how it works.

If this sounds too good to be true, there is a catch – the service is not free. There is a 2.95% charge on every payment you make, i.e. if you pay a bill of £100, you will pay £102.95 in total.

This is an expensive way of earning miles or points. It IS something that you will find useful if you are struggling to hit the ‘£4000 spend in 90 days for 30000 bonus points’ target on a new American Express Platinum card for example, or need to pump up your spending towards your next 241 voucher.

This HfP article explains in step-by-step detail how to set up a Billhop account.

The company was founded in Stockholm in 2012 – where it has proven very popular with the frequent flyer community – and launched in the UK in 2016.

The company is fully regulated in Sweden (which, under EU passporting rules, means they are regulated here as well) and, in any event, your money is fully protected because all payments are handled by an established bank. Billhop never has access to your funds, apart from the fee.

METHOD THREE – Via a Visa or Mastercard card, using Curve

Curve is a Mastercard DEBIT card that recharges every purchase you make to a linked Visa or Mastercard.

This is why Curve Card is worth having:

You make your debit card purchase using your Curve Card

Curve recharges it to your linked Visa or Mastercard credit card

It goes through your linked Visa or Mastercard credit card as a purchase

It therefore earns points from your linked Visa or Mastercard

You have just earned credit card points from making a debit card transaction

And the best bit is that Curve Card is free. In fact, it is better than free – Curve Card will pay you £10 for taking it out.

It actually gets even better, due to two additional Curve Card benefits:

You can withdraw £200 of cash per month from an ATM and have it charged to your credit card as a purchase – this means it earns miles and points.

Foreign currency transactions made on Curve are recharged to your linked Visa or Mastercard in Sterling with no foreign exchange fee (Mon-Fri, 0.5% fee at weekends). This makes it a better deal than using the underlying card which is likely to have a 3% FX fee. Foreign currency ATM withdrawals incur an additional £2 fee. Your monthly FX limit will depend on which variant of Curve Card you hold.

That’s the good news. Here is the bad news.

Today, Thursday 23rd, is the last day that you can pay HMRC using the free Curve card and not pay a fee. From tomorrow, there is a 1.5% fee on HMRC payments.

The fee is waived if you pay £150 per year for the Curve Metal premium version of the card. If you are a very heavy spender, this may still be worthwhile.

If you want to find out more, I ran this article on Monday which runs through the maths of using Curve Metal to pay HMRC going forward.

The Curve Card is FREE so there is no harm in applying. Curve will pay you £10 for trying it out if you use our link.

The Curve website is here if you want to know more. You need to download the Curve app for your phone and order a card from there if you want to try it out.

METHOD FOUR – Using the Miles & More Global Traveller Mastercard

You may be confused about this suggestion. After all, I told you at the top of the article that HMRC no longer accepts payments by credit card.

The Miles & More Global Traveller card IS accepted, however.

The reason it is accepted is that, technically, this is not a credit card. It is a prepaid Mastercard. You need to read our full article on the Miles & More Mastercard to understand exactly how it works, but basically:

when you apply, you get a Diners Club (really!) card and a Mastercard

when you spend on the Mastercard, it is treated as a prepaid debit card and – at the point of purchase – Diners Club (silently and in the background) loads on enough money to fund the transaction

In practice, it works in exactly the same way as a standard charge card. Note that, as a charge card, you MUST clear your balance at the end of each month.

The card has a £79 annual fee and a 5,000 Miles & More miles sign-up bonus. You earn a whopping 1.25 miles per £1 spent.

You should NOT use this card to pay VAT or business taxes. People who have done this are getting into trouble, since the card is only meant to be used for personal transactions. Your statement does break out the exact type of tax which was paid. I have not heard of anyone getting any push back for paying self assessment.

I am only scratching the service of how the cards work here, so please do read our full Miles & More Global Traveller review.

METHOD FIVE – Using a Revolut, Monese etc account topped up with a credit card

I do not recommend this because the big clampdown has already begun. However, there are often ways of loading up online bank accounts run by the main fintech companies with a credit card, in ways which allow the transaction to be seen as a purchase. You can then pay your tax bill using the debit card supplied with the account.

Until last week, for example, you could load a Monese account at a Post Office using your American Express card. Similarly, until last week, you could load a Revolut card with a Virgin Atlantic credit card. Neither of these options now work – the Post Office has blocked Amex transactions and Virgin Money is charging cash advance fees for Revolut loads recharged to its credit cards.

As a matter of editorial policy we do not encourage such opportunities on Head for Points because they operate in a grey zone and, in any event, would be closed quickly if widely publicised. They are often discussed in our reader comments.

Conclusion

The good news is that it wasn’t totally ‘game over’ for earning miles and points from HMRC when the Inland Revenue stopped accepting personal credit cards.

The routes above are a bit fiddly, but if you are the sort of person who doesn’t like leaving miles on the table then they are worth a look.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 15th July 2025, the sign-up bonus on the Marriott Bonvoy American Express Card is TRIPLED to 60,000 Marriott Bonvoy points. This would convert into 25,000 Avios or into 40 other airline schemes. It would also get you at least £300 of Marriott hotel stays based on our 0.5p per point low-end valuation. Other T&C apply and remain unchanged. Click here for our full card review and click here to apply.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Comments (232)