N26 review: we look at their new metal card. Do the benefits stack up?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

EDIT: Unfortunately, N26 closed its UK operation in February 2020 and it is no longer possible to open an account

This is our updated review of N26, the online bank, focusing on its new metal premium card. Is N26 worth joining? Is it worth paying for the N26 metal card?

You will be reading quite a bit about metal payment cards on Head for Points over the next couple of weeks. Metal credit and debit cards have been very rare in the UK to date but they are about to take off in a big way – if you are prepared to pay the fees they ask.

The standard N26 card is FREE. What is more interesting about N26 is the travel and other benefits that come with its paid metal version. In particular, you get free WeWork membership which gives you one day per month of free hot desking and access to the WeWork member network. This benefit immediately got my interest as I used the WeWork hot desk plan for a year before we took a full time office, and we were paying $45 per month for the privilege.

The N26 website is here. You can find out about the travel and other benefits of its metal card here.

We have covered Monzo, Revolut and Starling on Head for Points in the past few months. These are all ‘online only’ ‘challenger’ banks, aimed at a generation used to running their entire life via a smartphone app. They are morphing into identical businesses offering app-driven current accounts, 0% FX fee debit card transactions, money transfers at interbank rates and analytical spending tools.

N26 is older than Monzo, Revolut and Starling, having launched in Germany in 2013. It was only in October 2018 that it launched in the UK and a lot of HfP readers may never have heard of it. It is also active in Ireland, France, Italy, Spain, Austria and Belgium. Our review of Starling Bank is here for comparison.

What does the free version of N26 offer?

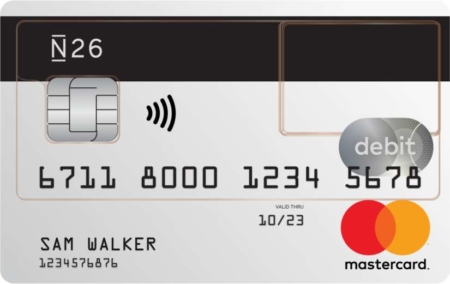

Let’s review the standard N26 card first.

A standard N26 account is FREE for life. The website claims that you can open an account in just 8 minutes.

N26 offers a range of benefits that will be familiar from other online banks. You sign up via the website here and then:

You receive a Mastercard debit card – which comes in funky clear plastic, as you can just about tell from the photo above – in the post (free, which is £4.99 cheaper than Revolut)

You get a sort code and account number, allowing you to use N26 as you would a traditional current account

All of your banking is done via the app, including locking and unlocking your card, changing your PIN etc

You receive push notifications of all transactions in and out

You can send and receive money from friends via the app

You pay 0% FX fees on overseas transactions (with no monthly limit and no weekend surcharges, unlike Revolut)

You can pay with Google Pay and Apple Pay

You can set up direct debits against your N26 account

You can withdraw cash for free from UK ATMs

The only charges you are likely to pay are:

Withdrawals from non-UK cash machines: 1.7% fee (Revolut allows one free £200 monthly overseas withdrawal)

14.9% interest rate if you go overdrawn

N26 does offer international money transfers but this is done via a partnership with TransferWise. If this is important to you then Revolut is probably a better option as it offers £5,000 per month of transfers for free.

There is a £20,000 limit on monthly card payments and a £5,000 daily limit. These are unlikely to trouble 99% of cardholders.

More interesting for Head for Points readers, however, is the metal version and its travel benefits.

What does the metal version of the N26 card offer?

Let’s move on to review the premium metal N26 card which is potentially of more interest to Head for Points readers due to its travel benefits.

Whilst a standard N26 account is totally free, the metal version of N26 offers a number of premium benefits. Whether they justify the £14.90 monthly fee is a different question.

The card comes in three different metallic colours. My favourite is probably the coral version:

…. which I can imagine looks good in the flesh. There is also a slate version pictured below and a black version.

This is what you get:

Unlimited free cash withdrawals outside the UK

Travel and purchase protection insurance

LoungeKey airport lounge access

FREE WeWork hot desk membership, allowing you to work from one of their offices anywhere in the world for one day per month (you can come and visit us at Moorgate!) – this is usually $45 per month as you can see here

10% off hotels.com bookings

20%-30% off IHG bookings (I think this is the standard partner discount which can also be accessed via various other routes)

World Elite Mastercard benefits

There are other partner benefits – see the N26 metal website – but I have just focused on the travel ones above.

This is an odd package to value. One thing is clear – if you can use the WeWork membership, and especially if you are already paying $45 per month for WeWork hot desk membership – this is great value. You are swapping your $45 fee for N26’s £14.90 fee, which is a big saving.

How would I value the rest of the package?

Value of a cool metal card in your wallet – up to you!

Unlimited free overseas ATM withdrawals – value depends on your travel patterns

LoungeKey membership – this is equivalent to a basic pay-as-you-go Priority Pass which costs £69 per year

Travel insurance – I haven’t seen the policy document so it is difficult to say how ‘strong’ it is, although many HFP readers will be covered via other sources

Hotels.com / IHG benefits – no real value as these can be found via other sources

For me, the package is driven by the WeWork benefit but obviously that is only relevant to a segment of our readers.

Conclusion – should you get the N26 metal card?

N26 is an interesting addition to Monzo, Starling, Revolut etc, all of which have launched very similar products in recent years. N26 gives the impression of being a slightly more grown-up and simpler package than some of its competitors, but at the end of the day the features are similar.

If I was still using WeWork on a hot desking basis I would have jumped on N26 Metal. For everyone else, £14.90 seems steep – even if the travel insurance is suitable for your needs – and I think I’d want to try the free version for a few months before I thought about upgrading. As it is free to sign up with N26, there is no harm in trialling it.

Of course, if you have always wanted a metal payment card for your wallet then this is an easy way of getting hold of one. The only question is whether coral, grey or black is slicker …..

You can find out more about N26, and sign up, on its website here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 15th July 2025, the sign-up bonus on the Marriott Bonvoy American Express Card is TRIPLED to 60,000 Marriott Bonvoy points. This would convert into 25,000 Avios or into 40 other airline schemes. It would also get you at least £300 of Marriott hotel stays based on our 0.5p per point low-end valuation. Other T&C apply and remain unchanged. Click here for our full card review and click here to apply.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (188)